Investing.com’s stocks of the week

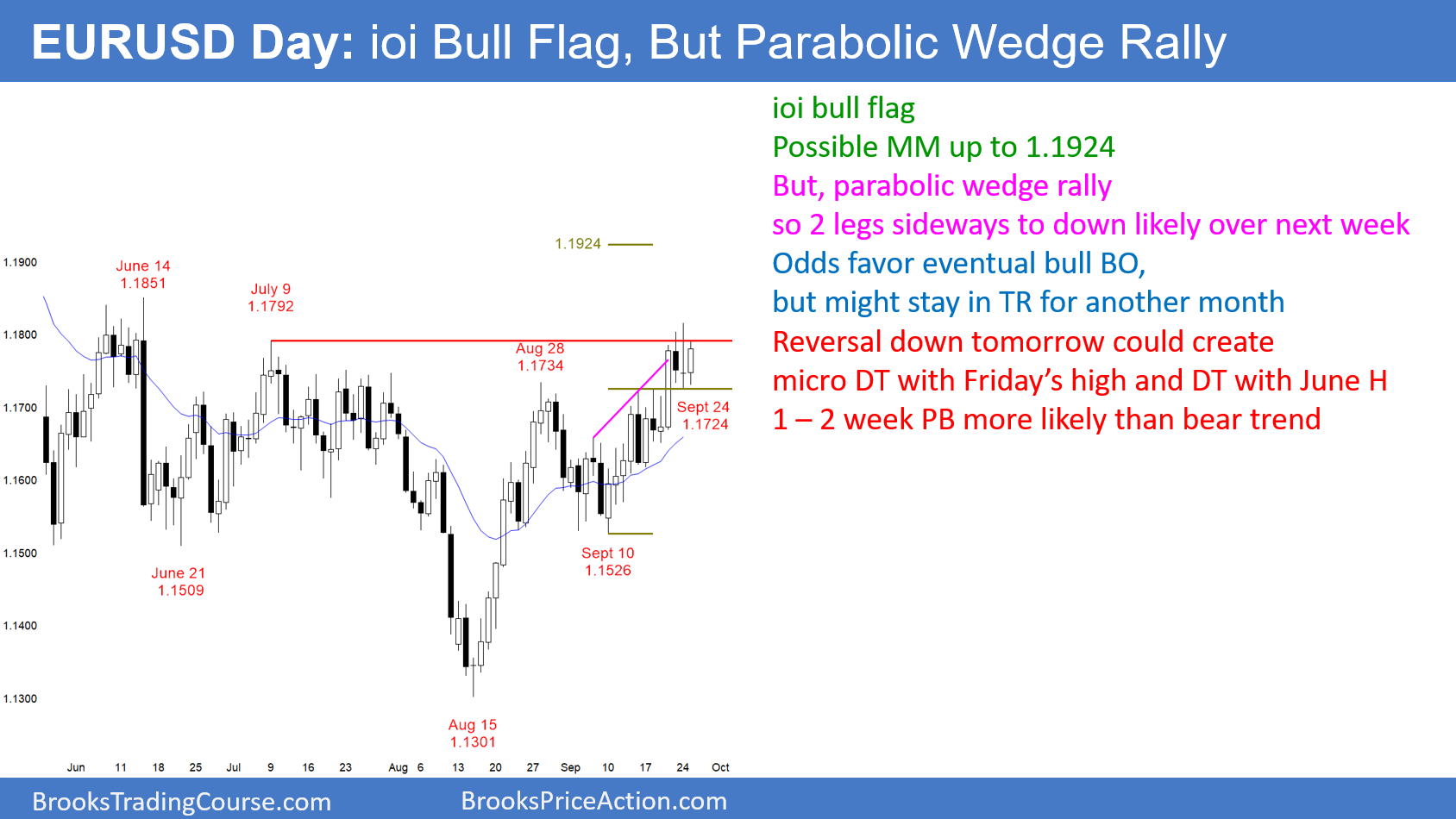

The EUR/USD daily Forex chart today has an inside day after yesterday’s outside day. This is an ioi (inside-outside-inside) bull flag. There is also a potential measuring gap below yesterday’s low. But the 3-week rally is also a parabolic wedge at the top of a 5-month trading range.

If today remains a bull inside day, it will be a buy signal bar for tomorrow. Since yesterday was an outside day, the pattern would be an ioi bull flag. But, it is at the top of a 5-month trading range and most breakout attempts fail. Furthermore, the 3-week rally is a parabolic wedge. While the momentum favors the bulls and an eventual rally to 1.20, the chart is more likely to pullback for the next couple of weeks.

Traders should find out over the next few days. If there are 2 – 3 big bull bars, the breakout will probably continue to 1.19 to 1.20. On the other hand, if tomorrow triggers the buy by going above today’s high, but tomorrow or Thursday close near their lows, the breakout will likely fail. If so, there will probably be a 200 pip pullback over the next 2 weeks.

Overnight EUR/USD Trading

The EUR/USD 5-minute chart has rallied 50 pips overnight. Since the bulls do not need today to go above yesterday’s high, there might not be much left to the rally today. However, the bulls do want today to close near its high, and especially above the midpoint. This would create a good buy signal bar for tomorrow. Therefore, the bulls will buy 20 – 30 pip selloffs today.

The bears would like today to close near its low. Then today would be a bear ioi and a sell signal bar for tomorrow. At the moment, this is unlikely. The best the bears can reasonably hope to achieve is to prevent today from closing on its high. They will therefore sell rallies for 10 pip scalps.

Their next goal is to get today to close below the midpoint. If there is strong momentum down, they might even get a close below the open, but that is unlikely at the moment.