The EURO has come under a lot of pressure as of late, and the bears have taken a fair few swipes to knock it down further. But lately it looks to have run out of steam when it comes to that volatility that we got comfortable with.

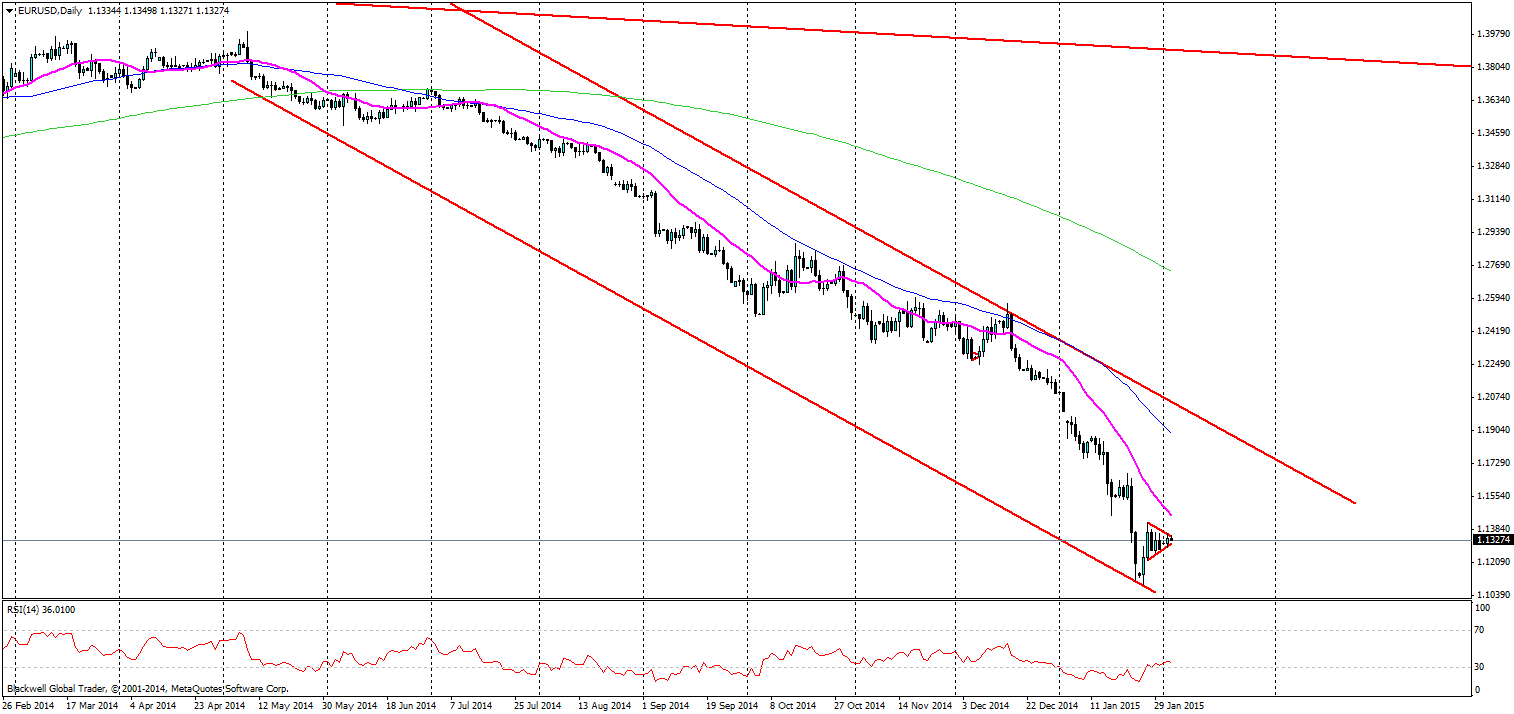

Source: Blackwell Trader (EUR/USD, D1)

On the charts we can see that the channel rushing down has been very, very aggressive, and only just recently we have seen selling pressure come back above the oversold level. In fact, this past few weeks have been slightly bullish for the most part. But I believe that is nothing more than a dead cat bounce and we are due a solid test of 1.10 in the very near future.

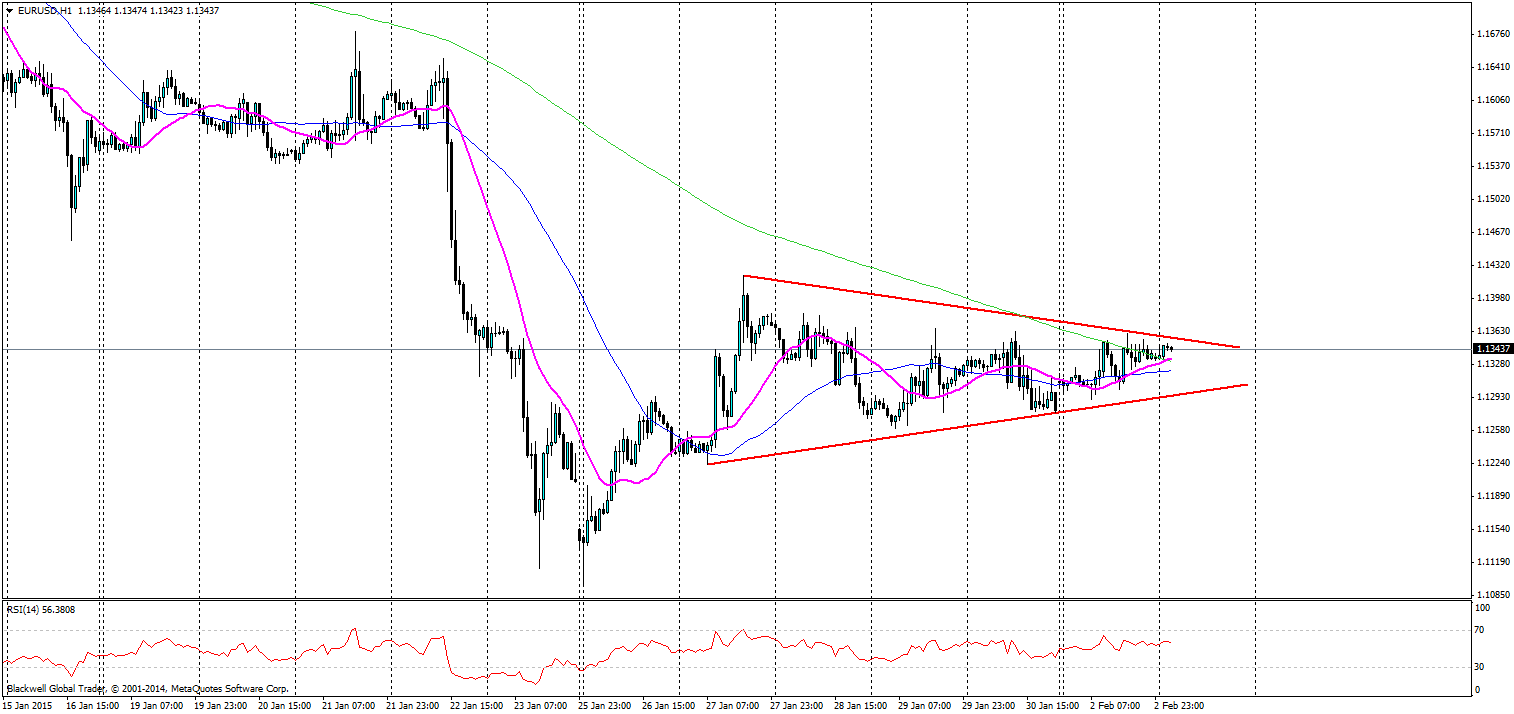

On the H1 chart we can see the converging of the candles at this stage, in a classic pennant pattern. With each movement, avoiding the RSI overbought/sold levels. This is certainly looking like it could crack lower and lower with a vengeance.

So far I’ve talked about the possibilities of further falls, but there is fundamental justification in it. Greece has caused problems in the Euro-zone for the last 5 years, and the markets may have forgotten briefly, Germany has certainly not. With Greece looking to renegotiate its debt agreement, the Germans will challenge them at every stage and even be willing to call their bluff in an effort to make sure they are not taken for a ride.

If anything, it’s likely we could see a period of strife in the Euro-zone as terms are agreed upon, with a backdrop of market chaos. Either way we are set for some big movements in the Euro-zone and the markets will look to run into the USD where it can find suitable safety.

Overall, it looks like the EUR/USD is consolidating before another move, and markets will be looking for the breakout before pilling into the bearish side.