- Scott Bessent has been nominated by Donald Trump for US treasury secretary

- Nomination sends US bond yields, dollar lower

- EUR/USD bounces from multi-year lows but faces resistance at 1.0496.

- Yield spreads remain firmly in the US’s favour, keeping downside risks alive

Overview

It didn’t take Donald Trump’s nomination for the key US treasury secretary post, Scott Bessent, to have an impact on markets, with bond and short-dated US rates futures jumping upon the resumption of trade in Asia, weakening the US dollar in the process.

Bessent’s reputation as being a fiscal conservative with strong understanding of markets has, so far, been welcomed by traders. EUR/USD has been a beneficiary of the rates-led move, rebounding strongly from multi-year lows set in European trade on Friday.

EUR/USD an Inverse Play on Rate Differentials

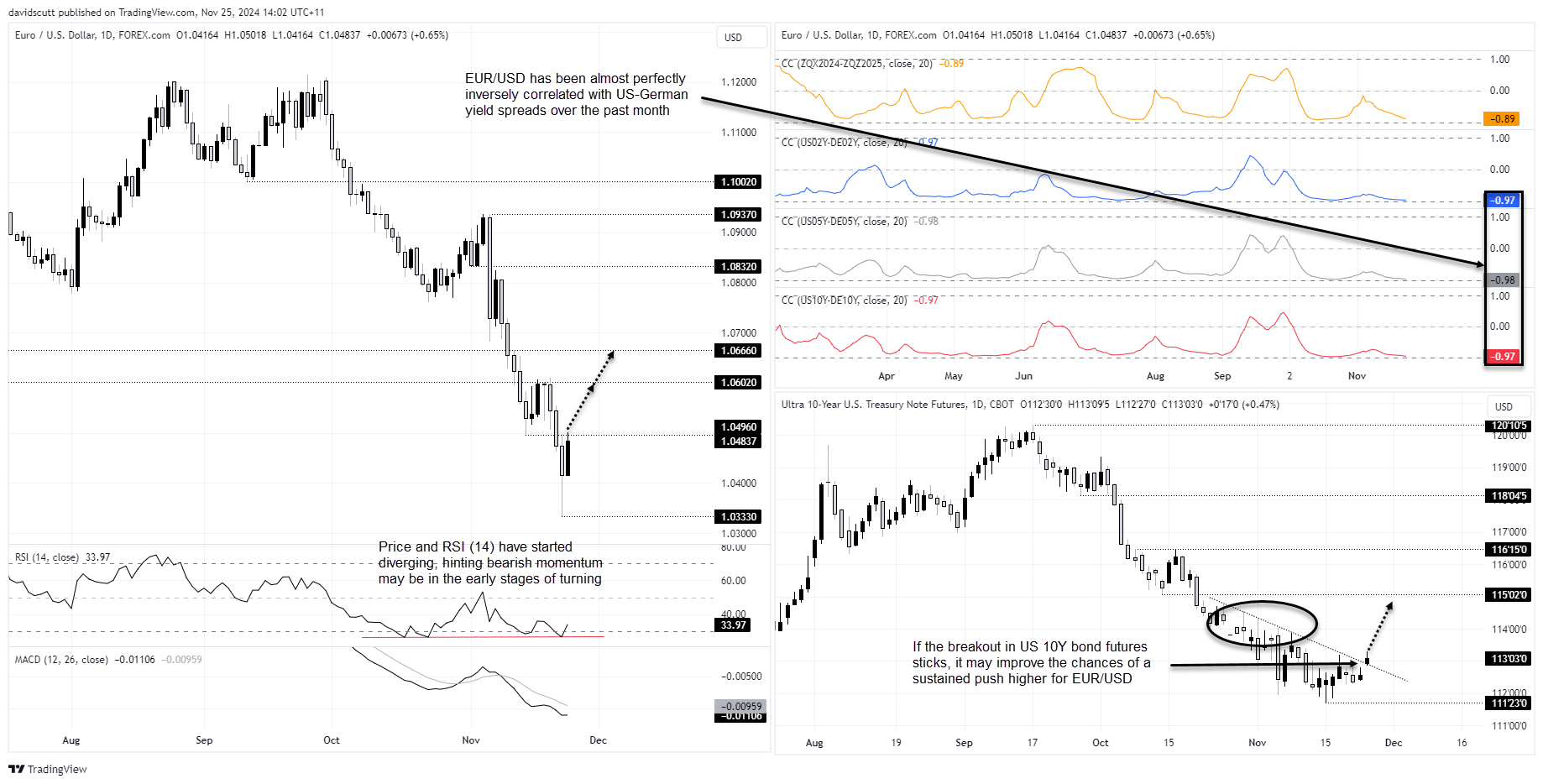

You can see how important yield differentials have been for EUR/USD moves over the past month in the chart below, with correlation coefficient scores with US-German 2-year, 5-year and 10-year interest rate spreads sitting between -0.97 to -0.98 – that’s nearly a perfect inverse relationship.

As yield differentials have widened in favor of the US, it’s weighed heavily on EUR/USD, reflecting the increasingly divergent performance of both economies. Right now, there’s no sign of that trend turning, hinting the impact of Bessent’s nomination may not last long, especially with so much uncertainty as to whether he’ll be able to deliver on views previously slated once in the position.

Besant Bid Generates Bullish Bond Breakout

Source: Trading View

For any traders dabbling in pairs with strong correlations with US interest rates, keeping an eye on US 10-year Treasury note futures could be informative on directional risk for the US dollar over the short-to-medium term.

As seen in the bottom-right pane above, the price has broken the downtrend it was trading in since late October. If the move holds in European and North American trade, the break, combined with bullish signals from momentum indicators, may increase the probability of a prolonged pullback in US long bond yields. That would usually weaken the US dollar if not accompanied by a major risk-off episode.

Without a big surprise in US PCE inflation, US Q2 GDP revision or auctions of US 2-year, 5-year and 10-year Treasuries this week, which screens as unlikely, technical signals may carry more weight than normal until Thanksgiving when we receive important macro data from Europe, including flash inflation readings for November.

EUR/USD Trade Ideas

If the bullish breakout in US 10-year Treasury futures sticks, watch for a possible topside break in EUR/USD above 1.0496. RSI (14) has already diverged from price on the daily timeframe, warning momentum may be skewing higher even if not yet confirmed by MACD.

A break of 1.0496 would allow for longs to be established with a tight stop below for protection. 1.0602 looms as an initial target with 1.0666 the next after that. If the price were unable to break 1.0496, the setup could be flipped, with shorts established below with a tight stop above for protection. The initial target would be 1.0333, the low struck on Friday.