- The EUR/USD is testing the supply zone near 1.0870 again.

- This comes amid more hawkish statements from the Fed officials.

- As the pair approaches a key resistance, we will take a look at the bullish and bearish scenarios.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The EUR/USD pair has hovered between 1.0870 and 1.08 for the past two weeks, setting the stage for a potential breakout as the ECB interest rate decision approaches.

Buyers and sellers both have arguments for various scenarios, but recent statements from the Fed's board of governors suggest a commitment to a hawkish monetary policy for a more extended period than initially anticipated in 2023/24.

Traders have been focusing on the recent weaker-than-expected data from the US, adding pressure on the supply zone just below 1.09 for the EUR/USD pair.

No interest rate cuts are expected in the upcoming European Central Bank meeting, but market participants will keep an eye on insights into the ECB's future actions.

Fed's Bostic Expects One Cut and a Pause

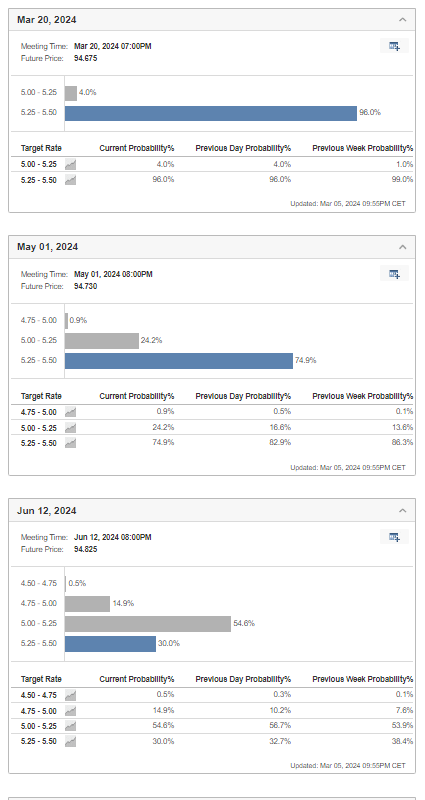

Fed's Bostic, head of the Atlanta Fed, shared his perspective on the 2024 monetary policy. He sees room for only one rate cut in the third quarter, followed by a pause to evaluate its impact on the economy.

This differs significantly from the market's expectation of at least four rate cuts of 25 bps each, starting in June.

Jerome Powell, the Federal Reserve chief, will present reports to the House of Representatives Financial Services Committee today and tomorrow. We expect to gather valuable insights from these sessions.

If Jerome Powell confirms a cautious approach regarding a potential policy shift this year, it could lead to a strengthening of the US dollar. This effect might be even more pronounced if Raphael Bostic from the Atlanta Fed maintains a similar stance.

EUR/USD: Nonfarm Payrolls Key for Next Direction

The US nonfarm payrolls report traditionally holds significance for the EURUSD currency pair.

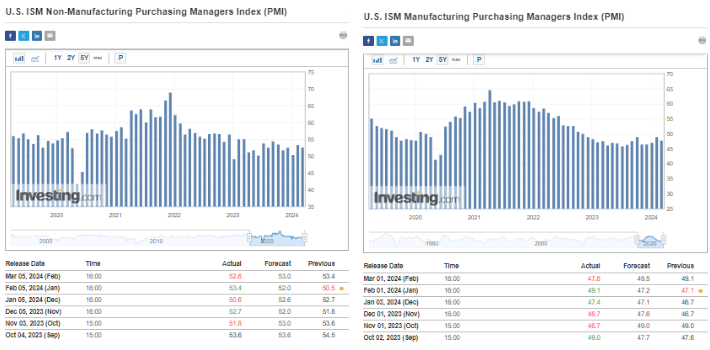

Recent data releases from the US economy have been less than encouraging. Both the ISM manufacturing and services indicators fell short of expectations.

While these figures might suggest the possibility of a policy shift later in the year, they do not yet indicate a clear negative trend when considering the broader economic landscape.

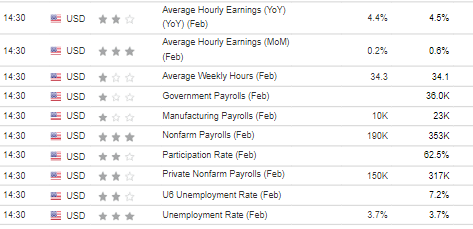

Undoubtedly, at the end of the week, data from the US labor market will be key. If the readings are close to forecasts, this will enable the Federal Reserve to keep interest rates relatively high for a longer period of time.

EUR/USD Technical View: Bulls Still on Top

Although, a hawkish Fed could potentially strengthen the US dollar. But from a technical point of view, bullish pressure is evident in the EUR/USD pair. It could end up breaking the 1.0870 area, where a strong supply zone falls.

In this scenario, the path is clear for more rises, possibly reaching around 1.10.

However, for buyers to gain momentum, the ECB needs to express a hawkish stance in tomorrow's meeting. If the bears resist this level and the uptrend line breaks, keep an eye on the 1.08 support area.

If the ECB's announcement is neutral, the final opportunity to trade this week will be the US labor market data.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Now with CODE INVESTINGPro1 you can get as much as a 10% discount on InvestingPro annual and two-year subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.