One currency’s sorrow is another currency’s joy: Friday’s UK Q1 GDP numbers came in at a miserly 0.1 percent, sending the British pound into a tailspin against the US dollar. Market participants have now priced out a rate hike in May, after a previous rate hike probability of 85 percent just over a week ago. Traders now expect Bank of England policy makers to reserve the August MPC meeting for a potential rate increase. But if, against all expectations, the BoE decides to hike rates at the next meeting on May 10, it would be a shock for the market and could lead to a short squeeze in the pound.

As for the US dollar, Friday’s better-than-expected Q1 GDP print has helped the dollar to mark new highs against most major peers. In contrast to the British pound, swelling Federal Reserve rate hike bets have pushed the greenback higher. Even though the Fed is not expected to announce a rate increase on Wednesday when the FOMC decision is due, market participants still price in a 34-percent probability of a rate hike. We bear in mind that there will be no press conference with Fed Chair Powell, so traders who hope for big market moves on Wednesday could be disappointed. Instead, the focus shifts to the FOMC meeting in June when chances of a rate hike are at 93 percent with Powell holding a press conference.

Apart from the FOMC rate decision, this week’s focus will be on PCE inflation data, due for release today at 12:30 UTC, and the April US Jobs Report on Friday. The payrolls report is forecast to show a 185K jobs increase while the unemployment rate is expected to drop to 4 percent, the lowest level in nearly two decades. All in all, this means good prospects for the dollar rally.

Let’s take a quick look at the technical picture in larger time frames.

EUR/USD

Looking at the weekly chart we see increasing chances of a bear trend provided that the euro breaks below 1.20. Following the euro’s decline below 1.2150 we will now pay attention to the 1.20-support level. If the euro falls significantly below that crucial level traders should brace for accelerated bearish potential towards 1.1750 and 1.1670. On the topside, the focus is on 1.26-barrier which is equivalent to a falling trend line since 2008.

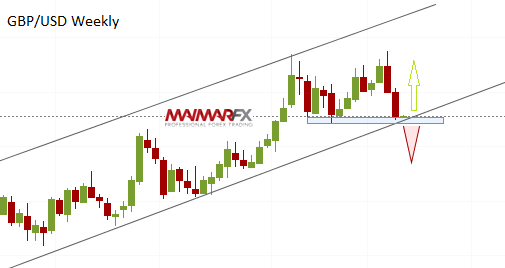

GBP/USD

Chances appear to be in favor of the bears, provided that the cable breaks out of its uptrend channel. Following the recent strong bear candles short traders are sensing further profitable opportunities but hold your horses! The 1.37-level could act as a ‘make-it’ or ‘break-it’ level in terms of a follow through. If the pound can hold above 1.37 we may see the pound recovering some of its losses. Whatever the case, we will prepare for breakouts in either direction and will keep subscribers updated about any major change in sentiment.

Here are our daily signal alerts:

EUR/USD

Long at 1.2165 SL 25 TP 20, 40

Short at 1.2115 SL 25 TP 18, 40

GBP/USD

Long at 1.3810 SL 25 TP 20, 60

Short at 1.3765 SL 25 TP 30-40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.