EUR/USD: Long-Term Bias Remains Bearish, But A Short-Term Bullish Reversal Is On The Cards

The euro's sell-off is primarily due to the divergence in monetary policy between the Federal Reserve and the European Central bank, the fallout from the Ukraine war, and negative market sentiment. Even though these reasons should keep the euro under pressure, bears could not create a lower low when testing the 1.0340-support area.

However, if this crucial support level breaks, the focus will shift to parity. In the positive case, however, if the euro holds above 1.0350, bulls may push the pair towards another test of 1.0570-1.06. Above 1.0660, the next bullish target could be at 1.0770.

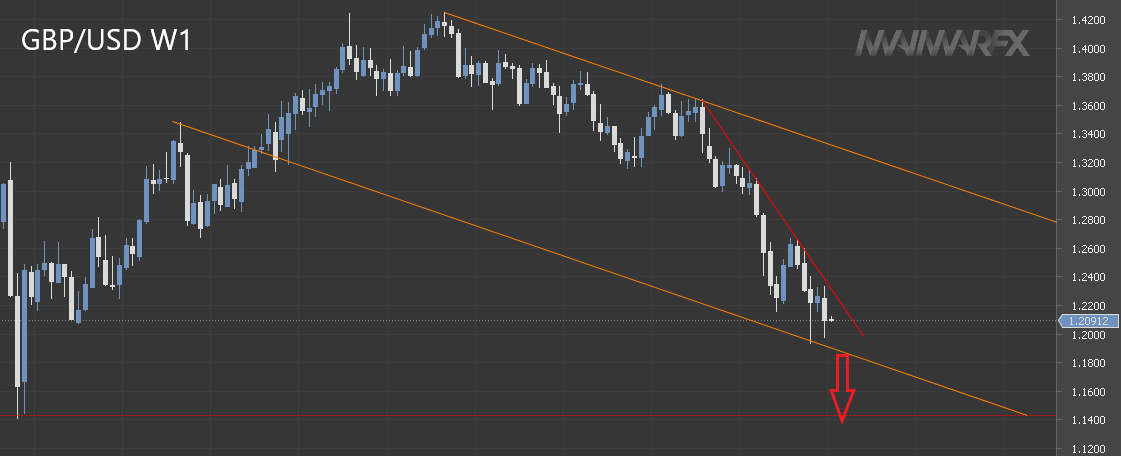

GBP/USD dipped below 1.20 last Friday, and traders wonder whether the 1.19-support area could be tested. As long as sterling bulls cannot push the pair above 1.23, we may see lower price targets such as 1.1820 and possibly even 1.1750. From a fundamental perspective, and even though the economic outlook in the U.K. remains gloomy, the sterling’s heavy sell-off may abate due mainly to a weakening U.S. dollar.

Trading could be quiet today as U.S. markets will be closed for Independence Day. Our trading ideas for today:

EUR/USD

- Long at 1.0475

- Short at 1.0415

GBP/USD

- Long at 1.2125

- Short at 1.2080

DAX

- Long at 12970 (DAX)

- Short at 12840. A second sell attempt has hit our profit target at 12800.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumptions of MaiMarFX traders. They are not meant to be solicitations or recommendations to buy or sell a specific financial instrument.