The European Union leaders have come to an agreement at the EU Summit over immigration after marathon talks in Brussels. The deal appears to include the setting up of migrant centers within the EU and improving border controls. It remains to be seen if the agreement will be sufficient to keep the Merkel coalition government intact. The market reacted with a bounce in the EUR/USD pair but the gains could be short-lived as the EU monitory policy differential with the Federal Reserve continues to put pressure on the Euro. However, market sentiment appears to be more optimistic over trade war issues as there have been no new developments over the last couple of days.

Traders should be aware that today is the end of the week, month and quarter so there may be choppy action as money managers adjust their portfolios.

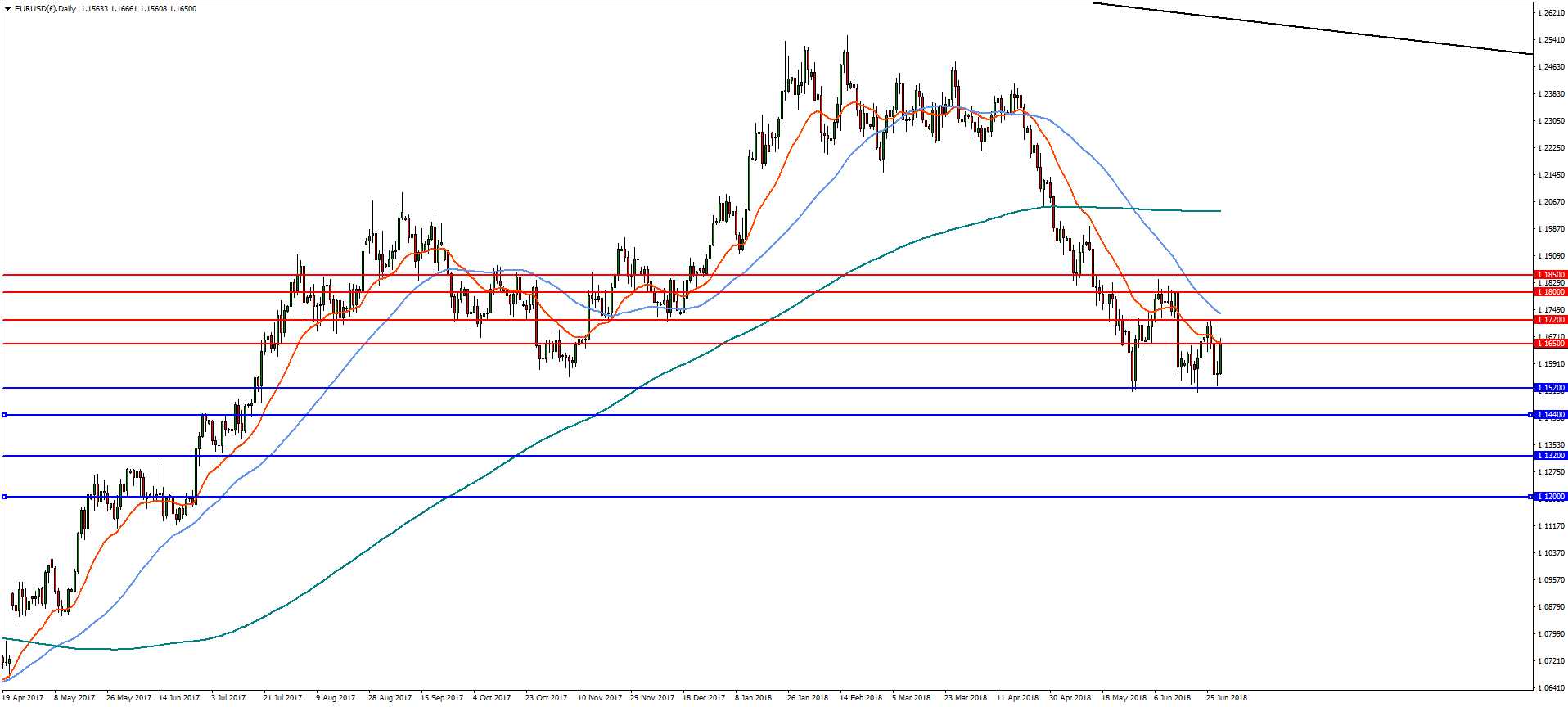

EUR/USD

On the daily chart, EUR/USD continues to bounce from the 1.1500-1.1520 zone. A break of this support will open the way to continued declines to the 50% retracement from the November 2016 lows at 1.1440 and then 1.1320. To the upside, immediate resistance is at 1.1650 and a break will find strong resistance at the 23.6% and horizontal at 1.1720. A break of 1.1720 will be needed to change the bearish outlook.

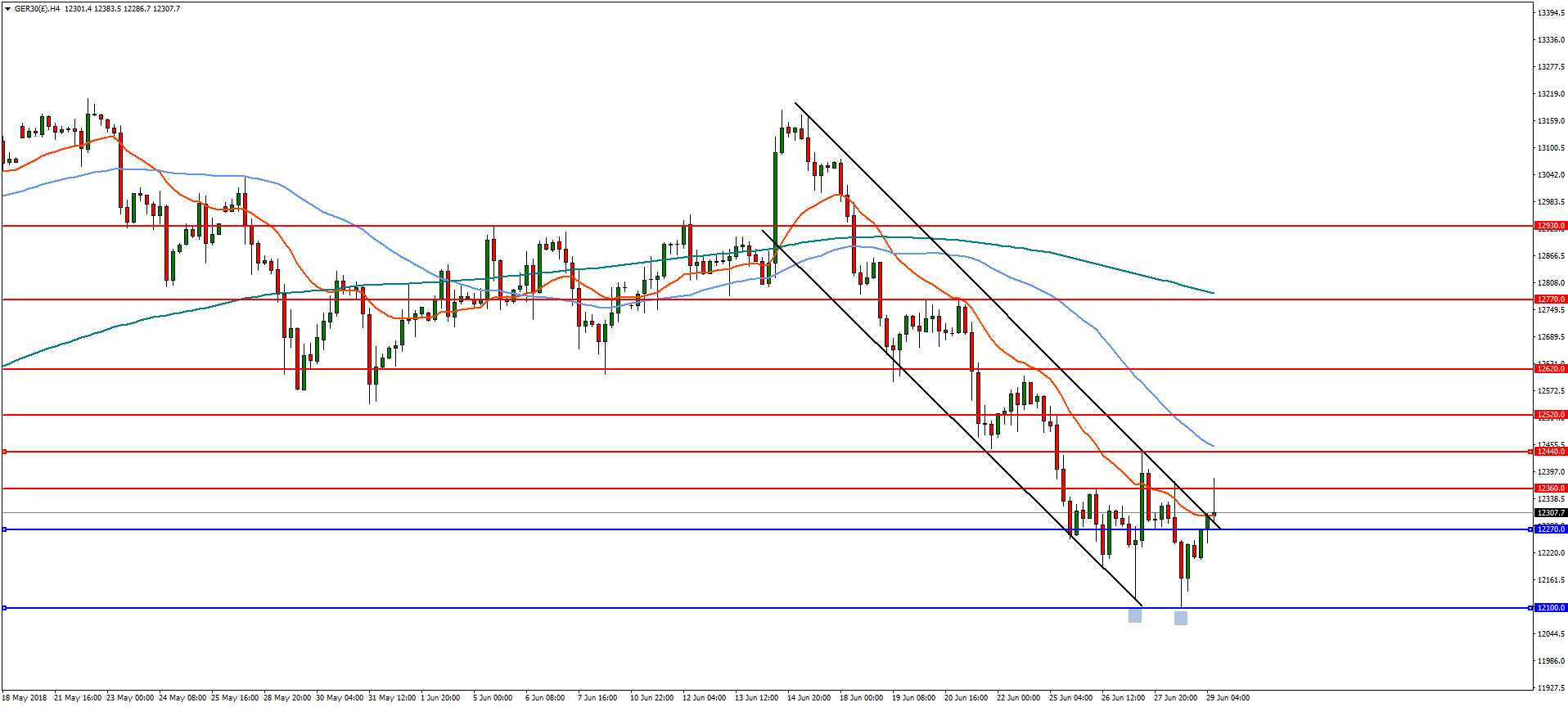

DAX

In the 4-hourly time frame, the DAX index has formed a possible double bottom and broken out of a bearish trading channel. A break of 12360 which is the 23.6% Fibonacci of the decline from the highs in June would indicate a potential upside target of 12620 with resistance at 12440 and 12520. On the flip-side, a reversal below 12270 would open the way for a return to the lows at 12100.

For more in-depth analysis and market forecasts visit our FxPro Blog.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.