Risk-on is in play, with stocks futures rising as USD turns down, while US notes trade sideways. We see that majors found some buyers during the Asian session as DXY stops at 107.70 resistance.

However, the EUR/USD bulls may slow down a bit after PMI figures show contraction, but ECB's de Guindos says the ECB will keep raising interest rates to try to bring inflation down towards mid-term goals. It appears that even bad data won't stop ECB from hiking.

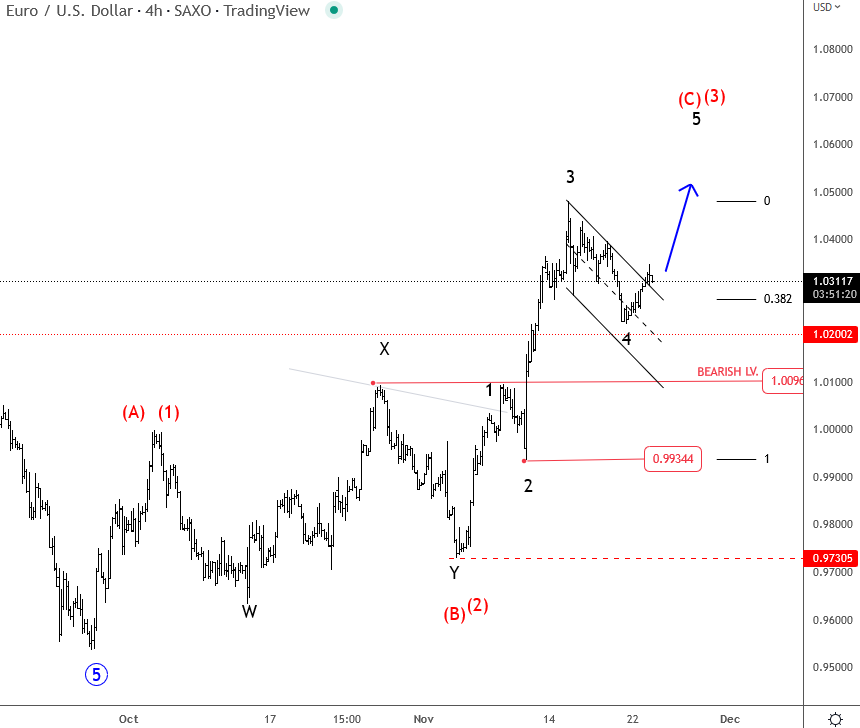

Technically speaking, we see EUR/USD in strong recovery mode in the 4-hour chart after recent complex W-X-Y correction in wave (B)/(2), so we are now tracking a five-wave cycle within wave (C) up to 1.06 area or maybe even wave (3) if we see an acceleration higher towards 1.07 area.

In either case, there is room for more upside after the current intraday fourth wave set-back that can find support at 1.02-1.0270. So for now, the trend is up on the intraday chart, but drop back to parity will be again bearish for the euro as recovery from the September low would then be treated as a correction within the downtrend.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.