- Ahead of the Fed decision, the EUR/USD pair's local downtrend has slowed near 1.08.

- Despite robust U.S. economic data, any hint of rate cuts during Powell's press conference could lead to a significant decline in the US dollar.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- Get an extra 10% off our annual and 2-year Pro+ plans with codes PROTIPS2024 and PROTIPS20242.

Before the Federal Reserve meeting, the financial markets typically experience reduced volatility as anticipation builds up ahead of the main event.

This trend may also influence the EUR/USD pair during today's and tomorrow's sessions, as sellers approach the demand zone at 1.08, potentially signaling a local low.

Meanwhile, recent data from the U.S. economy suggests it remains robust, alleviating the need for Fed officials to rush into an interest rate cut cycle.

While the probability of rate cuts in March remains relatively unlikely, any hint of such a move during Jerome Powell's press conference could prompt a steep decline in the US dollar.

Hawks Set to Come to the Fore

As the Federal Reserve meeting approaches, attention turns to the composition of the board, which includes hawkish members such as Loretta Mester, Thomas Barkin, Raphael Bostic, and Mary Daly.

Their recent statements indicate a preference for delaying interest rate cuts until the third quarter of the year, further reinforcing the expectation of maintaining the status quo in Wednesday's meeting.

Currently, the market predicts a slightly over 50% probability of a 25-basis-point move in May, setting the tone for Powell's press conference.

According to Michael Gapen, an economist at Bank of America Securities:

"The Fed needs to buy time to see more data."

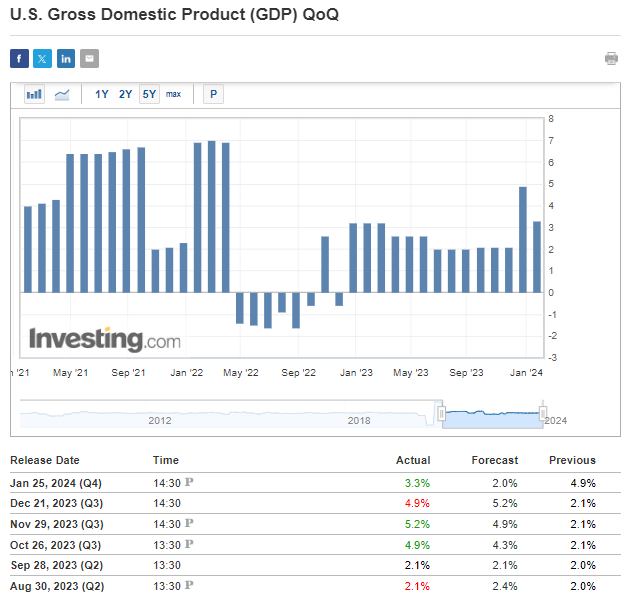

Recent U.S. economic data, including the surprising annualized GDP growth rate of 3.3% versus forecasts of 2%, suggests the possibility of a soft landing, further supporting the Fed's cautious approach.

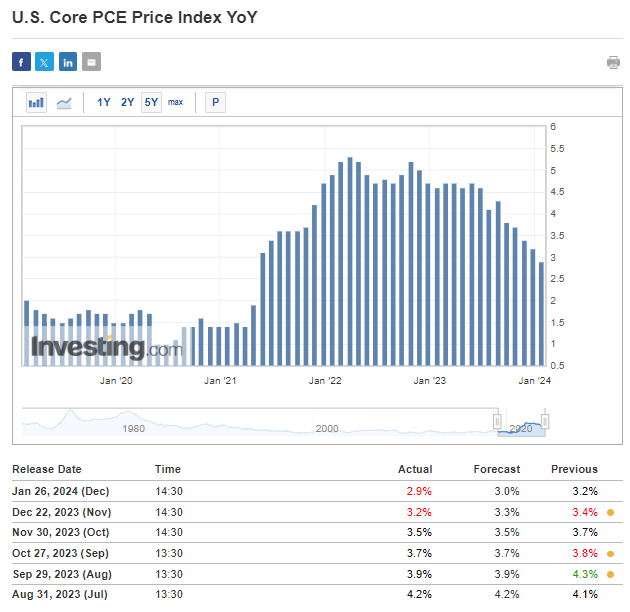

On Friday, the key reading was the Fed's preferred PCE inflation, ultimately shaping up just below forecasts, continuing the disinflationary processes.

Despite the decline in inflation, it appears that the Fed's leadership, drawing from the experience of the 1970s and aiming to avoid a "stop-and-go" approach, intends to prolong the period of restrictive monetary policy.

Positive GDP data, not signaling a recessionary scenario, further supports this approach.

EUR/USD to Consolidate Ahead of Fed: Key Levels to Monitor

The major currency pair has been consistently falling since the beginning of the year, which led to a test of a strong demand zone located in the 1.08 price area.

Given the nature of the period before the announcement of the Fed's decision, it is very possible to stop and form a local consolidation in this area.

However, when considering only the price dynamics, bulls appear to be weak near this zone.

This may encourage sellers to initiate and sustain further declines.

Such a scenario paves the way for an attack on the next demand zone, which is located near the next round level of $1.07 per euro.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Get an extra 10% off our annual and 2-year Pro+ plans with codes PROTIPS2024 and PROTIPS20242. Limited time offer - act now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.