The EUR/USD price opened a week with a gap to the upside and reached the weekly target mentioned last week. The strong bullish trigger to the upside pushed the price higher, reaching $1.01960.

The price stopped on the strong supply zone where we have a confluence of resistance. It stopped in the second supply zone mentioned in the previous analysis, and from there, the price returned down inside the indecision area.

A strong supply zone with sellers entering the trades and buyers exiting their trades and locking the profits pushed the price down. The week ended with the price inside the indecision area between the supply and demand zone.

The price is likely to break again to the upside. But, keep in mind that the breakout on Monday and Tuesday was a false breakout, with the second candle returning down instead continuing up.

We have had two false breakouts in the last two weeks, and bulls and bears have one. So, this represents indecision from the market, where it is best to wait until a clean breakout happens.

The price still needs to break above the small downtrend channel resistance line and small supply zone slightly above that resistance line. And then the strong supply zone around $1.01368.

The current market overview suggests we must wait until the price goes above $1.01368 or below $0.99314. These two levels are strong, with sellers and buyers pushing the price in their direction.

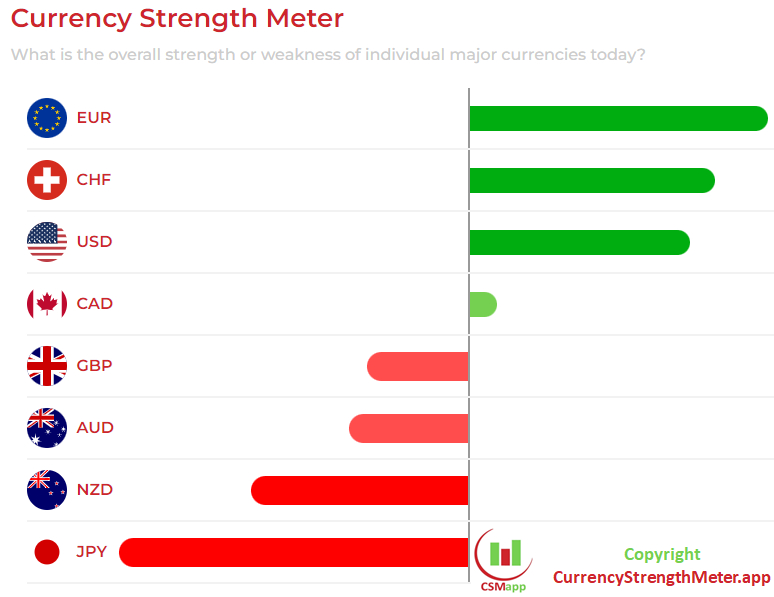

This is visible on the currency strength meter where EUR and USD strength show similar strength, but EUR is slightly stronger than USD.

When it breaks beyond these levels, the price will have a clear path toward the next levels. On the upside, we have $1.02975, which is above the downtrend channel, which will signal the price is changing from a bearish to a potential bullish trend.

On the downside, we have $0.96716, which is in the current bearish downtrend but to reach lower levels, we will need more EUR weakness, which is currently not visible on the chart.