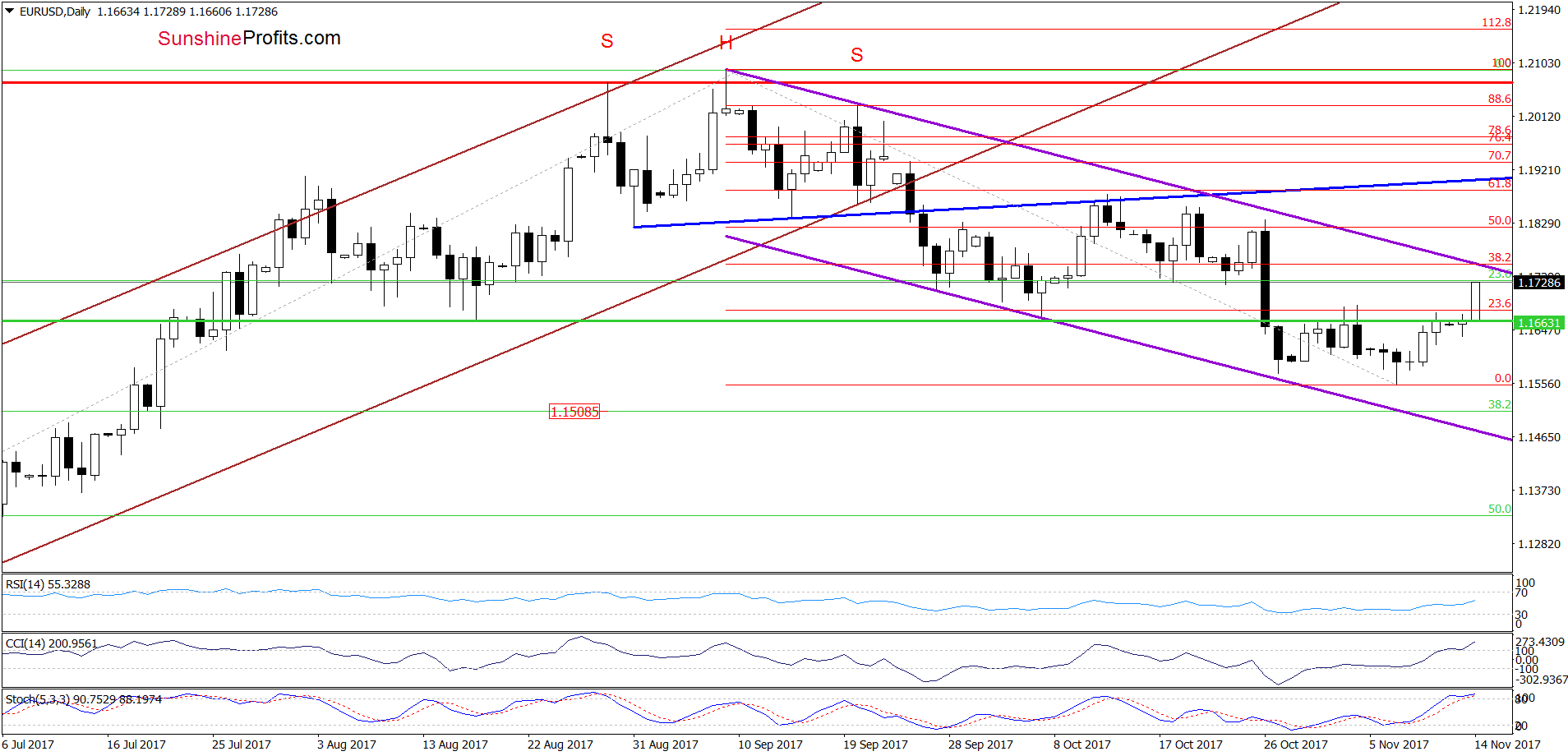

Earlier today, EUR/USD increased sharply, increasing to the resistance area created by two important resistances. Will they stop currency bulls and trigger one more move to the downside in the following days?

EUR/USD

The overall situation in the long- and medium-term hasn’t changed much and we’ll focus on the very short-term changes today.

The first thing that catches the eye on the daily chart is invalidation of the breakdown under the green line based on the August and October lows. This positive development encouraged currency bulls to act, which suggests a test of the upper border of the purple declining trend channel and the 38.2% Fibonacci retracement later in the day.

What’s next? Taking into account the above-mentioned resistances and the current position of the CCI and Stochastic Oscillator (they are overbought and very close to generating sell signals), it seems that EUR/USD will reverse and decline in the following day(s). Nevertheless, if we see a breakout above these resistance levels, we’ll consider closing our short positions and taking profits off the table.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

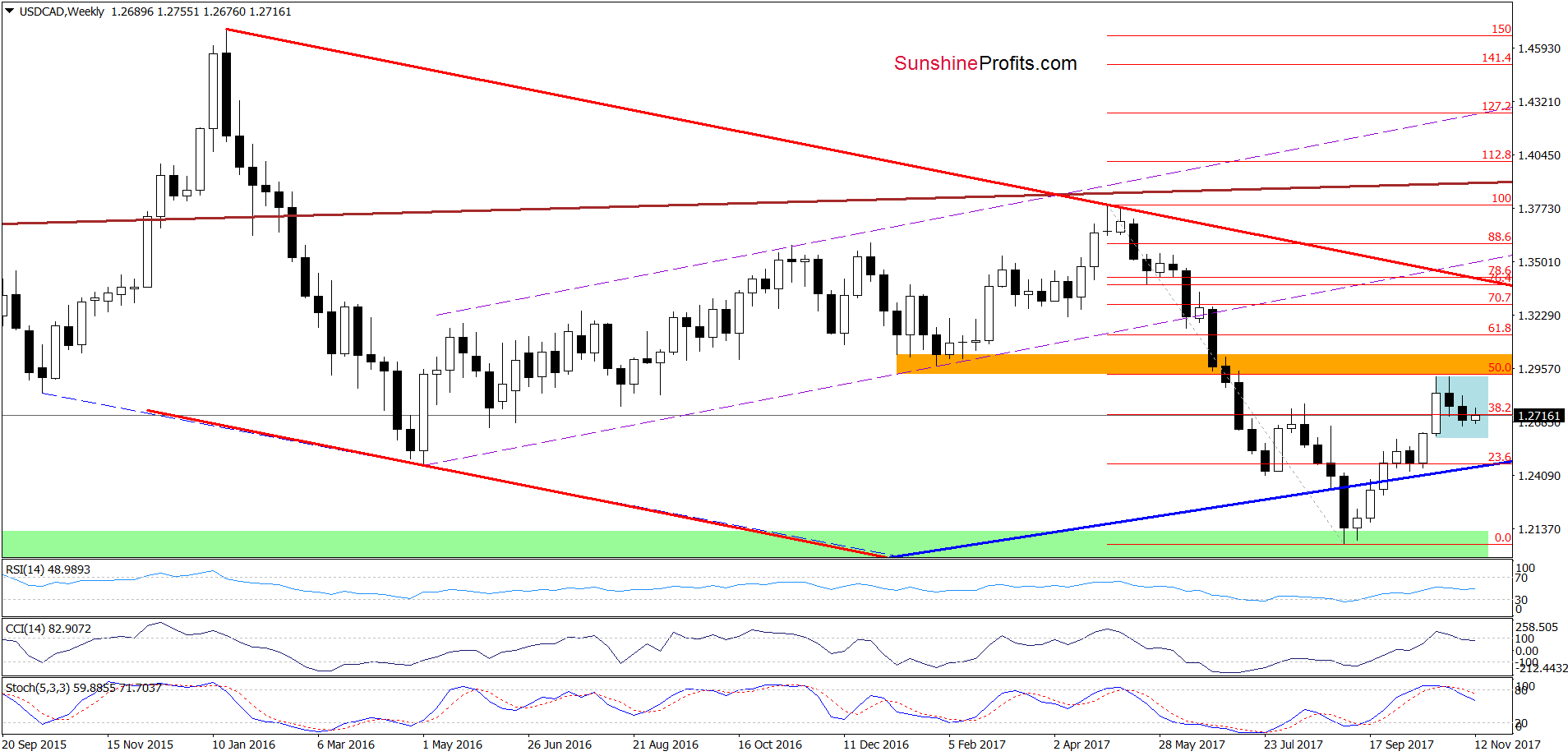

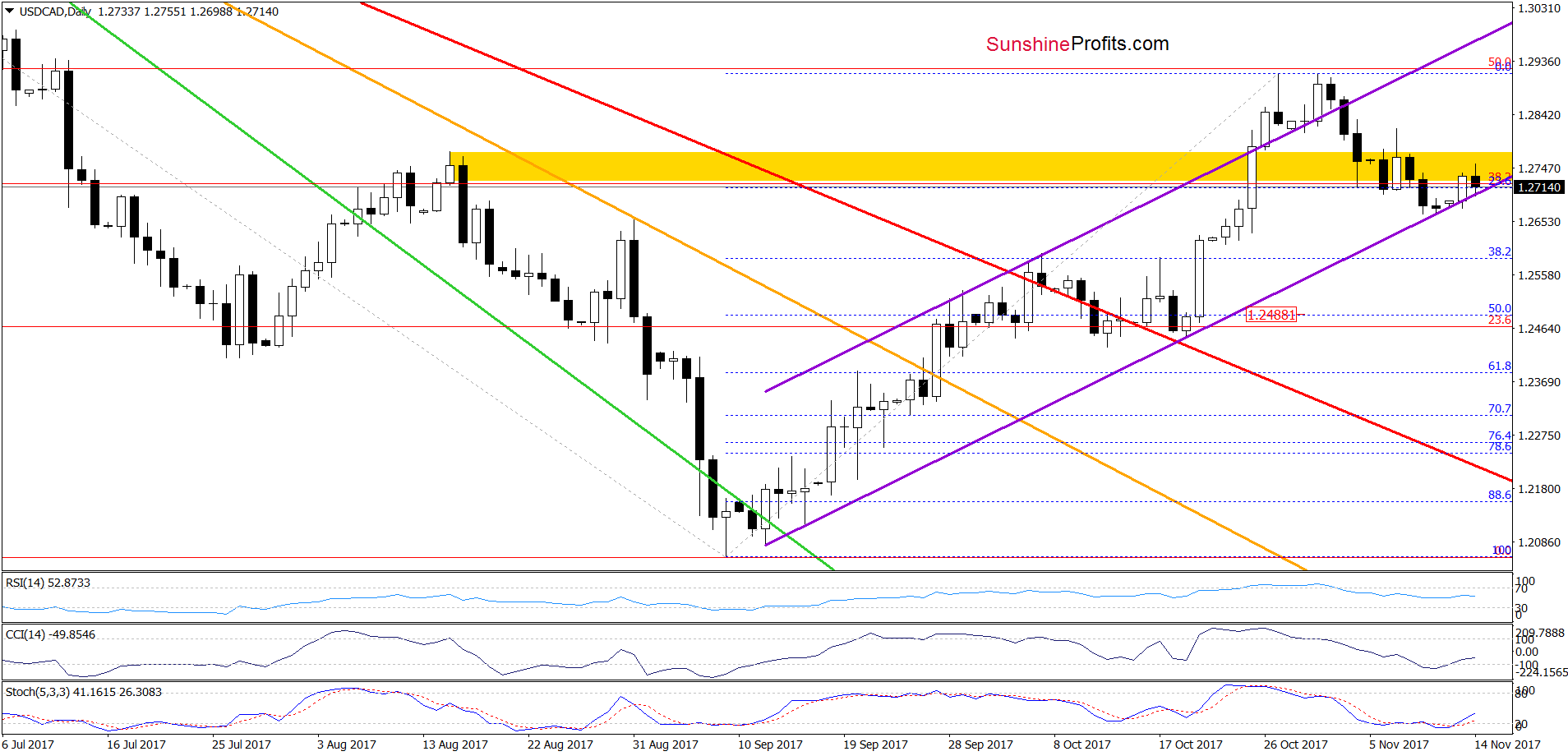

USD/CAD

On the weekly chart, we see that USD/CAD remains in the blue consolidation, which suggests that as long as there is no breakout above the upper border of the formation or a breakdown under the lower line, the situation will remain a bit unclear and short-lived moves in both directions should not surprise us.

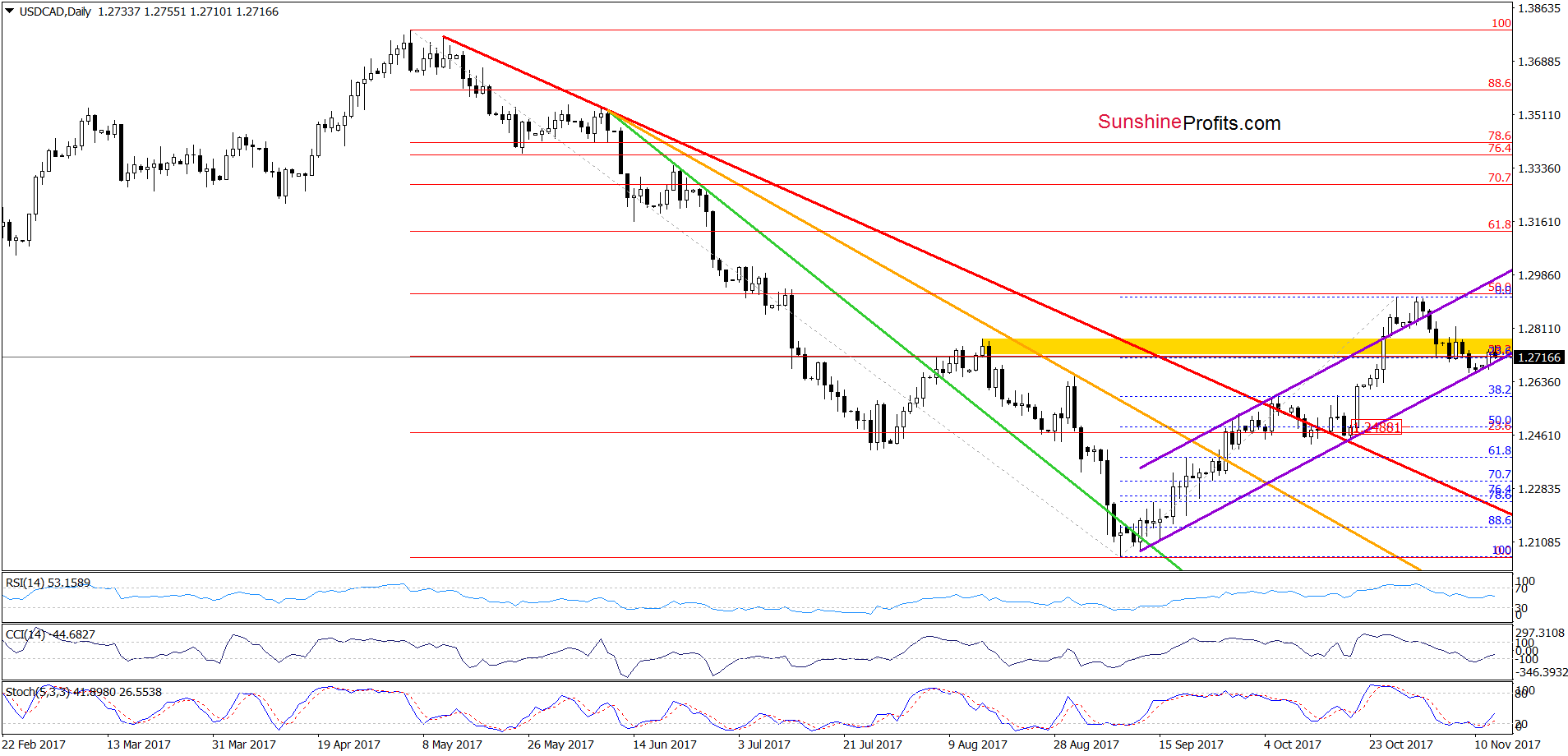

Will the very short-term chart give us more clues about future moves? Let’s check

Although USD/CAD bounced off the lower border of the purple rising trend channel yesterday, currency bears triggered a reversal and decline earlier today. Will we see further deterioration in the coming days? In our opinion, such price action will be more likely and reliable only if the exchange rate closes today’s session (or one of the following sessions) under the lower border of the purple rising trend channel. Additionally, looking at the buy signals generated by the indicators, another rebound from this area should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

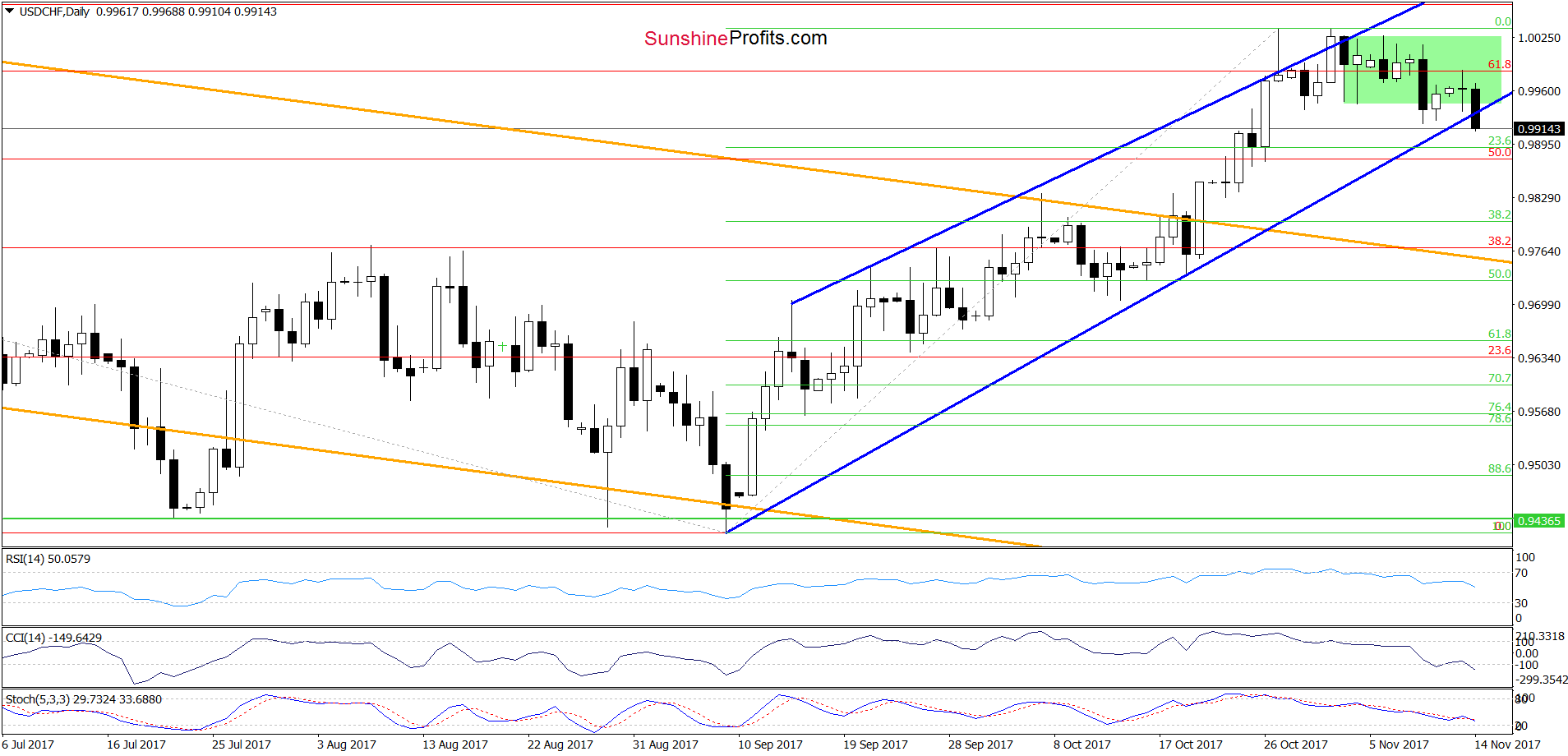

USD/CHF

Last Tuesday, we wrote the following:

(…) Where will the exchange rate head next? Taking into account the sell signals generated by the daily indicators and two invalidations of the breakout above the upper border of the blue rising wedge, it seems that the pair will test the lower border of the formation in the coming week. (…)

From today’s point of view, we see that the situation developed in line with the above scenario and currency bears not only realized the above-mentioned scenario, but also pushed the exchange rate lower earlier today. As a result, the pair dropped under the lower border of the blue rising wedge, which doesn’t bode well for higher values of the exchange rate in the coming days. Why? Because if the pair closes today’s session under this line, we could see a drop to around 0.9861 (in this area the size of the move will correspond to the height of the green consolidation) or even to the 38.3% Fibonacci retracement around 0.9800 in the following days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed