The euro has inched lower in the Wednesday session. Currently, EUR/USD is trading at 1.1566, up 0.08% on the day. There are no major events in the eurozone or the US, it could remain a quiet day for the euro. France posted a trade deficit of EUR 4.7 billion, which matched the estimate. On Thursday, Germany releases Trade Balance and the US publishes unemployment claims.

Eurozone retail sales rebounded sharply in September, pointing to an improvement in consumer spending. The gain of 0.7% came after two straight declines, and was the strongest gain since February. The markets are hoping for strong euorozone consumer spending in the fourth quarter, given the robust German economy and stronger economic conditions in the eurozone.

German coalition talks appear to be closer to a breakthrough, as Angela Merkel’s conservative bloc and two small parties have managed to narrow gaps on taxation climate control and immigration. The parties started exploratory talks on Tuesday, and Merkel could have a government in place in December.

After failing to pass a new healthcare act, President Trump has his sights set on tax reform, a key item in his domestic platform. Trump wants Congress to pass legislation overhauling the tax code before the end of the year, but that could prove to be too tight of a deadline. Most Democrats have come out against the proposal, and not all Republicans are on board. The bill would cut corporate taxes from 35% to 20%, but predictably, Democrat and Republican lawmakers are at odds as to whether the bill will lower taxes for the middle class. The bill is presently being debated in a congressional committee and is expected to move to the House floor next week. The Senate will present its version of the bill on Thursday, so we can expect plenty of activity in Congress in the next few weeks. Expectations that Trump will cut taxes has been the catalyst for a stock market rally over the past year, and if the bill does become law, the US dollar will likely gain ground.

EUR/USD Fundamentals

Wednesday (November 8)

- 2:45 French Trade Balance. Estimate -4.7B. Actual -4.7B

- 10:30 US Crude Oil Inventories. Estimate -2.5M

- 13:01 US 10-year Bond Auction

Thursday (November 9)

- 2:00 German Trade Balance. Estimate 21.0B

- 4:00 ECB Economic Bulletin

- 5:00 EU Economic Forecasts

- 8:30 US Unemployment Claims. Estimate 232K

- 10:00 US Final Wholesale Inventories. Estimate 0.3%

- 10:30 US Natural Gas Storage. Estimate 15B

- 13:01 US 30-year Bond Auction

*All release times are GMT

*Key events are in bold

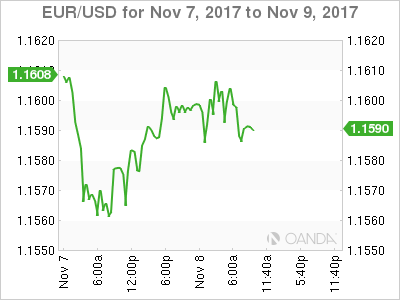

EUR/USD for Wednesday, November 8, 2017

EUR/USD for November 8 at 6:00 EDT

Open: 1.1586 High: 1.1611 Low: 1.1585 Close: 1.1597

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1366 | 1.1489 | 1.1574 | 1.1657 | 1.1777 | 1.1876 |

EUR/USD has been flat in the Asian and European sessions

- 1.1489 is providing support

- 1.1574 has switched to a resistance role after losses by EUR/USD on Tuesday

Further levels in both directions:

- Below: 1.1574, 1.1489, 1.1366 and 1.1268

- Above: 1.1657, 1.1777 and 1.1876

- Current range: 1.1574 to 1.1657

OANDA’s Open Positions Ratio

EUR/USD is unchanged this week. Currently, short positions have a majority (62%), indicative of EUR/USD continuing to move downwards.