EUR/USD continues to drift, as the pair is unchanged this week. Currently, the pair is trading at 1.1189, down 0.03% on the day. On the release front, there are no German or eurozone events. The U.S. releases PPI and Core PPI, both of which are expected to slow to 0.2%. Unemployment claims are forecast to drop sharply to 215 thousand, after a reading of 230 thousand in the previous release. As well, Federal Reserve Chair Jerome Powell speaks at an event in Washington. On Friday, Germany releases trade balance and the U.S. posts consumer inflation reports.

On Tuesday, the European Commission lowered its 2019 growth forecasts for Germany and the eurozone, compared to the forecast back in February. The eurozone downgrade was minor, from 1.5% to 1.4%. However, the forecast for Germany was slashed from 1.1% to 0.5%. The EU noted that the downside risks to the eurozone remain “prominent”, and noted that deadlines for the U.S-China trade talks and Brexit had come and passed, leaving significant uncertainty about the economic outlook. The report warned that “an escalation of trade tensions could prove to be a major shock.” The weak German forecast and pessimistic tone of the report could dampen investor appetite for the euro, although the currency has held steady on Tuesday.

At last week’s Federal Reserve policy meeting, the Federal Reserve maintained its key interest rate and indicated that it was comfortable with current monetary policy and had no plans to raise or lower rates in the coming months. However, the U.S. economy has exceeded expectations, with a sparkling GDP of 3.2% in Q1, and a sharp nonfarm payrolls of 263 thousand. Will these sharp numbers make a rate hike more likely? The markets don’t think so. According to the CME Group (NASDAQ:CME), there is zero probability that the Fed will raise rates before 2020. Moreover there is a 60% likelihood that the Fed will cut rates before the end of 2019. This sentiment could weigh on the greenback, as rate hikes make the currency more attractive to investors.

EUR/USD Fundamentals

Thursday (May 9)

- 4:57 Spanish 10-year Bond Auction. Actual 0.94/1.4

- 8:30 Fed Chair Powell Speaks

- 8:30 US PPI. Estimate 0.2%

- 8:30 US Core PPI. Estimate 0.2%

- 8:30 US Trade Balance. Estimate -51.4B

- 8:30 US Unemployment Claims. Estimate 215K

- 10:00 US Final Wholesale Inventories. Estimate 0.0%

- 10:30 US Natural Gas Storage. Estimate 88B

- 13:01 US 30-year Bond Auction

Friday (May 10)

- 2:00 German Trade Balance. Estimate 19.4B

- 8:30 US CPI. Estimate 0.4%

- 8:30 US Core CPI. Estimate 0.2%

*All release times are DST

*Key events are in bold

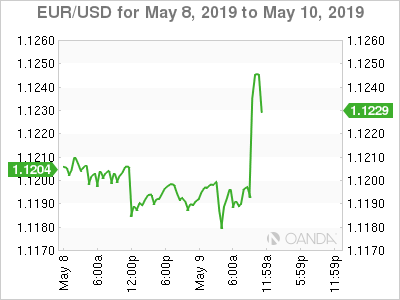

EUR/USD for Thursday, May 9, 2019

EUR/USD for May 9 at 6:45 DST

Open: 1.1192 High: 1.1203 Low: 1.1174 Close: 1.1189

EUR/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0950 | 1.1046 | 1.1120 | 1.1212 | 1.1300 | 1.1434 |

EUR/USD is showing limited movement in the Asian and European sessions

- 1.1120 is providing support

- 1.1212 remains a weak resistance line

- Current range: 1.1120 to 1.1212

Further levels in both directions:

- Below: 1.1120, 1.1046 and 1.0950

- Above: 1.1212, 1.1300, 1.1434 and 1.1553