EUR/USD continues to stay close to the 1.17 level. In the Wednesday session, the pair is trading at 1.1697, up 0.11% on the day. On the release front, German Ifo Business Climate ticked lower to 101.7, just above the estimate of 101.6 points. In the US, New Home Sales is forecast to drop sharply to 669 thousand. On Thursday, Germany releases GfK Consumer Climate and the ECB will set its minimum bid rate. The US will release durable goods reports and unemployment claims.

The EU and the US are engaged in a nasty trade war, and the EU has promised to impose $20 billion in tariffs on US products if the Trump administration slaps $50 billion on European goods. Will the trade war worsen or will the sides pull back and make up? We could be a bit wiser after an EU delegation, led by European Commission President John-Claude Juckner, meets with President Trump at the White House on Wednesday. The euro has been fairly steady in recent weeks, despite the growing trade tensions. If, however, the trade talks between Trump and Juckner fall flat, the euro could lose ground.

With the global tariff war threatening to hurt German and eurozone exports, investors have been keeping a close eye on manufacturing data. There was positive news on Tuesday, as eurozone and German manufacturing PMIs continue to point to expansion. The German release improved to 57.3, easily beating the estimate of 55.5, while the eurozone reading of 55.1 was above the forecast of 54.7. Both indicators had dropped over six consecutive months and the July releases put an end to that nasty streak. Services PMIs were not as strong, as the German and eurozone releases missed their estimates.

EUR/USD Fundamentals

Wednesday (July 25)

- 4:00 German Ifo Business Climate. Estimate 101.6. Actual 101.7

- 4:00 Eurozone Money Supply. Estimate 4.0%. Actual 4.4%

- 4:00 Eurozone Private Loans. Estimate 3.0%. Actual 2.9%

- 9:00 Belgian NBB Business Climate. Estimate 0.4

- 10:00 US New Home Sales. Estimate 669K

- 10:30 US Crude Oil Inventories. Estimate -2.6M

Thursday (July 26)

- 2:00 German GfK Consumer Climate. Estimate 10.7

- 7:45 ECB Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

- 8:30 US Core Durable Goods Orders. Estimate 0.5%

- 8:30 US Durable Goods Orders. Estimate 3.0%

- 8:30 US Unemployment Claims. Estimate 215K

*All release times are DST

*Key events are in bold

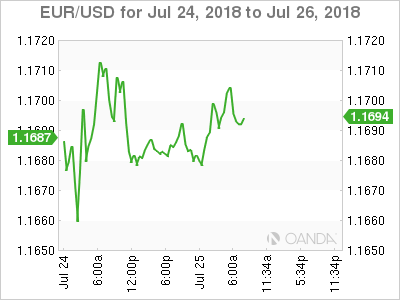

EUR/USD for Wednesday, July 25, 2018

EUR/USD for July 25 at 6:35 DST

Open: 1.1683 High: 1.1705 Low: 1.1675 Close: 1.1697

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1434 | 1.1553 | 1.1637 | 1.1728 | 1.1829 | 1.1910 |

EUR/USD showed little movement in the Asian session and has edged upwards in European trade

- 1.1637 is providing support

- 1.1728 is the next line of resistance

Further levels in both directions:

- Below: 1.1637, 1.1553, 1.1434 and 1.1312

- Above: 1.1728, 1829 and 1.1910

- Current range: 1.1637 to 1.1728