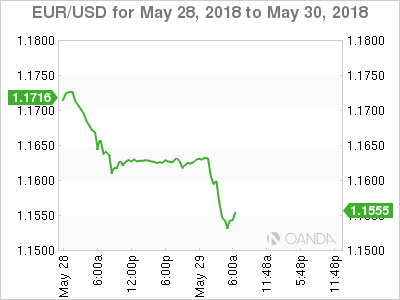

EUR/USD has posted sharp losses in the Tuesday session. Currently, the pair is trading at 1.1541, down 0.72% on the day. On the release front, there are no major eurozone indicators. In the US, CB Consumer Confidence is expected to dip to 128.0 points. On Wednesday, there are a host of key indicators. Germany will release retail sales and Preliminary CPI, and the US publishes ADP nonfarm payrolls and US Preliminary GDP.

The euro has sunk to its lowest level since early July of 2017, as Italy is in the midst of a severe political crisis. The drama started on the weekend, when President Sergio Mattarella vetoed a ministerial choice of the two parties which were expected to form a coalition, the League Nord and the Five Star Movement. Mattarella rejected the suggestion of Paolo Savona as economic minister, given that Savona is a firm critic of the euro and supports Italy exiting from the eurozone. Predictably, the response from the two parties was harsh, with claims that Mattarella was a puppet of Germany and the EU, and there were even demands for his impeachment. The prime minister-elect, Giuseppe Conte, has given up his mandate to form a government, and Mattarella has invited Carlo Cottarelli, a former IMF economist, to form a temporary technocrat government. This could mean that Italy will hold another election in the fall, unless there are more political twists and turns in this crisis.

The ECB is scheduled to wind up its massive stimulus program in September, but weak growth in the first quarter has raised speculation that the bank could decide to extend the program, a tactic it has often used in the past. Still, most analysts believe that the ECB will go ahead and terminate stimulus, but there is more uncertainty regarding future rate hikes. Higher oil prices and a weaker euro will likely mean that inflation is moving upwards, but core inflation projections, which ECB policymakers are most interested in, are expected to remain below the ECB inflation target of just below 2 percent. Investors will be keeping a close look at upcoming rate statements, looking for clues regarding the wind-up of the stimulus scheme.

EUR/USD Fundamentals

Tuesday (May 29)

- 4:00 Eurozone M3 Money Supply. Estimate 3.9%. Actual 3.9%

- 4:00 Eurozone Private Loans. Estimate 3.2%. Actual 2.9%

- 9:00 US S&P/CS Composite-20 HPI. Estimate 6.5%

- 10:00 US CB Consumer Confidence. Estimate 128.2

Wednesday (May 30)

- 2:00 German Retail Sales. Estimate 0.5%

- 2:00 German Import Prices. Estimate 0.7%

- All Day – German Preliminary CPI. Estimate 0.3%

- 2:45 French Consumer Spending. Estimate 0.2%

- 2:45 French Preliminary GDP. Estimate 0.3%

- 3:00 Spanish Flash CPI. Estimate 1.7%

- 3:55 German Unemployment Change. Estimate -10K

- Tentative – Italian 10-year Bond Auction

- 8:15 US ADP Nonfarm Employment Change. Estimate 186K

- 8:30 US Preliminary GDP. Estimate 2.3%

- 8:30 US Goods Trade Balance. Estimate -71.2B

- 8:30 US Preliminary GDP Price Index. Estimate 2.0%

- 8:30 US Preliminary Wholesale Inventories. Estimate 0.4%

- 14:00 US Beige Book

*All release times are DST

*Key events are in bold

EUR/USD for Tuesday, May 29, 2018

EUR/USD for May 29 at 5:30 DST

Open: 1.1624 High: 1.1640 Low: 1.1531 Close: 1.1541

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1212 | 1.1312 | 1.1448 | 1.1613 | 1.1718 | 1.1809 |

EUR/USD was flat in the Asian session and has edged lower in European trade

- 1.1448 is providing support

- 1.1613 is the next line of resistance

Further levels in both directions:

- Below: 1.1448, 1.1312 and 1.1212

- Above: 1.1613, 1.1718, 1.1809 and 1.1915

- Current range: 1.1448 to 1.1613

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Tuesday session. Currently, long positions have a majority (57%), indicative of trader bias towards EUR/USD reversing directions and moving to higher ground.