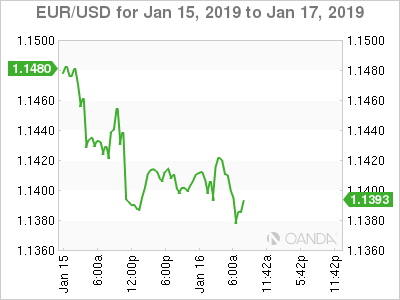

EUR/USD has moved lower in the Wednesday session, after considerable losses on Tuesday. Currently, the pair is trading at 1.1380, down 0.30% on the day. On the release front, German Final CPI came in at 0.1% for a second successive month. There are no major U.S. events on the schedule. On Thursday, the Eurozone releases Final CPI and the U.S. will publish unemployment claims and the Philly Fed Manufacturing Index.

With the Eurozone struggling, there are plenty of headaches for ECB policymakers, and Mario Draghi shared some of his concerns on Tuesday, at a plenary session on the ECB annual report. Draghi highlighted Brexit and the U.S-China trade war as significant concerns and noted that Eurozone economic conditions have been weaker than expected, adding that the Eurozone was undergoing a slowdown but was not heading into recession. The ECB holds its next policy meeting on January 24, with no change in monetary policy expected.

Germany’s economic data is closely watched, as the economy is a bellwether not just for the Eurozone, but for the global economy as well. Germany has not yet released GDP data for the fourth quarter, but officials have reported that it will be a ‘slight gain’. The German economy grew 1.5% in 2018, the lowest level of growth since 2013. A key reason for the weak expansion is the ongoing global trade war, which has taken a bite out the export sector and dampened manufacturing activity. German Industrial production has fallen for three successive months, and Eurozone industrial production is also pointing downwards.

On the bright side, German unemployment is at record lows and domestic demand has remained strong. The ECB winded up its stimulus program last month and had expressed plans to raise rates later this year. However, this is unlikely to happen unless economic conditions improve the Eurozone.

EUR/USD Fundamentals

Wednesday (January 16)

- 2:00 German Final CPI. Estimate 0.1%. Actual 0.1%

- Tentative – German 30-year Bond Auction. Actual 0.85/1.1

- 8:30 US Import Prices. Estimate -1.3%

- 10:00 US NAHB Housing Market Index. Estimate 56

- 10:30 US Crude Oil Inventories. Estimate -1.4M

- 14:00 US Beige Book

Thursday (January 17)

- 5:00 Eurozone Final CPI. Estimate 1.7%

- 5:00 Eurozone Final Core CPI. Estimate 1.0%

- 8:30 US Philly Fed Manufacturing Index. Estimate 9.7

- 8:30 US Unemployment Claims. Estimate 219K

*All release times are EST

*Key events are in bold

EUR/USD for Wednesday, January 16, 2019

EUR/USD for January 16 at 6:50 EST

Open: 1.1412 High: 1.1425 Low: 1.1392 Close: 1.1380

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1120 | 1.1212 | 1.1300 | 1.1434 | 1.1553 | 1.1685 |

EUR/USD showed limited movement in the Asian session. In European trade, the pair posted small gains but has reversed directions and edged lower

- 1.1300 is providing support

- 1.1434 is the next resistance line

- Current range: 1.1300 to 1.1434

Further levels in both directions:

- Below: 1.1300, 1.1212 and 1.1120

- Above: 1.1434, 1.1553, 1.1685 and 1.1803