EUR/USD has paused on Thursday, after gains on the Wednesday session. Currently, the pair is trading at 1.2327, down 0.10% on the day. On the release front, eurozone and Germany Manufacturing PMIs missed their estimates. Eurozone Manufacturing PMI dropped to 56.6, down from 58.1 points. The German release slowed to 58.4, compared to the estimate of 59.8 points. German Ifo Business Climate also dipped to 114.7, matching the estimate. In the US, the key indicator is unemployment claims, which is expected to edge lower to 225 thousand. On Friday, the US releases durable goods and housing reports.

As widely expected, the Federal Reserve raised rates by a quarter-point on Wednesday, bringing the benchmark rate to a range between 1.50% and 1.75%. The markets were looking for any clues with regard to the pace of rate hikes in 2018 – currently the Fed is projecting three hikes, but a robust US economy could push the Fed to press the rate trigger four times. The rate statement did not directly address the issue, but there was a refreshing lack of Fedspeak from policymakers, who said that “the economic outlook has strengthened in recent months”. This phrase has not been used in previous rate statements, and if Fed policymakers reiterate positive sentiment towards the economy, could push the US dollar to higher ground.

EUR/USD Fundamentals

Thursday (March 22)

- 4:00 French Flash Manufacturing PMI. Estimate 55.6. Actual 53.6

- 4:30 French Flash Services PMI. Estimate 57.0. Actual 56.8

- 4:30 German Flash Manufacturing PMI. Estimate 59.8. Actual 58.4

- 4:30 German Flash Services PMI. Estimate 55.0. Actual 54.2

- 5:00 Eurozone Flash Manufacturing PMI. Estimate 58.1. Actual 56.6

- 5:00 Eurozone Flash Services PMI. Estimate 56.0. Actual 55.0

- 5:00 German Ifo Business Climate. Estimate 114.7. Actual 114.7

- 5:00 Eurozone Current Account. Estimate 30.2B. Actual 37.6B

- 5:00 ECB Economic Bulletin

- 8:30 US Unemployment Claims. Estimate 225K

- 9:00 US HPI. Estimate 0.4%

- 9:45 US Flash Manufacturing PMI. Estimate 55.4

- 9:45 US Flash Services PMI. Estimate 55.9

- 10:00 Belgian NBB Business Climate. Estimate 1.2

- 10:00 US CB Leading Index. Estimate 0.5%

- 10:30 US Natural Gas Storage. Estimate -88B

Friday (March 23)

- 8:30 US Core Durable Goods Orders. Estimate 0.5%

- 8:30 US Durable Goods Orders. Estimate 1.6%

- 10:00 US New Home Sales. Estimate 621K

*All release times are GMT

*Key events are in bold

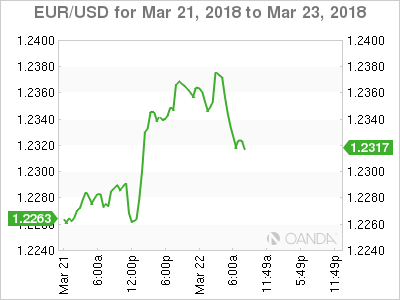

EUR/USD for Thursday, March 22, 2018

EUR/USD for March 22 at 7:05 DST

Open: 1.2338 High: 1.2389 Low: 1.2321 Close: 1.2327

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2092 | 1.2235 | 1.2319 | 1.2460 | 1.2581 | 1.2662 |

EUR/USD was flat in the Asian session and has edged lower in European trade

- 1.2319 is a weak line of support

- 1.2460 is the next line in resistance

Further levels in both directions:

- Below: 1.2319, 1.2235, 1.2092 and 1.2025

- Above: 1.2460, 1.2581 and 1.2662

- Current range: 1.2319 to 1.2460

OANDA’s Open Positions Ratio

EUR/USD ratio is showing little movement in the Thursday session. Currently, short positions have a majority (59%), indicative of EUR/USD reversing directions and moving to lower ground.