The euro is almost unchanged in the Tuesday session, after starting the week with considerable losses. Currently, EUR/USD is trading at 1.1736, up 0.03% on the day. German banks are closed for a holiday, so we’re unlikely to see much movement from the pair during the day. The eurozone will release PPI, which is expected to post a weak gain of 0.1%. There are no major US releases on the schedule.

The Spanish region of Catalonia was a scene of chaos of violence on the weekend. The Catalan regional government attempted to hold a referendum on independence, but the national government was adamantly opposed to the move and banned the vote. When voters showed up at polling stations, the police moved in with force, injuring close to 900 civilians. Catalonian officials claimed that 90 percent of voters had voted for independence, setting the stage for a full-blown crisis with Madrid. The Spanish constitution prohibits any region from seceding, but Catalan Carles Puigdemont has no intention of backing down, and has called for a general strike on Tuesday. Although the euro lost ground on Monday, the crisis is not expected to continue to weigh on the currency, given that the referendum is viewed as an issue local to Spain, and not to the eurozone in general. As well, the Spanish economy is in good shape, so a constitutional crisis is unlikely to affect the country’s economic growth.

President Trump has set is sight on tax reform, but the tax proposal, called the Unified Tax Reform Framework, has been sketchy and short on specifics. Under the proposal, corporate tax would be lowered from 35 percent to 20 percent, and there would be deep cuts in personal income tax as well. However, it’s not clear how the government would pay for these cuts, with Trump saying that the cuts will trigger strong economic growth. Moody’s, the well-respected credit rating company, isn’t buying what Trump is selling. On Monday, Moody’s said that the tax plan is “likely credit negative”, arguing that tax cuts would not be offset in spending cuts, which would result in a higher federal budget deficit and debt. The reduction in federal government revenue would negatively affect the US credit rating. Some republican lawmakers have already come out against the plan, so it appears that the proposal will have an uphill battle to pass through the House of Representatives and the Senate.

EUR/USD Fundamentals

Tuesday (October 3)

- 3:00 Spanish Unemployment Change. Estimate 21.3K. Actual 27.9K

- All Day – German Bank Holiday

- 5:00 Eurozone PPI. Estimate 0.1%

- 8:30 US FOMC Member Jerome Powell Speaks

- All Day – US Total Vehicle Sales. Estimate 16.9M

Wednesday (October 4)

- 8:15 US ADP Nonfarm Employment Change. Estimate 151K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 55.5

- 13:15 ECB President Mario Draghi Speaks

- 15:15 Federal Chair Janet Yellen Speaks

*All release times are GMT

*Key events are in bold

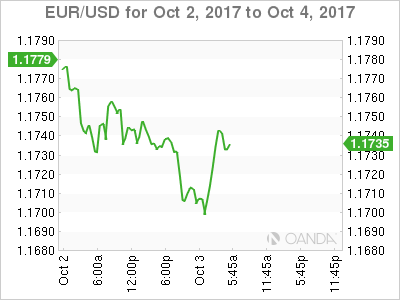

EUR/USD for Tuesday, October 3, 2017

EUR/USD Tuesday, October 3 at 5:10 EDT

Open: 1.1732 High: 1.1747 Low: 1.1696 Close: 1.1736

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1489 | 1.1611 | 1.1712 | 1.1876 | 1.1996 | 1.2018 |

EUR/USD edged lower in the Asian session but has reversed directions and is moving higher in European trade

- 1.1712 is a support line

- 1.1876 is the next resistance line

Further levels in both directions:

- Below: 1.1712, 1.1611 and 1.1489

- Above: 1.1876, 1.1996, 1.2018 and 1.2108

- Current range: 1.1712 to 1.1876

OANDA’s Open Positions Ratio

EUR/USD ratio is showing movement towards short positions. Currently, short positions have a majority (66%), indicative of EUR/USD reversing directions and moving lower.