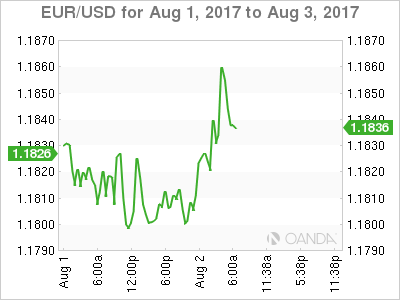

EUR/USD has edged higher in the Wednesday session. Currently, the pair is trading at 1.1840, up 0.33% on the day. On the release front, Eurozone PPI declined 0.1%, matching the estimate. The US will post key employment numbers for the remainder of the week, starting with ADP Nonfarm Employment Change. After a slowdown in June, the indicator is expected to rebound to 187 thousand. On Thursday, the US releases two key events – unemployment claims and ISM Non-Manufacturing PMI.

The ECB meets next in early September, and as things currently stand, the bank is expected to hold the course on its ultra-accommodative monetary policy. Currently, ECB interest rates stand at a flat 0.00%, where they have been pegged since March 2o16. Under the bank’s quantitative easing program (QE), the bank has been purchasing assets at a rate of EUR 60 billion/month. The QE program is scheduled to wind up in December, although the ECB has provided itself with some wiggle room, saying that that it could extend the program “if necessary”. With the eurozone economy finally flexing some muscle in 2017, there has speculation that the ECB would tighten policy, and this has led to some frenzied buying of euros, much to the consternation of the ECB. At a conference of central bankers in June, ECB President Mario Draghi said that the reflationary forces could result in the bank “adjusting the parameters” of current stimulus. The comments did not appear to mark a change in ECB policy, but investors seized on the remarks and the euro soared. The ECB was caught off guard, and resorted to the unusual step of stating that the markets had misinterpreted Draghi’s comments. Given that fiasco, it’s a safe bet that the ECB will be ultra-cautious in upcoming statements in order to avoid any repeat convulsions in the markets. At the same time, as we approach the December timeline for winding up QE, the ECB would do well to act in a transparent fashion and let the markets know if the QE program will indeed wind up in December. A lack of transparency could trigger market volatility, which is precisely what ECB policymakers wish to avoid.

The sparkling euro has posted weekly gains for three straight weeks, and even a strong gain from US Advance GDP last week failed to stem the euro rally. The first GDP report for the second quarter came in at impressive 2.6%, beating the estimate of 2.5%. This strong expansion should put to rest concerns of a second straight quarter of weak growth – Final GDP came in at just 1.4%. Still, EUR/USD soared in July, gaining 3.5%. Investors remain concerned that low inflation in the US could mean that the Fed will balk and not raise interest rates in December, despite all but promising to increase rates three times in 2017. In June, Fed Chair Janet Yellen dismissed low inflation as “transient”, but she has since changed her tune, as economists remain at a loss to explain why a red-hot economy has not translated into stronger wage growth, and hence higher inflation. The markets are skeptical about a December hike, with the odds at just 42%, according to the CME Group (NASDAQ:CME).

EUR/USD Fundamentals

Wednesday (August 2)

- 2:00 Spanish Unemployment Change. Estimate -66.5K. Actual -26.9K

- 5:00 Eurozone PPI. Estimate -0.1%. Actual -0.1%

- Tentative – German 10-y Bond Auction

- 8:15 US ADP Nonfarm Employment Change. Estimate 187K

- 10:30 US Crude Oil Inventories. Estimate -3.2M

Thursday (August 3)

- 8:30 US Unemployment Claims. Estimate 242K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 56.9

*All release times are GMT

*Key events are in bold

EUR/USD for Wednesday, August 2, 2017

EUR/USD Wednesday, August 2 at 5:25 EDT

Open: 1.1802 High: 1.1869 Low: 1.1794 Close: 1.1844

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1534 | 1.1616 | 1.1712 | 1.1876 | 1.1996 | 1.2108 |

EUR/USD edged higher in the Asian session and continues to post gains in European trade

- 1.1712 is a weak support line

- 1.1876 is the next resistance line

Further levels in both directions:

- Below: 1.1712, 1.1616, 1.1534 and 1.1465

- Above: 1.1876, 1.1996 and 1.2108

- Current range: 1.1712 to 1.1876

OANDA’s Open Positions Ratio

In the Wednesday session, EUR/USD ratio is showing short positions with a majority (69%). This is indicative of EUR/USD reversing directions and moving downwards.