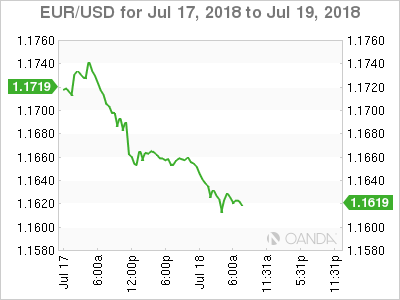

EUR/USD is lower in the Wednesday session, following the downward trend which was seen on Tuesday. Currently, the pair is trading at 1.1619, down 0.37% on the day. The pair is currently at its lowest level since July 2. On the release front, eurozone Final CPI edged up to 2.0%, matching the estimate. Final Core CPI dipped to 0.9%, short of the estimate of 1.1%. The markets are expecting mixed construction numbers – Building Permits are expected to climb to 1.33 million, while Housing Starts are forecast to drop to 1.32 million. Later in the day, Federal Reserve Chair Jerome Powell testifies before the House Financial Services Committee. On Thursday, the US releases the Philly Fed Manufacturing Index and US unemployment claims.

A milestone was reached on Thursday, as eurozone Final CPI reached the 2.0% threshold in the June release. On an annualized basis, Final CPI also came in at 2.0%. This marks the highest level since February 2017. As the ECB prepares to wind up its asset-purchase program, the markets are looking for clues about a possible rate hike. Such a move would likely have a significant impact on the markets, as the ECB last raised rates back in 2011. If inflation levels continue to rise, there will be more pressure on the ECB to consider a rate hike sooner rather than later.

Fed Reserve Chair Jerome Powell reaffirmed his positive outlook on the US economy in testimony before the Senate Banking Committee. Powell said that he expected the labor market to remain tight and inflation to stay close to the Fed’s target of 2 percent for the next several years. Powell added that the Fed would continue to gradually raise interest rates. Lawmakers appeared satisfied with current monetary policy, but Powell did face some pointed questions regarding the escalating trade war, which has raised concerns that the economy could take a downturn if the tariff battles continue.

With global protectionist winds getting stronger by the week, Japan and the EU signed a free trade agreement on Tuesday. At the signing ceremony, Prime Minister Shinzo Abe and European Council head Donald Tusk said that the deal is a response to growing concerns about protectionism. The agreement will eliminate most tariffs between the EU and Japan, and will be particularly beneficial for Japanese car makers and European food producers. No less important, the agreement marks the largest free trade agreement in the world, as the EU and Japan cover about one-third of global GDP and some 600 million people.

EUR/USD Fundamentals

Wednesday (July 18)

- 5:00 Eurozone Final CPI. Estimate 2.0%. Actual 2.0%

- 5:00 Eurozone Final Core CPI. Estimate 1.0%. Actual 0.9%

- Tentative – German 30-year Bond Auction

- 8:30 US Building Permits. Estimate 1.33M

- 8:30 US Housing Starts. Estimate 1.32M

- 10:00 US Federal Reserve Jerome Powell Testifies

- 10:30 US Crude Oil Inventories

- 14:00 US Beige Book

Thursday (July 19)

- Tentative – Spanish 10-year Bond Auction

- 8:30 US Philly Fed Manufacturing Index. Estimate 21.6

- 8:30 US Unemployment Claims. Estimate 220K

- 9:00 US FOMC Member Randal Quarles

- 10:00 US CB Leading Index. Estimate 0.4%

- 10:30 US Natural Gas Storage. Estimate 58B

*All release times are DST

*Key events are in bold

EUR/USD for Wednesday, July 18, 2018

EUR/USD for July 17 at 6:30 DST

Open: 1.1662 High: 1.1665 Low: 1.1607 Close: 1.1619

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1312 | 1.1434 | 1.1553 | 1.1637 | 1.1728 | 1.1829 |

EUR/USD ticked lower in the Asian session and has edged lower in European trade

- 1.1553 is the next support level

- 1.1637 has switched to a resistance role following losses by EUR/USD on Wednesday. It is a weak line

Further levels in both directions:

- Below: 1.1553, 1.1434 and 1.1312

- Above: 1.1637, 1.1728, 1829 and 1.1910

- Current range: 1.1553 to 1.1637