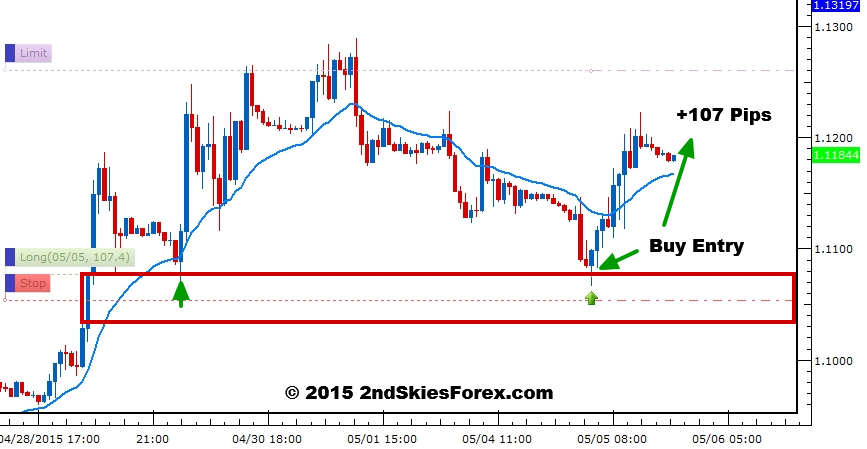

EUR/USD – Buy Setup On Pullback In Heavy Profit (1hr chart)

Yesterday in the members trade setups commentary, we talked about looking to buy a pullback setup on the key support zone between 1.1070 and 1.1030.

As you can see from the chart below, this worked out to perfection with the euro now up about +110 pips from there.

You can also see in the chart below I put my money where my blog posts are and am long on this pair at 1.1077, now up about +107 pips with a 24 pip stop, so a +4R at the moment.

I’ll be locking some profit and neutralizing all the risk shortly. The impulsive buying off the level followed by a corrective pullback suggests the next leg is up.

I’m targeting just above 1.1250 but may exit if it continues to get stuck just below here. If the price action climbs impulsively from here, I’ll consider lifting the limit and gunning for the mid 1.14’s.

Only a daily close below my key support zone negates my bullish bias MT.

EUR/JPY – Buy Setup Profits After Corrective Structure Reverses (1hr chart)

Yesterday we also talked about the impulsive and corrective price action structure on the EUR/JPY, with the current corrective phase likely signaling another leg up.

Our buy zone between 133.60 and 132.75 held nicely as you can see the pair bounced heavily today forming a bullish with trend impulsive move. The pair is corrective off the intra-day highs and I’m suspecting another leg up and attack on the 135 ‘big figure’ is underway.

133.70 comes in at ST support for now. Only a daily close below 132.76 negates my bullish bias.