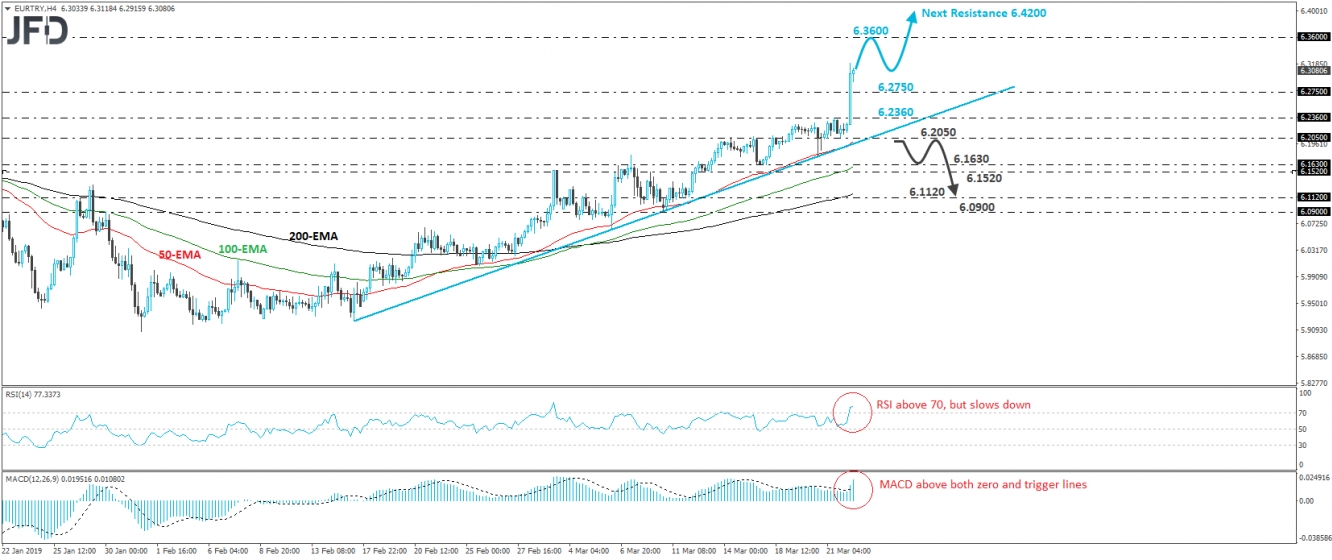

EUR/TRY skyrocketed during the European morning, after Turkish President Erdogan said that US President Trump’s remarks over recognizing Golan Heights as Israeli territory, threaten a new crisis. From a technical standpoint the pair surged above 6.2050, confirming a forthcoming higher high, and then broke above the peak of January 15th, at around 6.2750. The rally, combined with the fact that the rate continues to trade above the uptrend line drawn from the low of February 15th, keeps the near-term bias to the upside, in our view.

If the bulls are willing to stay in the driver’s seat, we may see them challenging the 6.3600 zone soon, defined by the peak of January 14th. It is also fractionally below the high of January 10th. If that zone fails to prove an obstacle this time around, its break may carry more bullish implications, perhaps paving the way for the 6.4200 area, marked by the high of November 1st. That said, bearing in mind that today’s rally appears overstretched, we would stay cautious of a possible corrective setback, perhaps from current levels, or after the rate hits the 6.3600 zone.

Shifting attention to our short-term oscillators, we see that the RSI emerged above 70, while the MACD lies above both its zero and trigger lines. Both indicators suggest strong upside speed, but the fact that the RSI shows signs of slowing down within its above-70 zone, enhances our choice to stay careful over a possible corrective retreat.

In order to start examining a bearish reversal, we would like to see a decisive dip below 6.2050. Such a move could confirm a break below the aforementioned uptrend line and may initially pave the way towards the 6.1630 area, marked by the lows of March 15th and 18th. That said, we would start looking for more downside extensions, only after the rate falls below 6.1520. Such a dip may pave the way for the low of March 12th, at around 6.1120, or the low of March 11th, near 6.0900.