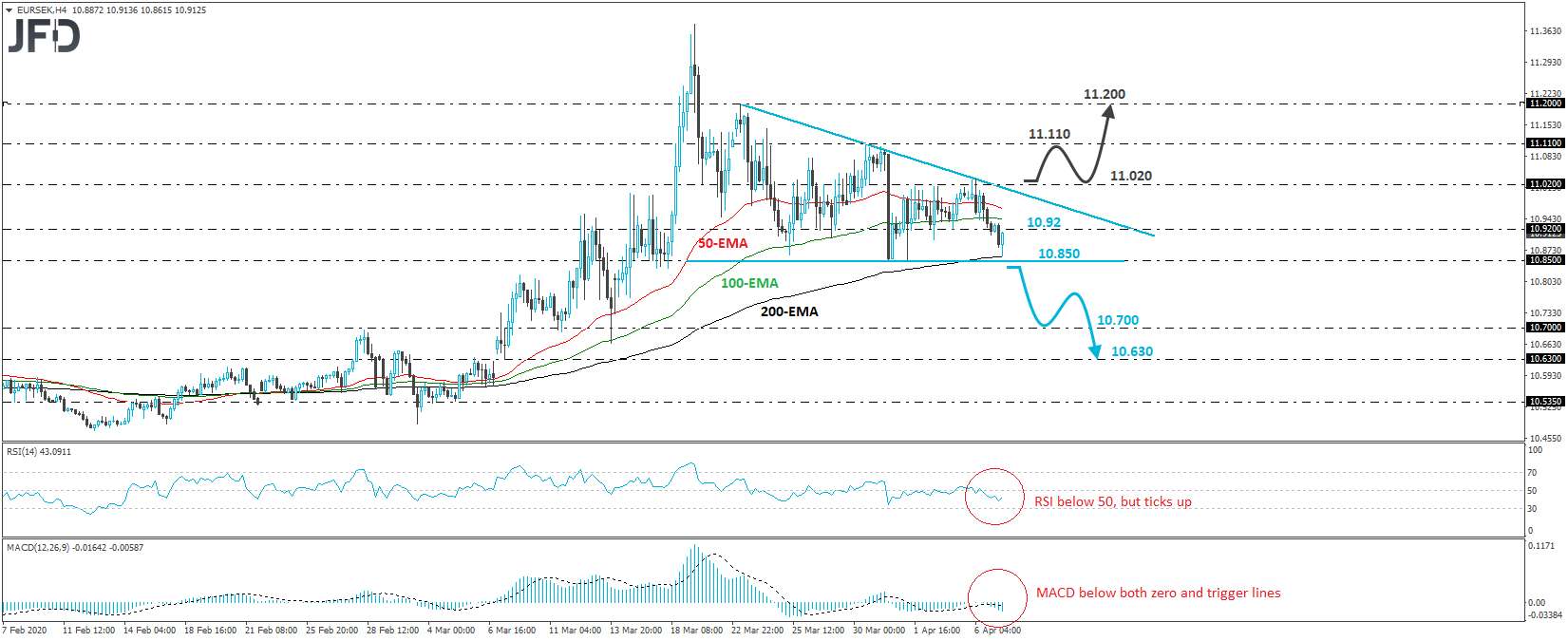

EUR/SEK traded somewhat lower today, but the slide stayed limited near the 200-EMA on the 4-hour chart, slightly above the lower bound of a descending triangle that’s been containing the price action since March 23rd. In theory, such triangles are considered bearish, but bearing in mind that, in reality, we saw such patterns being exited to the upside, we will hold a neutral stance for now and wait for the rate to break out, in either direction.

A break of the triangle’s lower end, which coincides with the 10.850 zone, would confirm a forthcoming lower low and may encourage the bears to push towards the 10.700 territory, fractionally above the inside swing highs of January 31st and February 3rd, as well as near the low of March 11th. Another break below 10.700 could extend the slide towards the low of March 9th, at around 10.630.

Turning attention to our short-term momentum studies, we see that the RSI runs below 50, while the MACD lies below both its zero and trigger lines. Both indicators detect downside speed, but the RSI has just ticked up, which supports our view to wait for a dip below 10.850 before getting confident on larger bearish extensions.

On the upside, we would like to see a decisive break above 11.020, before we start examining whether the bulls have stolen the bears’ weapons. Such a move may confirm the break of the triangle’s upper side and may initially pave the way towards the high of March 30th, at 11.110, where another break may carry more bullish implications, perhaps setting the stage for the peak of March 23rd, at around 11.200.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/SEK Trades In A Descending Triangle

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.