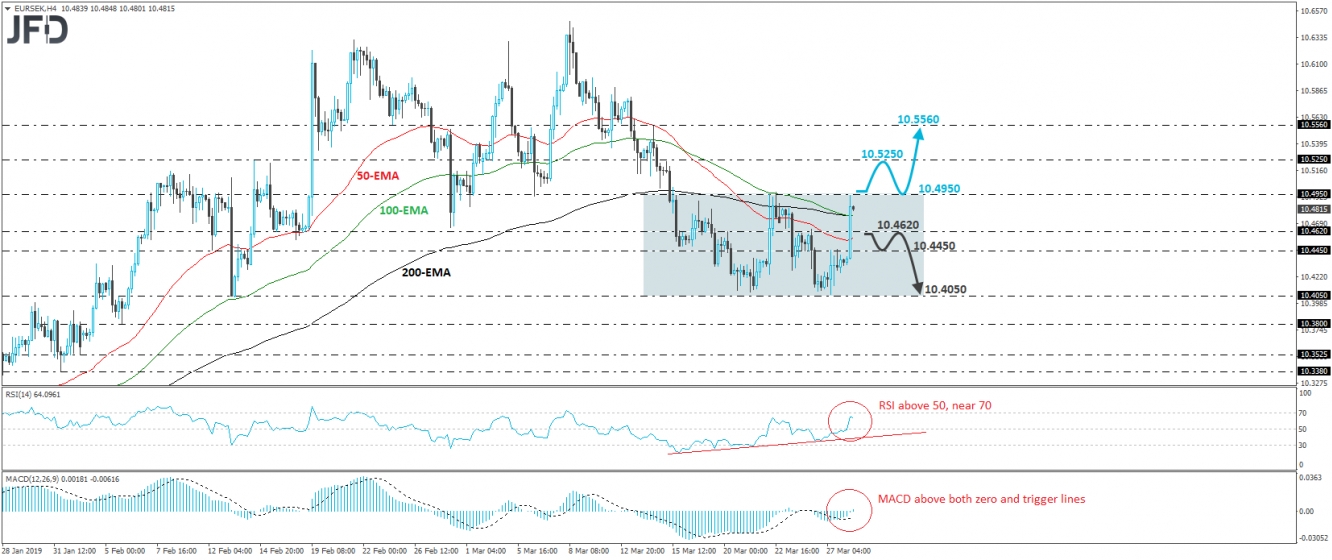

EUR/SEK spiked north during the European morning Thursday, breaking above two resistance barriers in a row. However, the rally was stopped by the 1.4950 hurdle, which appears to be acting as the upper bound of the sideways range the pair has been trading within since March 15th. That level is also marked by the inside swing low of March 6th. Bearing in mind that the pair is still trading within the aforementioned range, we will hold a flat stance.

We would like to see a clear break above 10.4950 before we get confident that the near-term outlook has turned positive. Such a move would signal the completion of a double bottom formation and may allow extensions towards the 10.5250 zone. If that level fails to stop the bulls from driving the rate higher, then we may see them putting the 10.5560 hurdle on their radars, which is a resistance defined by the high of March 14th.

Shifting attention to our short-term oscillators, we see that the RSI drifted north after it crossed above its 50 line but ticked down from slightly below 70. The MACD, already above its trigger line, has just obtained a positive sign. Both indicators detect upside momentum, but the fact that the RSI ticked down enhances our choice to wait for a move above 10.4950 before we start looking higher.

On the downside, a dip below 10.4620 may signal that traders want to keep the pair range-bound for a while more. This may trigger a slide, initially aiming for the 10.4450 level, the break of which may pave the way towards the lower end of the range, at around 10.4050. Having said all that though, we would like to see a clear close below 10.4050 before we start examining whether the picture has turned from flat to negative.