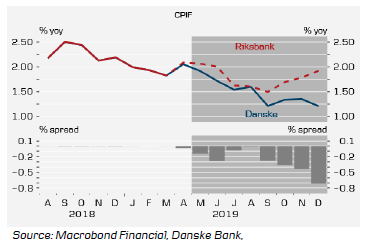

Our May CPIF estimate at 1.9% y/y is in line with consensus and 0.2% points below the Riksbank, see chart. The main risk, in our view, is related to charter prices and skewed to the downside. If it materialises, CPIF could print 1.7% y/y instead. See our preview for details.

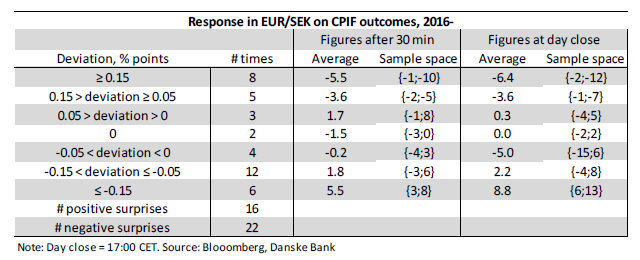

On the back of this, we have analysed how EUR/SEK responds to deviations from consensus (and the Riksbank) going back to 2016, see table. Since January 2016, there have been 22 negative and 16 positive surprises. Only two outcomes have been perfectly in line with consensus.

If CPIF prints 1.9% in line with our main scenario, history suggests that there should not be a big reaction in EUR/SEK.

If the 0.2pp downside risk materialise, a bigger move should be expected. On average, negative surprises bigger than 0.15pp have sent EUR/SEK 5.5 figures higher during the first 30 minutes after the release and almost 9 figures during the day (up until 17:00 CET). As shown in the table, the minimum response in EUR/SEK following such a surprise has been six figures over the day with a maximum of 13 figures.

Market view. If the main scenario plays out, we expect EUR/SEK to stay close to 10.70. In the risk scenario, EUR/SEK could once again test 10.80.