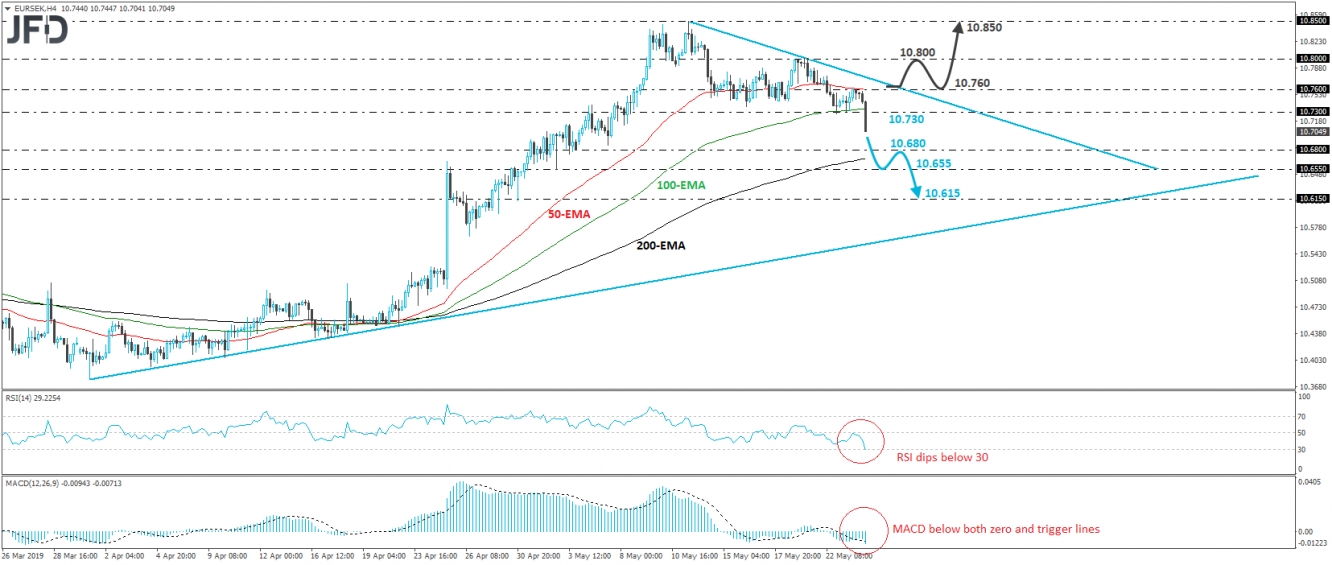

EUR/SEK tumbled during the European morning Friday, breaking below the support (now turned into resistance) barrier of 10.730, marked by Wednesday’s and Thursday’s lows. The move confirmed a forthcoming lower low on the 4-hour chart, which, combined with the fact that the rate has already been printing lower highs, paints a negative short-term picture in our view.

We expect the bears to stay in the driver’s seat for a while more and perhaps challenge the 10.680 zone soon, which is fractionally above the low of May 3rd. If they prove strong enough to overcome it, then we may see them aiming for the low of the previous day, at around 10.655. Another break, below 10.655, could carry more bearish implications and perhaps pave the way towards our next support, at 10.615, defined by the low of April 30th.

The RSI slid after it hit resistance near 50 and just touched its toe below its 30 line. The MACD, already negative, has crossed below its trigger line and points down as well. Both indicators detect strong downside speed, which corroborates the case for some further near-term declines.

On the upside, we would like to see a decisive rebound above 10.760 before we start examining whether the bears have left the field. Such a move may also drive the pair above the short-term downside resistance line drawn from the peak of May 13th. The bulls may then get encouraged to drive the action towards the 10.800 area, near the highs of May 20th and 21st, the break of which could allow extensions towards the peak of May 13th, at around 10.850.