With a market cap of just over $1B, Garrett Motion Inc (NYSE:GTX). is still considered a small company. Founded less than two years ago in Rolle, Switzerland, the company provides electric-boosting technologies for light and commercial vehicle manufacturers. In September 2018, GTX stock started trading on the NYSE.

It was hovering in the vicinity of $20 a share in April, but has been drifting lower ever since. Last week, the price breached the $14 mark and fell to $13.61. Apparently, it didn’t take too long for GTX stock to produce a clear Elliott Wave pattern.

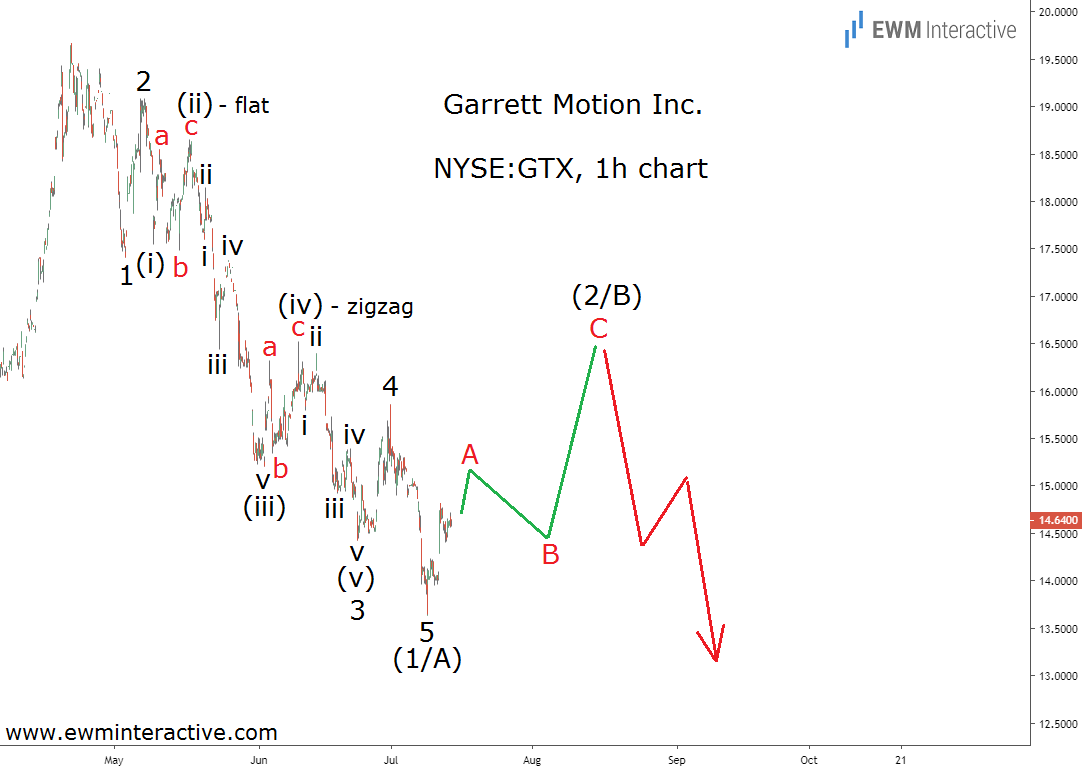

As visible from the chart above, Garrett’s decline from $19.71 to $13.61 is a textbook five-wave impulse. It is labeled 1-2-3-4-5, where the sub-waves of wave 3 are clear, as well. In fact, the impulsive structure of waves (iii) and (v) of 3 can be recognized, too.

The market has taken the guideline of alternation into account in wave 3. Wave (ii) is an expanding flat correction, while wave (iv) is a simple zigzag. But the most important thing is that impulse patterns point in the direction of the larger trend. Garrett’s impulsive decline from $19.71 means GTX stock is in a downtrend.

On the other hand, a three-wave correction in the other direction follows every impulse before the larger trend can resume. Here, we can expect a three-wave recovery in wave (2/B) up to $16-17, followed by more weakness in wave (3/C) to a new low.