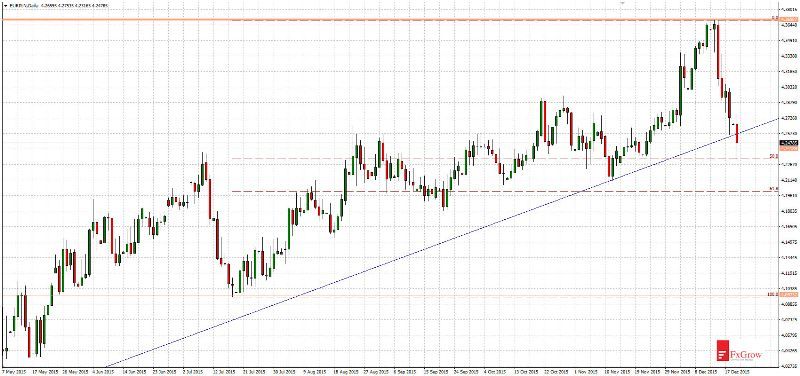

EUR/PLN - rebound from important resistance, falls targeting 4.1000

Confusion after polish election in Poland led to depreciation of the Polish currency. EUR/PLN reached strong resistance at 4.3000 level. Rebound from that level occurred last week and was so dynamic that also the uptrend line was broken. In 5 days falls of 1400 pips and currently reached to the support area of 4.2400. That support is also strengthened by Fibonacci 50% of last upward movement. This should induce corrective rebound, after which falls could be continued. After break below that level, the nearest support is located at: 4.2100, and the main target for supply is at 4.1000 level.

Since 4 years EUR/PLN moves in the regression channel. Upper and lower limits of that channel have been constantly tested: 4.3000 and 4.1000. Right now there is nothing which could indicate that this consolidation is coming to an end.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.