Since the summer, a new divergence has characterized the economic performance of the eurozone. Not only has there been a decoupling of the manufacturing and service sectors, the manufacturing sector itself has also differed strongly across countries. And this divergence is here to stay for a while

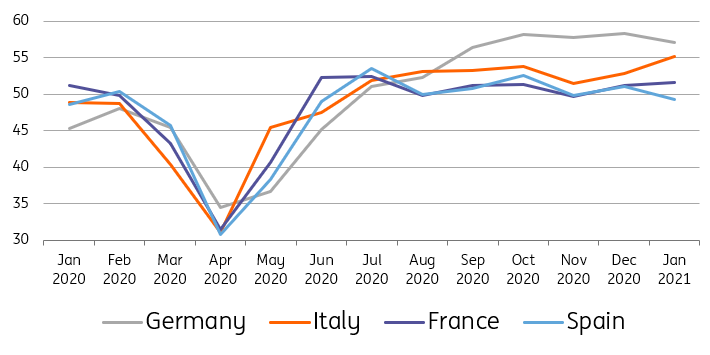

At the start of the pandemic, a large manufacturing sector was a clear negative for eurozone economies. Supply chain disruptions as well as (voluntary) closures of many industries were important drivers behind the economic slump during the first lockdown. Since the summer, the manufacturing sector has decoupled from services, which have continued to suffer from ongoing social distancing and new lockdowns. However, this decoupling at the eurozone level has masked significant differences across individual countries. From the summer months onwards, the manufacturing sectors of Germany and Italy were able to expand, while in Spain and France, the sector flirted with contraction.

And the start of the year didn’t change this dynamic. The Italian PMI for the manufacturing sector increased to 55.1 compared to 52.8 in December, while the index for Germany remained firmly above the 55 level. This is in contrast to the developments in France and Spain. In France, the situation for the manufacturing sector improved slightly, while in Spain, the sector is again in contractionary territory.

Purchasing Managers Index by Country

Drivers of Divergence

The severity of the pandemic and the strictness of the lockdown measures can only do so much to explain the depth of the trough in April. The number of new infections (per million inhabitants) did start to increase during the summer months in France and Spain, which was not the case in Germany and Italy, however this is more significant for the services sector and should have had only a limited impact on manufacturing.

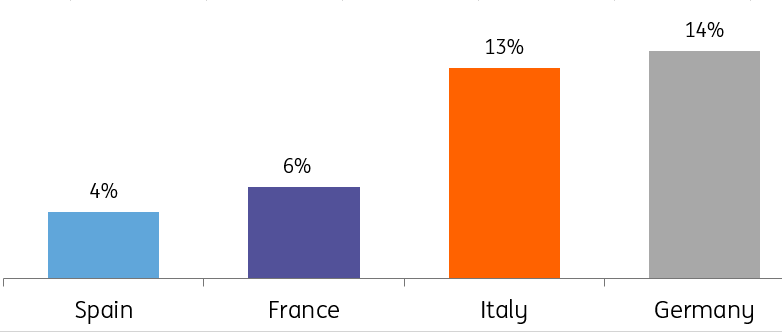

A more important driver of the divergence is the structure of the manufacturing sectors. Countries that produce a lot of products that can be exported to countries that are currently doing well economically, such as China, have shown a stronger and more stable performance.

The composition of the manufacturing sector of these countries shows that the key difference lies in the production of machinery and equipment, which are important export goods. In Italy and Germany, the share of these goods in the total value of manufacturing production is equal to 13% and 14%, respectively. In Spain and France, in contrast, the share is only equal to 4% and 6%, respectively. So, Italy and Germany can certainly profit more from the strong Chinese recovery than Spain and France.

Value of Machinery and Equipment Production as a Share of Total Manufacturing Production

Add to this the fact that the share of the manufacturing sector in total added value for the entire economy is much larger in Germany (19%) and Italy (15%) than it is in Spain (11%) and France (10%), and it seems likely that we'll see not only continued divergence in manufacturing sectors but in total economic performance, too. Once the number of infections has come down, in particular in Spain, and more and more Europeans are vaccinated, we expect that manufacturing activity in Spain and France will also be able recover.

Original Post

Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. Read more