The euro currency managed to rise as the U.S. dollar was seen trading lower. Economic data of the day showed that the final inflation for November rose at a slower pace of 1.9%. This was below the flash estimates which showed a 2.0% increase. The final core inflation rate was however unchanged at 1.0%.

The NY trading session saw the Empire State Manufacturing Index data. The index fell to 10.9 in December down from 23.3 the month before. This was also below the estimates of 20.1.

Ahead of the two day Fed meeting that starts today, President Trump once again expressed his displeasure with the Fed's plan to hike rates at the Fed meeting this week. This sent the U.S. dollar falling on the day. The FOMC will be concluding its two-day conference on the 19th of December.

Looking ahead, the economic calendar today is relatively quiet.

The German Ifo business climate index is forecast to show a decline to 101.8 on the index. This marks a decline from 102.0 that was registered previously. Canada's manufacturing sales report kicks off the NY trading session with forecasts pointing to a 0.3% increase on the month.

The U.S. housing data is on the cards next. Building permits are forecast to rise modestly to 1.26 million in November, slightly up from October's fall to 1.26 million. Housing starts are expected to remain steady at 1.23 million for November.

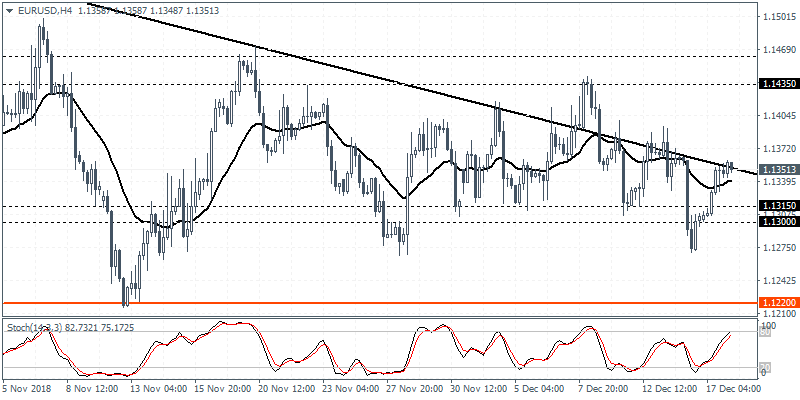

EUR/USD intraday analysis

EUR/USD (1.1351): The EUR/USD managed to maintain gains on the day as price action rebounded off the support level. The intraday rally sent the common currency to retest the falling trend line once again. However, we expect this short-term bullish momentum to fade as the EUR/USD maintains its range. A breakout from the falling trend line will no doubt see price action testing the resistance level once again at 1.14350.

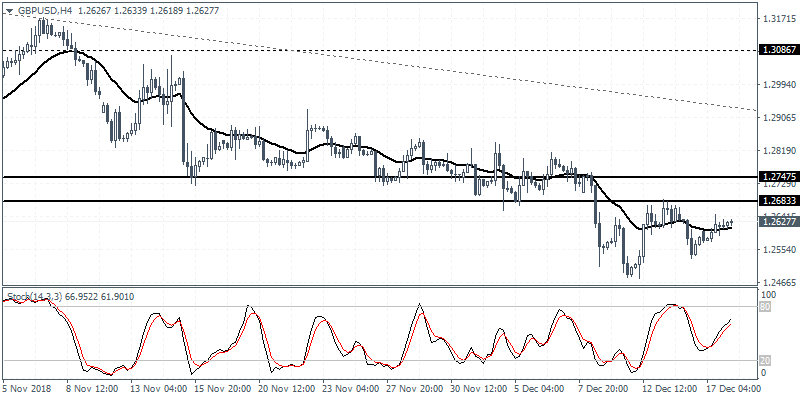

GBP/USD intraday analysis

GBP/USD (1.2627): The GBP/USD currency pair was seen gradually drifting higher. Price action remains subdued below the resistance level of 1.2683. A near-term rebound back to this resistance level could see the price being tested more firmly compared to the initial test at the resistance level. Further downside in the GBP/USD can be expected if price breaks past the previously established low. However, we expect some consolidation to take place that could keep the GBP/USD trading flat for the moment.

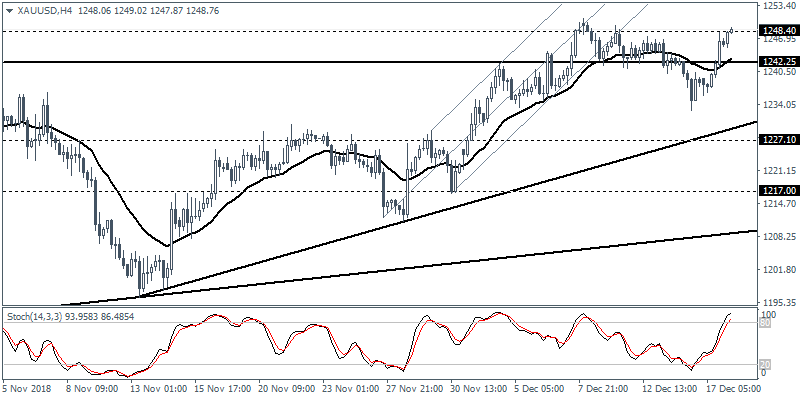

XAU/USD intraday analysis

XAU/USD (1248.76): Gold prices turned bullish on Monday. The sharp rally came following President Trump's comments on the Fed rate hikes. However, with price action reaching the 1248 handle, we expect the price to post a modest correction to the downside. The support at 1242 remains key to the downside. If gold prices break past the 1248 level of resistance that is currently being tested, a near-term target of 1250 can be further achieved. However, further gains are unlikely to come by unless support is firmly established at 1242.25 handle.