The euro fell to a two-week low against the US dollar during European trading yesterday, as investors remained doubtful that today's EU summit will produce any meaningful solutions to the eurozone debt crisis. The USD also saw gains vs. the JPY, as positive economic indicators boosted confidence in the US economic recovery. Today, in addition to any announcements out of the EU summit, traders will want to focus on the results of an Italian bond auction. Poor demand for Italian bonds could send the euro lower against its main currency rivals.

Economic News

USD - Positive US News Helps Boost USDThe greenback saw moderate gains against several of its main currency rivals yesterday, following the release of better-than-expected US news which boosted confidence in the American economic recovery. The US Core Durable Goods Orders and Pending Home Sales figures both came in well above their expected levels. The news contributed to the GBP/USD falling close to 90 pips during the European session, eventually reaching as low as 1.5544 before staging a mild upward correction. Against the JPY, the dollar advanced close to 40 pips over the course of the day, eventually peaking at 79.82.

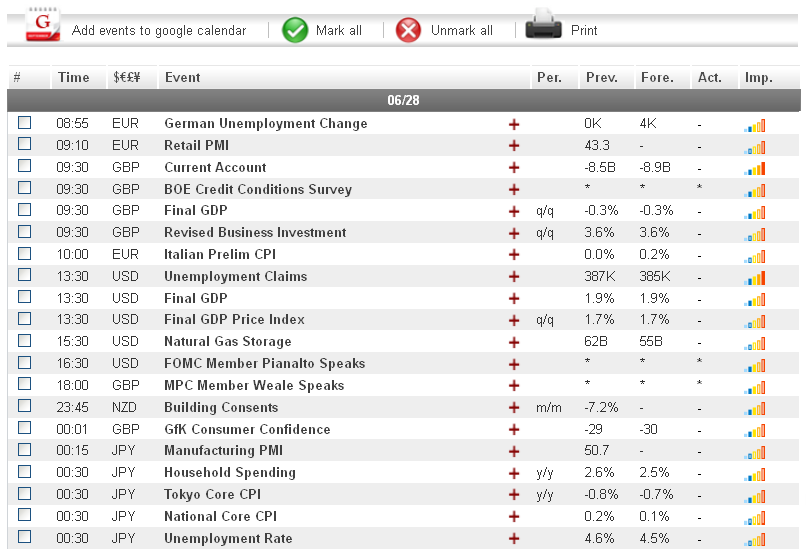

Turning to today, dollar traders will want to pay attention to the weekly US Unemployment Claims figure, set to be released at 12:30 GMT. The number of people filing for first time unemployment insurance has steadily increased over the last several weeks. Should today's news come in above forecasted number of 385K, the dollar may give back some of yesterday's gains. That being said, any losses could be temporary due to the dollar's status as a safe-haven currency and the high level of risk aversion among investors at this time.

EUR - EU Summit May Result In Additional Euro Losses

The euro took losses against several of its main currency rivals yesterday, as rising borrowing costs in both Italy and Spain caused investors to shift their funds to more stable currencies. The EUR/USD fell to a fresh two-week low during the afternoon session and was down more than 60 pips for the day. Against the Australian dollar, the EUR dropped close to 70 pips, eventually hitting 1.2361 toward the end of the European session.

Today, the euro is forecasted to see significant volatility as investors will be eagerly awaiting any news out of the EU summit. With no significant breakthroughs expected to take place regarding ways to combat the eurozone debt crisis, the euro could see additional losses against the USD in afternoon trading. Traders will also want to pay attention to the results of an Italian bond auction. If there is poor demand for Italian bonds today, it may be taken as an additional sign that the eurozone crisis is worsening, which could cause the euro to extend its bearish trend.

Gold - Eurozone News May Impact Gold Today

Gold largely range-traded yesterday, as eurozone fears combined with a strengthening US dollar kept the precious metal near its recent lows. After falling as low as $1562.29 an ounce during the first part of the day, gold was able to finish out the European session slightly above the $1570 level.

Today, gold is likely to be influenced by eurozone news, specifically any announcements out of the EU summit and the results of an Italian bond auction. Analysts are warning that without any significant breakthroughs at the EU summit, riskier assets, including gold, may continue falling for the rest of the week.

Crude Oil - US Inventories Figure Boosts Crude Oil

Crude oil saw moderate gains throughout the day yesterday as increased demand in the US helped boost prices. The weekly US Crude Oil Inventories figure showed that stockpiles fell by 100K barrels last week. As a result, the price of oil rose as high as $80.76 a barrel, up close to $2 for the day.

Turning to today, analysts are skeptical about whether oil will be able maintain its upward trend. With no breakthrough's expected at today's EU summit, investors may choose to abandon riskier assets, like crude oil, in favor of safe-havens, like the USD and JPY. That being said, any surprise breakthroughs at today's summit could cause oil to extend its bullish trend.

Technical News

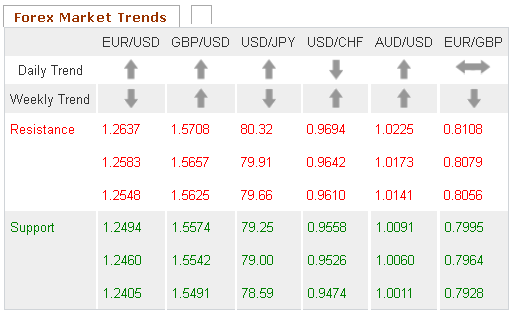

EUR/USDA bearish cross on the daily chart's MACD/OsMA indicates that this pair could see an upward correction in the near future. This theory is supported by the Williams Percent Range on the same chart, which has dropped into oversold territory. Going long may be a wise choice for this pair.

GBP/USD

Most long-term technical indicators show this pair range-trading, meaning that no defined trend can be predicted at this time. That being said, the Williams Percent Range on the weekly chart is slowly drifting into oversold territory. Traders will want to keep an eye on this indicator, as it may signal an impending upward correction.

USD/JPY

Long-term technical indicators show this pair trading in neutral territory, meaning that no defined trend can be determined at this time. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/CHF

The weekly chart's Williams Percent Range has drifted into overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Relative Strength Index on the same chart, which is currently approaching the 70 level. Going short may be a wise choice.

The Wild Card

NZD/CHFThe Slow Stochastic on the daily chart has formed a bearish cross, meaning that this pair could see downward movement in the near future. Furthermore, the Relative Strength Index on the same chart has crossed into overbought territory. Forex traders may want to go short ahead of a possible downward breach.