Tight credit conditions continue to persist in the Eurozone, inhibiting growth and dampening plans for fiscal consolidation.

AP via Yahoo: - Another drop in lending to companies in the 17-country eurozone showed the economic downturn is deepening, as a brighter mood on financial markets fails to catch on with businesses.

The European Central Bank said Thursday that loans to non-bank businesses shrank 1.4 percent year on year in September, double the 0.7 percent contraction reported the month before.

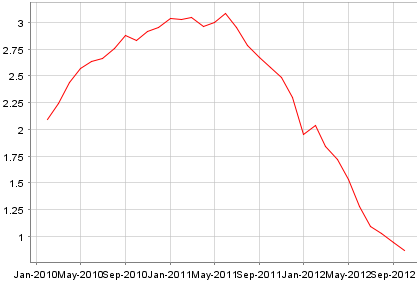

In fact loan growth to households trajectory shows an ongoing decline, while ...

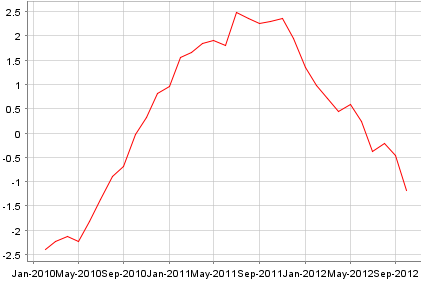

... loan growth to companies is declining sharply as well.

The stagnation in lending is in part due to banks deleveraging in order to improve capital ratios for Basel III. But a big part of the issue is simply lack of demand from borrowers.

AP via Yahoo: - The numbers show the economy is struggling despite efforts by the central bank to stimulate credit and calm financial markets fearful that the eurozone might break up. The ECB has cut its main interest rate to a record low 0.75 percent and made €1 trillion ($1.3 trillion) in cheap loans to banks that don't have to be paid back for three years.

Even so, that easy money is not making it from banks to businesses and consumers, largely because demand for credit remains weak. Businesses see no reason to borrow to invest in expanding production. Meanwhile, banks in some countries have less to lend because they are struggling to recover from losses on real estate loans that didn't get paid back and on government bonds that have fallen in value due to fears about those governments' finances.

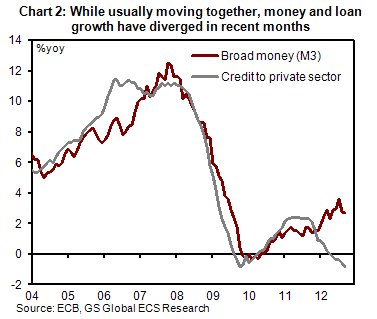

Liquidity is trapped in the Eurozone core where businesses are borrowing less, while periphery banks have limited liquidity even if there was demand. Either way, liquidity provided by the ECB is not making it into the private sector, as the growth in money supply diverges materially from growth in lending to the private sector.

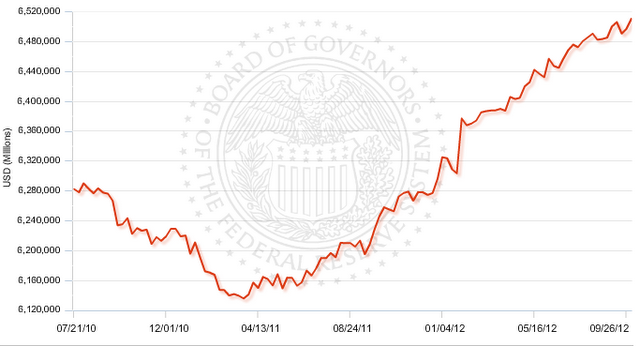

Note that this weakness in credit growth in the Eurozone is in stark contrast with the US, where banks continue to lend at a steady pace. This trend started in early 2011 (driven mostly by corporate lending) and seems to be ongoing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Eurozone Credit Growth Weakness Persists; Stark Contrast With The US

Published 10/26/2012, 02:39 AM

Eurozone Credit Growth Weakness Persists; Stark Contrast With The US

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.