- Flash HICP in August 5.3% (5.1% expected, 5.3% in July)

- Flash core HICP in August 5.3% (5.3% expected, 5.5% in July)

- The key moving average provides resistance once again

Eurozone economic indicators this morning have been something of a mixed bag, although traders seem enthused on the back of them rather than disappointed.

We’ve seen regional data over the last couple of days which gave us some indication of how today’s HICP report would look and a drop in the core reading in line with expectations combined with no decrease in the headline seemed to make sense. Unemployment, meanwhile, remained at a record low despite an increase in the number of those unemployed.

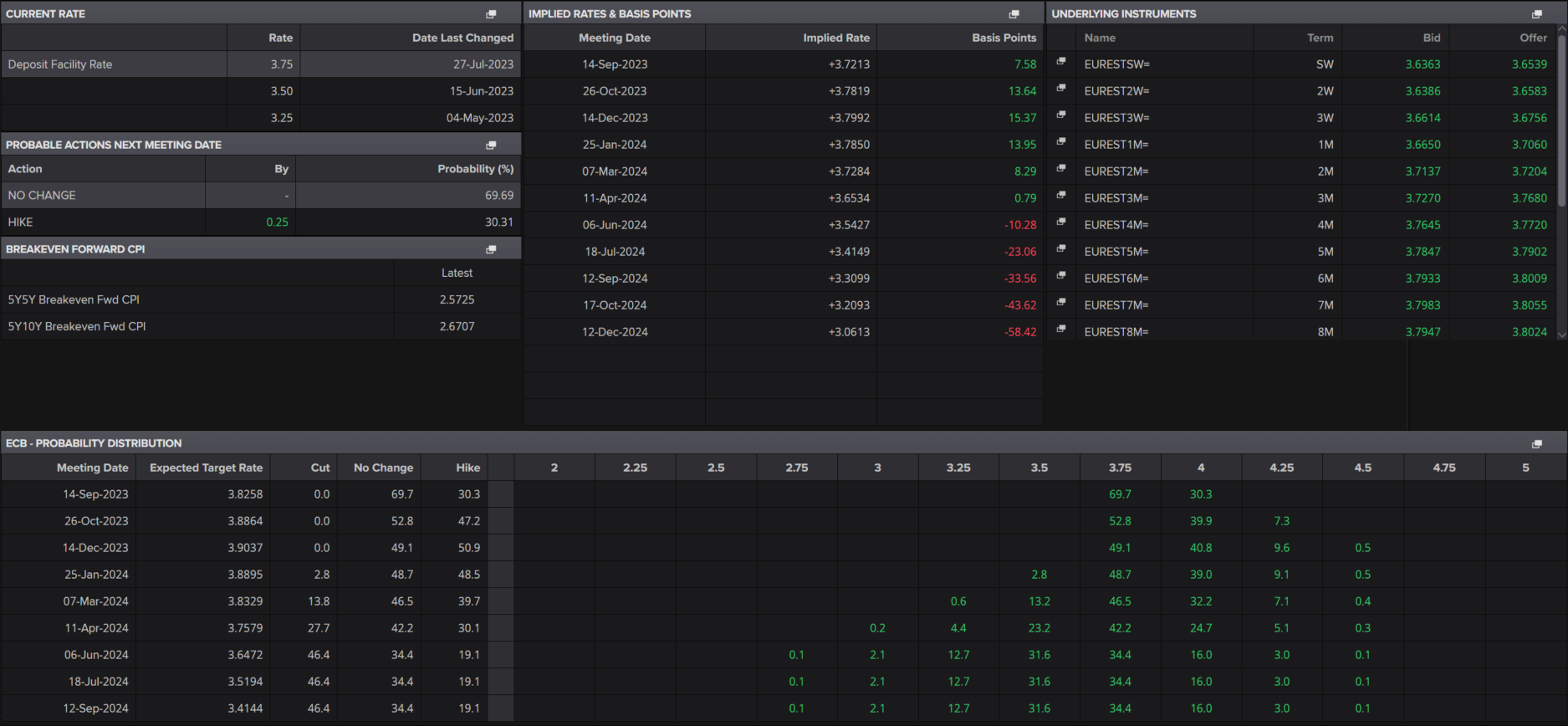

Perhaps there’s some relief that the headline HICP rate didn’t tick a little higher while the core did decline which combined with expectations for the coming months gives the ECB plenty to debate. Another hike in September still strikes me as more likely than not but on the back of this release, markets are swinging the other way, pricing in a near 70% chance of no increase.

ECB Probability

Source – Refinitiv Eikon

That’s helped the euro to slide more than 0.5% against the US Dollar this morning – similar against the yen and a little less against the pound while regional markets are seemingly unmoved and continue to trade relatively flat.

Further bearish technical signals following the eurozone data

While the fall against the pound was a little less significant, it has enabled it to once again rotate lower off the 55/89-day simple moving average band, reinforcing the bearish narrative in the pair.

EURGBP Daily

Source – OANDA on Trading View

EURGBP has run into resistance on a number of occasions around the upper end of this band, with the 100 DMA (blue) arguably being a more accurate resistance zone over the summer.

Regardless, that still leaves a picture of lower peaks and relatively steady support around 0.85. While that may simply be consolidation, the lower peaks arguably give it a slight bearish bias, a significant break of 0.85 obviously being needed to confirm that.