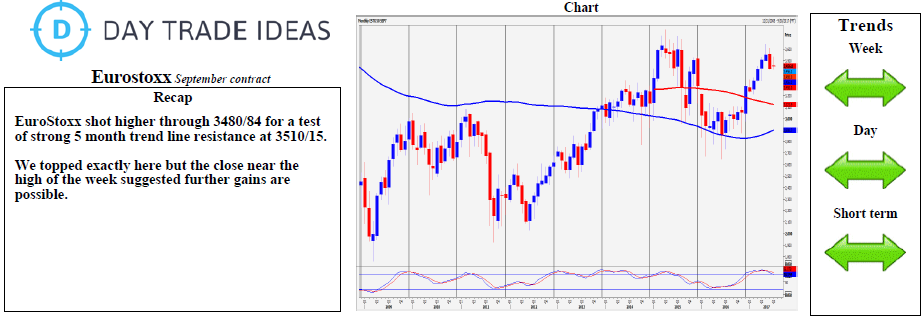

Euro Stoxx key to direction strong 5 month (rising) trend line resistance at 3510/20. A break higher is a buy signal therefore targeting the July high & 2.5 month trend line resistance at 3534/38. It is only above here that bulls are back in full control of the longer term trend & we should see minor resistance at 3560/64, perhaps as far as 3590/94.

First support at 3484/80 is a buying opportunity with stops below 3470. A break lower is more negative targeting 3462/58 & 3443/41 before support at the June/July low at 3428/25. A break lower meets 23.6% Fibonacci support at 3411/08. This could mark a low for correction, but longs need stops below the gap at 3391/84.