With the exception of a few premium brand producers such as BMW and Jaguar Land Rover, European carmakers are having a pretty awful time.

Rising unemployment and stagnant growth, if not outright recession in many European countries, are depressing new auto sales and adding to the capacity overhang that has dogged the market for years.

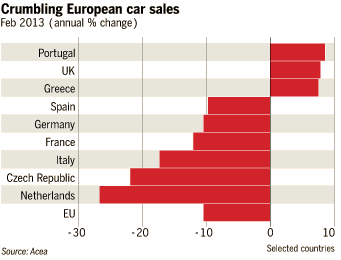

New passenger car registrations in the EU fell 10.5 percent in February, compared to the prior year according to the ACEA industry association.

Apart from the U.K., where sales rose 8 percent, sales declined across the continent’s major markets, down 10 percent in Spain, 10.5 percent in Germany and 17 percent in Italy.

According to the FT, some of the biggest declines were registered at Ford and General Motors – both down 21 percent – and Fiat and PSA Peugeot Citroën, down 16 percent and 13 percent respectively.

In contrast, sales at Honda rose 21 percent and at Hyundai, 2 percent. BMW, the largest global premium brand carmaker, posted another record year (up 9 percent in the third quarter), helped by a massive 39 percent rise in China.

Even BMW is warning there will probably be no overall growth in 2013, as Europe weighs on auto sales across the spectrum.

Didier Leroy, head of Toyota’s European division, is quoted as saying sales could fall a further 5-10 percent this year. European auto sales fell 9.5 percent in the first two months, forcing earlier analysts’ estimates of a 3 percent decline to reconsider.

The continuing decline in car sales will have a knock-on effect for platinum producers. Platinum group metals (PGM) are used in auto-catalysts around the world, but given the higher proportion of diesel cars in Europe, this points to a weaker outlook for platinum over palladium.

The markets agree with net speculative length increasing for palladium futures, but falling for platinum. ETF holdings have remained relatively stable for platinum.. With demand looking to slow in North America and China and fall in Europe, the markets are looking with more than passing interest to the supply side for balance with Amplats negotiations with government and unions later this month.

The major PGM producer will be closing shafts and laying off workers due to rising production costs and weak demand, but is facing resistance from both the government and the unions.

Even if cutbacks are scaled back, industrial action in the form of strikes may prove of limited support to the metal price.

by Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Europe’s Auto Market Weighs Heavy On Platinum Group Metal Prices

Published 03/22/2013, 03:25 AM

Updated 07/09/2023, 06:31 AM

Europe’s Auto Market Weighs Heavy On Platinum Group Metal Prices

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.