Elections in Europe went as the pollsters expected with Francois Hollande becoming the first French socialist President in 17 years and the Greek election devolving into a complete bun fight. The Greeks gave the world democracy and they can do what they like with it, but the inability of a government to be elected once again increases the risks that Greece will leave the eurozone.

In all likelihood, there will be another election in a month’s time as, after only 12hrs into the 72hr permitted negotiations, Samaras, the leader of the New Democracy party that won the most amount of votes, informed the President that forming a coalition was impossible. The onus will now fall on the Syriza party to form an anti-austerity coalition although that looks unlikely as well. All this is well and good until we start talking about money. Greece is still expected to deliver deficit reduction targets set down by the EU/IMF/ECB troika and will not receive further bailout funding unless they do so. Without that money, exit from the EU is the only real way to go.

Needless to say, the euro had a poor day yesterday with GBP/EUR hitting levels not seen since October 2010 and EUR/USD trading briefly below the 1.30 mark.

The data calendar is light today and therefore comments from both Greece and France will hold a lot of weight. Francois Hollande made a lot of noise in the campaign about renegotiating the fiscal pact and improving the French economy. His election reminds us a lot of the election of Mariano Rajoy in Spain; lots of promises that were deliberately vague.

Both Jean-Claude Juncker and Angela Merkel said over the weekend that renegotiations were not needed. The longer that the disagreement goes on and Hollande remains quiet on his fiscal policy, the more and more nervous markets will become.

French debt and the cost of insuring that French debt against default did little yesterday with the most movement seen in the Spanish variant. Contagion is still a very real possibility and while the Arab Spring saw the removal of oppressive dictators across the Middle East, this European Spring could be the start of the removal of oppressive austerity programs. Where we go after that however is still very much up for debate.

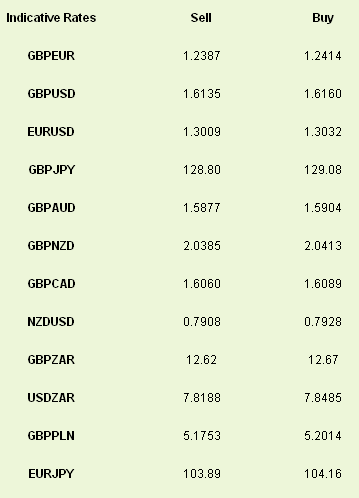

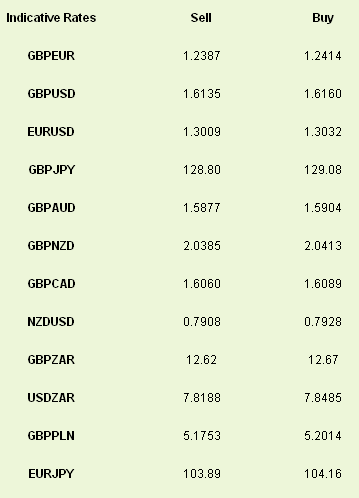

Latest exchange rates at time of writing:

In all likelihood, there will be another election in a month’s time as, after only 12hrs into the 72hr permitted negotiations, Samaras, the leader of the New Democracy party that won the most amount of votes, informed the President that forming a coalition was impossible. The onus will now fall on the Syriza party to form an anti-austerity coalition although that looks unlikely as well. All this is well and good until we start talking about money. Greece is still expected to deliver deficit reduction targets set down by the EU/IMF/ECB troika and will not receive further bailout funding unless they do so. Without that money, exit from the EU is the only real way to go.

Needless to say, the euro had a poor day yesterday with GBP/EUR hitting levels not seen since October 2010 and EUR/USD trading briefly below the 1.30 mark.

The data calendar is light today and therefore comments from both Greece and France will hold a lot of weight. Francois Hollande made a lot of noise in the campaign about renegotiating the fiscal pact and improving the French economy. His election reminds us a lot of the election of Mariano Rajoy in Spain; lots of promises that were deliberately vague.

Both Jean-Claude Juncker and Angela Merkel said over the weekend that renegotiations were not needed. The longer that the disagreement goes on and Hollande remains quiet on his fiscal policy, the more and more nervous markets will become.

French debt and the cost of insuring that French debt against default did little yesterday with the most movement seen in the Spanish variant. Contagion is still a very real possibility and while the Arab Spring saw the removal of oppressive dictators across the Middle East, this European Spring could be the start of the removal of oppressive austerity programs. Where we go after that however is still very much up for debate.

Latest exchange rates at time of writing: