Markets lower on renewed growth fears

Sentiment is fragile after a series of weak PMI readings this week, with the U.S. ISM number particularly shocking investors and sending stock markets tumbling.

Naturally, Trump was quick to point the finger of blame at the Fed and try to divert the conversation away from the trade war and the clear impact it’s having on global trade, with the survey’s everywhere in troubling territory. Investors voted with their feet and headed for the safe havens as stocks dropped more than 1% and today isn’t shaping up to be much better.

Traders may or may not agree with Trump’s assessment on the cause of the manufacturing decline – a case can clearly be made for both and the reality is it’s probably a combination of the two – but the data certainly increased the probability of another cut this year, in their mind.

Odds shifted from just below 70% to above 80% by the end of the year. I imagine there’ll be plenty more movement here in the weeks to come and this Friday could bring fireworks.

Boris – It’s my deal or no-deal

The spotlight is never too far away from Brexit and when it is, it’s not for long. Today, Boris Johnson will offer proposals to the EU in a final attempt to tempt them away from the backstop. Early reports based on various leaks don’t suggest his chances are very high but with the PM believed to be offering a take it or leave it ultimatum, the temperature in Brussels will almost certainly ramp up a few notches.

Sterling is looking vulnerable again as we embark on a critical two week period for Brexit. It had enjoyed a rebound in September as traders basked in the glory of Parliament apparently blocking no-deal. As we reach the crunch moment though, doubts seem to be creeping in as Boris is adamant we are leaving on Oct. 31, deal or no deal.

Gold testing prior support as Fed cut odds rise

Just as it looked down and out, the U.S. ISM manufacturing PMI gave us a swift reminder that gold will always maintain some appeal. Having touched a low just below $1,460 yesterday, gold is already back testing $1,480 from below, a level that provided so much support since the middle of August.

Should $1,480 hold, then this could be another bearish signal for gold and confirm the initial breakout, putting focus back on $1,460 and below.

Gold Daily Chart

Oil lower despite inventory decline

Oil prices are relatively flat so far today, despite API reporting an unexpectedly large drawdown of 5.92 million barrels on Tuesday. The U.S. PMI report on Tuesday may have soured the API data, with it just reaffirming fears of a global economic slowdown, in turn lowering global growth and demand expectations. We’re still hovering above the lows but, given the bullish factors that are being overlooked right now, they may be under threat.

Brent Daily Chart

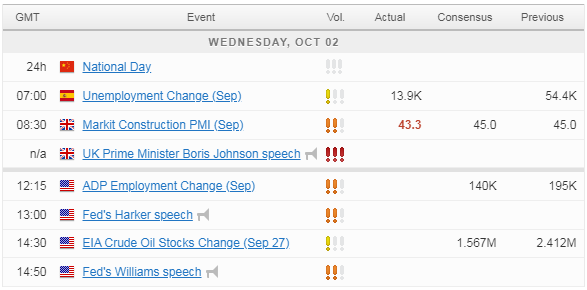

Economic Calendar