Investing.com’s stocks of the week

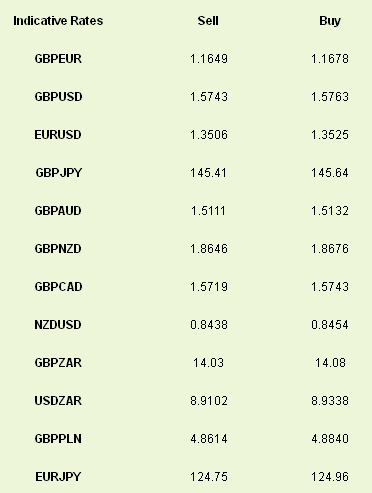

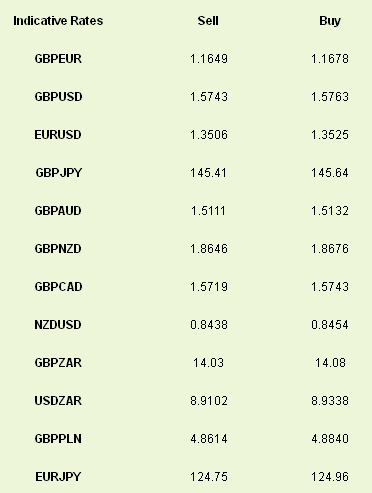

We finally started to see a reversal in the prospects for the euro yesterday with politics once again the catalyst for losses in peripheral Europe. The IBEX 35 in Spain dropped by 3.7% while the Italian FTSE MIB lost 4.5% and the yields on their respective sovereign debts lost all the gains they had made through the course of 2013. While GBPEUR is still at depressed levels it has managed to haul its carcass out of the 1.14 lows that were posted on Friday while EURUSD has come down from 1.37+ to the high 1.34s.

Political jitters came in the form of fears over the future of Spanish PM Mariano Rajoy and the prospect of Silvio Berlusconi having more than a minor part in the upcoming Italian election. Rajoy is in focus following the publication of corruption allegations and at a press conference yesterday with Angela Merkel seemed to suggest that some of the allegations may indeed be true. He looks unlikely to resign at the moment but should Spain’s chief prosecutor get involved then his position will become more tenuous – as will that of the Spanish yield.

Rajoy did receive a fillip as the IMF gave Mr Rajoy’s government a vote of confidence by saying that Spain’s financial and banking reforms were at an “advanced stage”.

There are three weeks to go until the Italian election and, according to an opinion poll released on Friday, Berlusconi’s coalition is within 5 points of the leading centre-left party. In a speech yesterday, Berlusconi promised to pay over EUR4bn back to Italians that had been taken as part of an unpopular property tax. Members of his campaign also promised a cut of EUR80bn in the deficit and over EUR2trn of debt cuts. It seems like Berlusconi has spent his time out of politics learning magic.

Whether the sell-off in European assets and risk in general will still remain largely data contingent. Services PMI numbers from Europe, the UK and the US are due through the session with most, including the UK’s, expected to remain below the 50.0 level that denotes expansion and contraction. The only likely positive will be the German number following that exceptional “flash PMI” release a couple of weeks ago. The divergence between Germany and the rest of Europe will be clear to see.

Chinese data overnight surprised to the high-side, with the Services PMI hitting the highest level since August last year.

Elsewhere we saw the Reserve Bank of Australia hold rates as was widely expected last night. The accompanying statement was a lot more dovish than had been expected however, and the comment that the inflation outlook “would afford scope to ease policy further, should that be necessary to support demand” sent AUD lower overnight. The slowing of the mining sector cannot be replaced by consumer demand as quickly and we expect further rate cuts from the RBA through the year.

USDJPY has come lower overnight on the wider slip in risk with prices back towards the 92.00 level. As with all things it is simply looking for fresh bullish impetus.

Political jitters came in the form of fears over the future of Spanish PM Mariano Rajoy and the prospect of Silvio Berlusconi having more than a minor part in the upcoming Italian election. Rajoy is in focus following the publication of corruption allegations and at a press conference yesterday with Angela Merkel seemed to suggest that some of the allegations may indeed be true. He looks unlikely to resign at the moment but should Spain’s chief prosecutor get involved then his position will become more tenuous – as will that of the Spanish yield.

Rajoy did receive a fillip as the IMF gave Mr Rajoy’s government a vote of confidence by saying that Spain’s financial and banking reforms were at an “advanced stage”.

There are three weeks to go until the Italian election and, according to an opinion poll released on Friday, Berlusconi’s coalition is within 5 points of the leading centre-left party. In a speech yesterday, Berlusconi promised to pay over EUR4bn back to Italians that had been taken as part of an unpopular property tax. Members of his campaign also promised a cut of EUR80bn in the deficit and over EUR2trn of debt cuts. It seems like Berlusconi has spent his time out of politics learning magic.

Whether the sell-off in European assets and risk in general will still remain largely data contingent. Services PMI numbers from Europe, the UK and the US are due through the session with most, including the UK’s, expected to remain below the 50.0 level that denotes expansion and contraction. The only likely positive will be the German number following that exceptional “flash PMI” release a couple of weeks ago. The divergence between Germany and the rest of Europe will be clear to see.

Chinese data overnight surprised to the high-side, with the Services PMI hitting the highest level since August last year.

Elsewhere we saw the Reserve Bank of Australia hold rates as was widely expected last night. The accompanying statement was a lot more dovish than had been expected however, and the comment that the inflation outlook “would afford scope to ease policy further, should that be necessary to support demand” sent AUD lower overnight. The slowing of the mining sector cannot be replaced by consumer demand as quickly and we expect further rate cuts from the RBA through the year.

USDJPY has come lower overnight on the wider slip in risk with prices back towards the 92.00 level. As with all things it is simply looking for fresh bullish impetus.