Investors brush aside trade pessimism

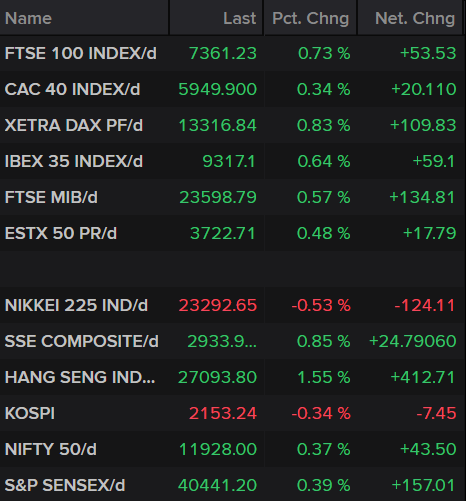

Europe is off to a decent start on Tuesday, despite a trade deal between the US and China still being up in the air as the mood in Beijing turns more pessimistic.

China is insisting on tariffs being rolled back as part of any phase one trade agreement, something that Trump has until now not been receptive to. There have been reports that the US trade team has been exploring rolling back some tariffs to get this over the line and the refusal to engage by Trump could simply be posturing, but time is running out if they want it signed this year.

That’s looking increasingly unlikely but as yet, investors are not losing faith with US equity markets holding at record highs and setting new records on an almost daily basis. Talks have collapsed before though and could again, the key difference this time though being that Trump will not want to go into an election without a deal.

Time to shine

Here in the UK, we’ll be treated to our first live TV debate tonight, lucky us! We may not have manifesto’s yet but both parties have been on the campaign trail for weeks now so we at least have an idea of the kind of agenda they’re preparing. It could be quite a fiery affair with the coming weeks likely being particularly divisive and explosive, even by the UK’s standards.

The Conservatives were given a lift last week in the polls by the Brexit party’s decision not to run in the 317 seats it already holds and risk splitting the leave vote. That’s not quite the concession Boris will have been hoping for but it certainly gave them a boost in the polls. Farage may well be hoping there’s still time for a pact on the remaining seats.

Gold runs into trouble around $1,480 again

Gold prices are steady on Tuesday after pulling back from minor gains earlier in the day. Once again the yellow metal ran into resistance on the approach to $1,480 which could prove a formidable opponent for gold bulls. Prices reached as high at $1,475 overnight but that didn’t last long and already they’re back below $1,470 which won’t inspire confidence. The absence of momentum was very evident in the latest push higher which adds to the bearish case.

Gold Daily Chart

Oil pulls back from highs

Oil prices reversed course on Monday, pulling back from $64 which Brent was approaching prior to the decline. The less than promising reports coming from China on the trade war may have taken some of the energy out of the rally but oil is already trading at quite elevated levels and in a region that has previously been problematic. We’re certainly seeing less momentum in the recent rallies which suggests the path of least resistance may be below in the near-term.

Brent Daily Chart

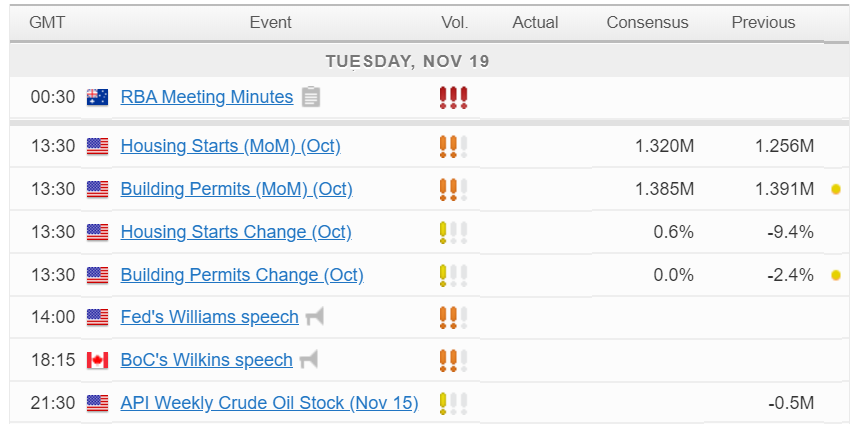

Economic Calendar