Europe higher on trade hope

European stocks are edging higher on Thursday as investors look beyond so interesting headlines and remain hopeful that a deal can be reached between the U.S. and China this year.

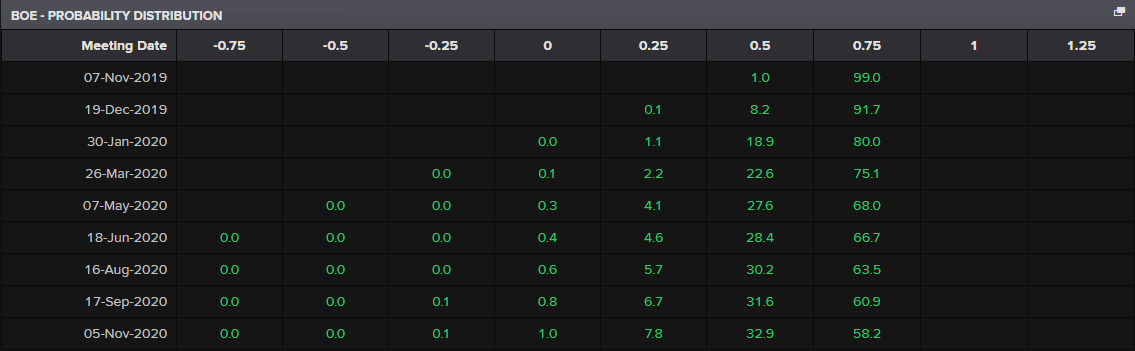

What Next For BoE?

Not-so-super Thursday is upon us again and once again, the Bank of England has very little to offer. Brexit delays and uncertainty have made normalizing monetary policy and providing accurate forecasts and guidance almost impossible for the central bank and this month it also has the most unpredictable election in living memory to contend with.

Mark Carney has not exactly endeared himself to Brexiteers over the last four years but they currently have one thing in common, a craving for 31 January. For Brexiteers, this will hopefully mark the end of the UK’s membership of the European Union and for Carney, the end of his term as Governor of the Bank of England. Assuming, of course, the government doesn’t request another extension to the disappointment of Brexiteers everywhere.

Are trade deal doubts creeping in?

It’s been a relatively peaceful week in the markets so far and today is shaping up in much the same way, although red flags are starting to appear around the much-sought-after phase one trade deal.

The agreement between the Trump and Xi administrations has given a massive lift to investors and propelled US stock markets back into record territory. In a way, it’s an acknowledgement that a more comprehensive agreement is extremely challenging and possibly impossible but it’s also the first de-escalation in the 18 month conflict.

But even this may not be straightforward, with even the date and location of the signing ceremony – Trump is a showman afterall – being difficult to agree. Early December is now being touted, with London the neutral location following the NATO summit.

Given the late push by the Chinese to remove additional tariffs as part of the deal though, you have to question whether these delays are simply an administrative conundrum or something deeper. If trade talks fell apart at the eleventh hour, the festive period may be a little less cheery this year for investors.

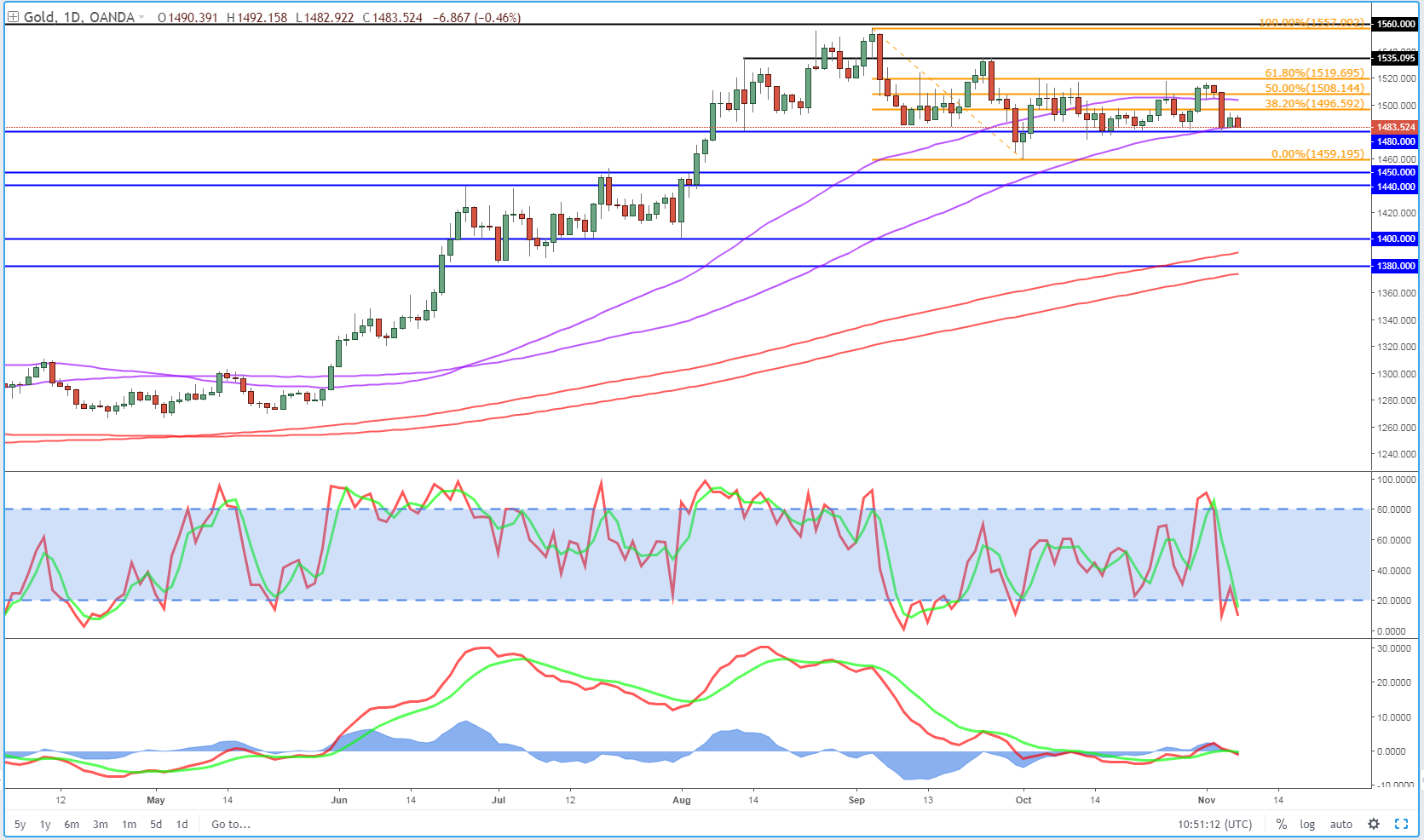

Gold content where it is

There isn’t much to add on gold that hasn’t been covered in every note for the last month. The yellow metal is still range-bound, with $1,520 providing resistance above and $1,480 support below. The latter has been tested once again this week but, so far, to no avail.

It is clearly perfectly content where it is, which we can all get on board with on these ever-colder morning’s as we’re wrapped up warm in bed pretending not to hear the alarm. Like the rest of us though, gold will have to move eventually, the question is whether bears can capitalize on the current soft patch.

Gold Daily Chart

Oil prices tumble on inventory rise

Oil prices are a little higher today, paring Wednesday’s losses which came as EIA not only matched API’s surprise inventory build but raised it a few million barrels. Let’s face it, these one-off numbers don’t necessary paint the full picture but coming in a week when trade deal doubt’s are starting to creep in, it probably gets more of a reaction.

Especially following what has been a strong rally in crude, with Brent up more than 12% since early last month. The uptrend currently remains in tact though as doubt’s are not yet turning into full blown concerns. If a date isn’t set in stone soon though, that may come.

Brent Daily Chart

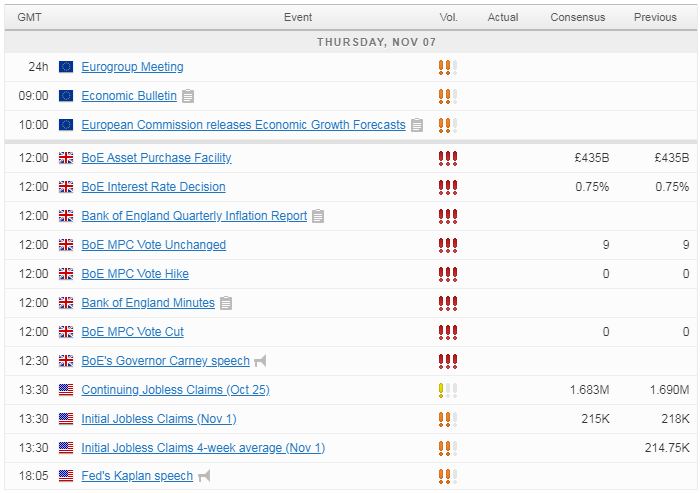

Economic Calendar