Powell’s time to shine

Weeks like this can be very frustrating and repetitive if, like me, you’re writing daily commentary on the markets, knowing all too well that the final act of the week is the only one people have come to see.

What is often even more annoying is that the headline act then dramatically underwhelms and leaves everyone in a state of deflation and confusion. I can’t help but think we’re heading for one of those weeks.

There has been so much made about Jerome Powell’s appearance today that he’s going to have to put on the performance of a lifetime just to avoid disappointing the crowd and leaving to a chorus of boos. Unfortunately for the Fed Chairman, I don’t think he has it in him to be the crowd-pleaser that everyone is desperate for, though maybe I’ll be proven wrong.

It’s worth noting that some less prominent members of the Fed have tried to argue the case for not cutting rates further at this moment in time, with Esther George, Robert Kaplan and Patrick Harker all in that camp on Thursday. But as we learned from the minutes, there is great division and Powell will be viewed as the voice of the majority.

Rays of hope for sterling?

Everyone seems very encouraged by the commentary we’ve had from Boris Johnson’s meetings with Angela Merkel and Emmanuel Macron over the last couple of days. I feel like I’m the only one that can’t see where the cause for optimism is. Their tones were certainly more pleasant but the message on the backstop was unchanged, unless Johnson has a workable and implementable plan for an alternative which, as far as we know, he does not.

Rather, it seems that the German and French leaders are keen to not be viewed as inflexible bullies that are forcing no-deal on the UK. Ultimately, it’s all talk right now and we’ll see over the coming weeks if there’s any substance but for now, sterling has been given a lift. Of course, that lift is always helped by the fact that it has been beaten black and blue since March and Thursday’s gains are tiny in comparison. But then, I’m all for a bit of optimism in this rather pessimistic environment.

GBP/USD Daily Chart

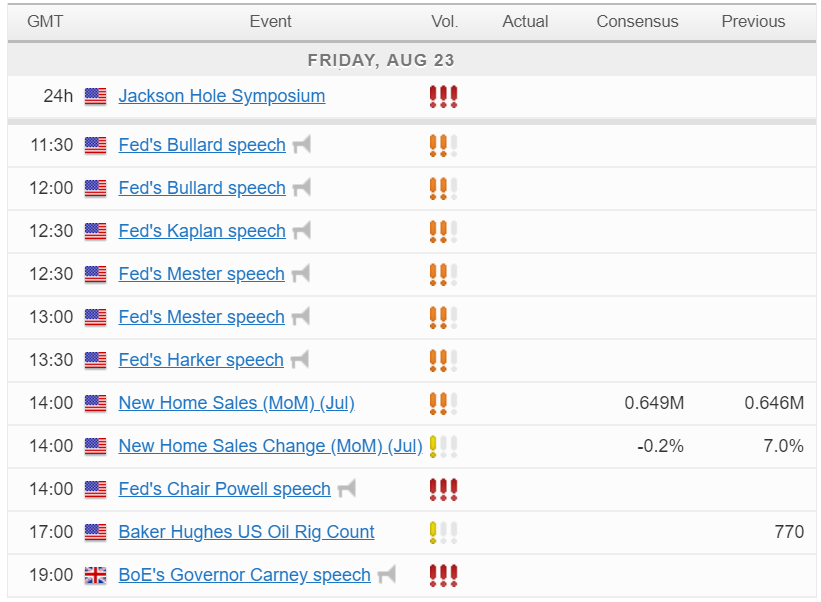

Economic Calendar