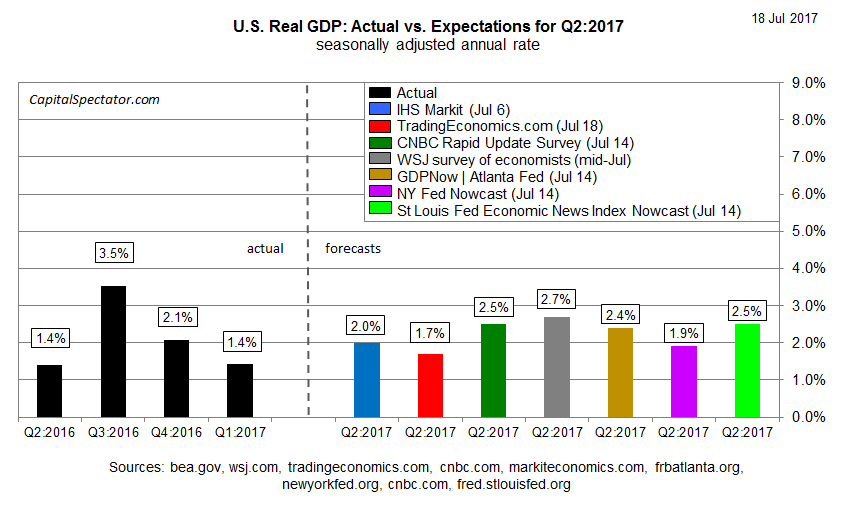

Estimates for next week’s “advance” report on GDP growth for the second quarter continue to point to a rebound after Q1’s sluggish pace, but the outlook has been revised down in recent weeks.

The Wall Street Journal’s latest survey data, for instance, is projecting a 2.7% advance for Q2 (real seasonally adjusted annual rate), based on this month’s average forecast. That’s an encouraging improvement over the 1.4% rise in Q1, but the Journal’s current projection has fallen from previous Q2 estimates. In May, the average forecast for economists was a bit firmer at 3.1%.

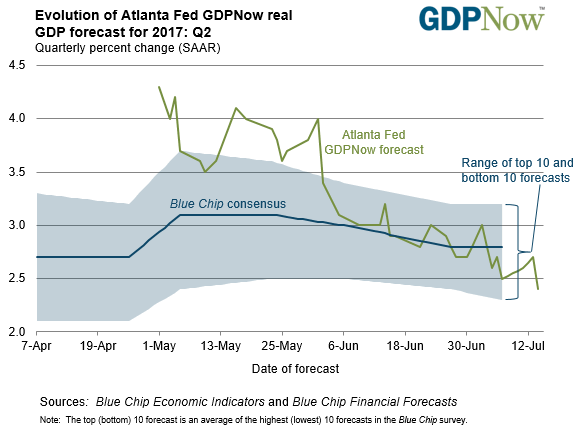

Projections from other sources anticipate even softer growth for the Q2 GDP report that’s scheduled for release on July 28. The Atlanta Fed’s widely followed GDPNow model is currently forecasting that economic output will expand 2.4% (as of July 14), the bank’s softest Q2 estimate to date.

Larry Fink, chief executive officer of BlackRock, told Bloomberg this week that the US economy is expanding at a softer pace than previously expected.

“There are still dark clouds we have to face,” said Fink, in an interview with Bloomberg News on Monday. While corporate earnings have been good, “we aren’t seeing that rise in personal income we would have thought,” he said.

Fink reiterated his concern that a risk to the market is the White House’s ability to quickly pass key reforms. “Are we going to see tax reform in the U.S.?” said Fink.

Friday’s retail sales report underlined Fink’s concern. Spending fell 0.2% in June, below expectations for a 0.1% rise. The dip marks the second straight monthly decline — the first back-to-back decreases in nearly a year. The annual pace of retail spending is still positive, although the trend has been decelerating this year, falling to a modest 2.9% increase through June, a 10-month low.

Nonetheless, most analysts and models still expect that GDP growth will pick up in next week’s Q2 report. That’s a moderately reliable forecast at this late date because most of the second-quarter data has been published. The mystery is the degree of the rebound relative to Q1. Using the latest forecasts as a guide, the crowd is hedging its bets by dialing down expectations relative to previous estimates.

Recession risk, however, remains low. Using data published through Jul. 14, the probability is virtually nil that an NBER-defined downturn has started, as detailed in the July 16 issue of The US Business Cycle Risk Report. A substantially weaker-than-expected GDP report next week, however, could change the calculus.