On Monday, 2/24, most market commentary centered on U.S. benchmarks rocketing to record highs. Writers have been missing the bigger story. Eurozone consumer prices fell in January at their fastest pace ever.

Let me reiterate. For as long as statisticians have been keeping data on eurozone inflation, the pace at which it is dropping is faster than at any other previously recorded moment.

I spoke at great length in 2013 about the possibility of deflationary scares. In fact, when asked in interviews about the biggest threats to the world economy and/or investments in the ensuing year, I said:

“Deflation will not necessarily impact markets adversely, as long as the European Central Bank (ECB) continues to cut rates, and as long as the Federal Reserve does not remove stimulus too quickly, and as long as the Bank of Japan keeps being aggressive. If, however, the world’s central banks declare that the deflation battle is over too soon, and if central banks appear to be tightening the reins, U.S. equities would suffer. In other words, it’s all about the central banks, electronic money creation, and the artificial manipulation of interest rates. I am by no means saying that what the central banks have been doing for five-plus years is the right thing for the longer-term well-being of economies… that’s a different discussion entirely. Yet the global issue that could knock the bull market for a loop in 2014 is the possibility that central banks like the ECB fail to move (shades of 2011 eurozone crisis) and/or the U.S. Fed moves too quickly towards ending its high-powered QE and zero-interest-rate-policy.”

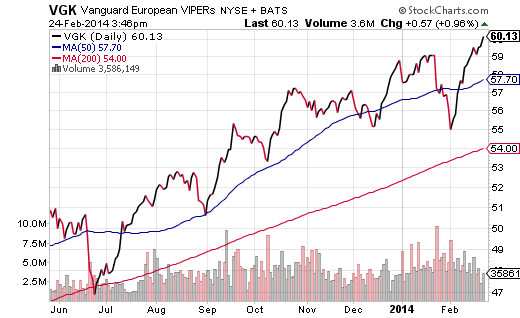

Like U.S. stocks, European stocks have been rocketing as well. Major European benchmarks are hitting 6-year highs and funds like Vanguard Europe ETF (VGK) show no signs of slowing down.

Employment, GDP, consumer spending data in the U.S. as well as Europe have been remarkably weak over the past few months. The markets have been climbing in spite of the warning signs. The idea that investors are looking past the weather is, in my estimation, a miscalculation of what is actually taking place. In reality, investors have been speculating that Janet Yellen’s Fed will respond to domestic and international concerns by potentially suspending a tapering increment and/or “talking up” another measure of monetary stimulus. Meanwhile, investors have become incredibly confident that the ECB will act to stimulate business/consumer demand so that a deflationary spiral does not set back the euro area’s fragile recovery.

Granted, the ECB may feel pressure to do nothing in the upcoming March 6 meeting. German banking leaders continue to push for austerity over stimulus, and there have been legal challenges to the notion of asset purchases. Yet the International Monetary Fund (IMF) has already declared the need for a rate cut from 0.25 down to zero (or less than zero) to support growth in the region. What’s more, ECB President Mario Draghi and other policy-setters simply cannot ignore the reality that consumers and businesses lack the conviction to spend, nor can they ignore that the deflationary scares are making it more difficult on the weakest governments’ ability to repay their debts.

Remember, Mario Draghi pulled the proverbial rabbit out of his hat in 2011 when he vowed to do whatever it takes to support the euro. If he dismisses the obvious, he and the ECB will lose credibility. It follows that the strong start to 2014 by European equities as well as the impressive relative strength compared to U.S. stocks is a signal that investors believe more stimulus is coming. A risky proposition? Perhaps. Yet I too believe the ECB will be cutting rates next week.

Need more proof of the investing winds? More often than not, small-cap stocks outperform large-cap stocks in a risk-on environment. This is just barely happening in the U.S. equity markets. Over the last three months in Europe, however, the WisdomTree Small Cap Europe ETF (DFE) is handily outperforming the Vanguard Europe ETF (VGK).

Equally worthy of note, small-cap stocks in Europe are performing far better than U.S. counterparts. Part of this may be attributable to relative attractiveness in terms of valuation. More likely, though, investors see a high probability of monetary stimulus for the eurozone whereas the jury is still out on the willingness of Yellen’s Fed to be “accommodating.”

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.