The USD is at session lows against all of the majors after European equities opened firmer: Euro stoxx +1.20%, FTSE + .60%, CAC +1.23%, DAX +1.21%.

The EUR/USD made a move higher following the open of these markets with the high testing the 38.2% fibo line on the move from December 19th lows to yesterday’s high. The next bullish target is the 0.0% line; 1.30919 if resistance is found here. Also note that our upward trend line, which began on December 14th, is still showing the pair support.

GBP/USD Testing Resistance @ 1.57246

With the taste of risk in the market in recent trading the GBP/USD is testing resistance at 1.57246; a support level from earlier in the month. If momentum continues we should see trading towards 1.57722.

Euro Back Where we Started

Since the last post the pair found resistance at 1.31161 and is back trading around 1.3050. We’ve seen heavy selling in the last hour, USD gaining strength, with the low being 1.3033; support is been shown at this level recently.

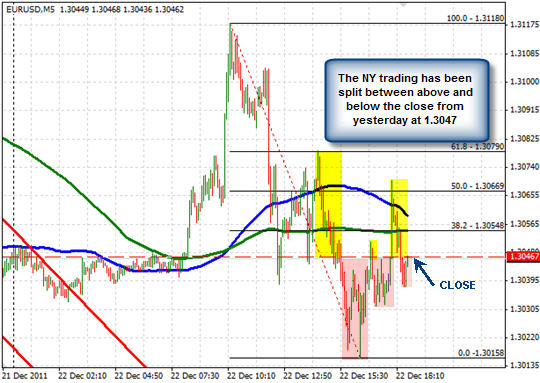

The Markets are Uncooperative in Holiday Trading. EURUSD above and below close from Yesterday.

The forex markets are a bit uncooperative today in the NY morning session. The EURUSD has spent half the morning above, and half the morning below the closing price from yesterday at the 1.3047 level (see yelllow and red area in the price above). The 100 hour MA (blue line in the chart below) is moving sideways and the price is currently below the level at the 1.3048 level. The rallies over the last few days have been spikes with quick reversals (see chart below).

If I were to assign a bias, the reluctance to keep the price elevated, the price below the close and the price below the close from yesterday gives a bearish bias for the pair. The problem is, does the market have the will to push the price materially lower in the near term? It certainly does not appear so…..