Asian markets ended lower as investors focused on debt troubles in Europe. China’s markets led the declines, as the Shanghai Composite shed 2.5%, and the Hang Seng skidded 2%, following a report from the IMF that China’s banks face systemic risks. The Nikkei fell.9% to 8463, while Olympus shares surged 15%, amid growing expectations that the company will not be delisted. The Kospi dropped 1.6%, and the ASX 200 slid .9%.

In Europe, news that the ECB was buying bonds helped stabilize the markets. The major indexes closed mixed, with the CAC40 up .7%, while the DAX slipped .2% and the FTSE eased .1%. Despite the ECB’s efforts, Italian 10-year notes settled above the 7%.

Heavy selling hit US stocks in the last hour of the day, as investors were spooked by a report from Fitch which discusses US bank exposure to European debt. The Dow dropped 191 points to 11906, and the S&P 500 and Nasdaq both fell 1.7%.

Currencies

The Australian Dollar tumbled 1.1% to 1.0081, as risk aversion hit the market. The Euro and Pound both lost .5% to 1.3463 and 1.5730 respectively, and the Canadia n Dollar eased .3% to 1.0236.

Economic Outlook

Wednesday’s reports were upbeat, suggesting the economic recovery is picking up. The housing market index jumped to 20 from 17, its highest level in 18 months. Industrial production rose .7%, more than forecast. CPI data showed a drop of .1% in prices, but core CPI, which excludes food and energy, rose .1%.

Stocks Tumble as European Bond Yields Surge

Equities

Asian markets closed mixed, as the major indexes pared early losses. The Nikkei rose .2% to 8480, the Kospi rallied 1.1%, and the ASX 200 ticked up .3%. China’s markets closed lower, as the Shanghai Composite eased .2%, and the Hang Seng dropped .8%, weighed down by real estate companies.

European markets sank, as rising bond prices reinforced fears of contagion. The CAC40 tumbled 1.8%, the DAX fell 1.1%, and the FTSE slumped 1.6%. Spanish bond prices continued to drop, pushing yields on 10-year Spanish notes up to 6.975% in a government auction, with a weak bid-to cover ratio of 1.54.

The selling continued in the US, with the Dow dropping 135 points to 11771, the Nasdaq falling 2%, and the S&P 500 closing down 1.7% to 1216.

Currencies

The Australian Dollar fell below the 1.000 parity level, closing down .8% to .9997, and the Yen rose .1% to settle below 77 at 76.98. The Canadian Dollar skidded .5% to 1.0289. The Euro closed up fractionally surrendering early gains, and the Pound gained .2% to 1.5754.

Economic Outlook

Thursday’s economic data was mostly positive. Weekly jobless claims dropped to their lowest level in 7-weeks at 388K, better than forecast. Building permits were higher than expected, while housing starts were in line with analyst expectations. On a weaker note, the Philly Fed manufacturing index unexpectedly dropped to 3.6 from 8.7.

Asian and European Equities Drop, US ends Mixed

Equities

Asian markets skidded on Friday, as Europe’s debt troubles remained in focus. The Nikkei fell 1.2% to 8375, the Kospi sank 2%, and the ASX 200 slumped 1.9%. China’s Shanghai Composite dropped 1.9%, and Hong Kong’s Hang Seng, declined 1.7%.

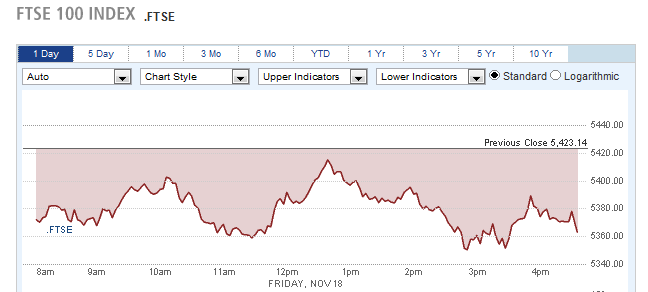

European markets continued to drop. Comments by German’s chancellor Merkel, that the ECB “cannot pretend to have powers they don’t have” cast doubt on plans for the ECB to lend money to the IMF to purchase sovereign bonds. The ECB cannot buy bonds directly. The FTSE fell 1.1%, the CAC40 dropped .4%, and the DAX closed down .9%.

FTSE slumps more than 1%

In the US, the Dow gained 26 points to 11796, while the Nasdaq fell .6% and the S&P 500 closed flat.

Currencies

The Dollar traded modestly lower against the major currencies. The Euro rose .4% to 1.3524, the Pound advanced .3%, and the Australian Dollar ticked up .1% to 1.0010. The Swiss Franc gained .5% to 1.0908.

Economic Outlook

Leading indicators gained by .9% last month, beating analyst forecasts.

Short Term Spanish Bond Yields Soar

Equities

Asian markets ended mixed as investors responded to the latest failure by US lawmakers to address the nation’s deficit troubles. The Nikkei fell .4% to 8315, but was well of its intraday low of 8261. The Korean Kospi rose .3%, erasing early losses, and the ASX 200 sank .7%, weighed down by a 4.3% drop in Qantas Airways. In greater China, the Shanghai Composite closed flat and the Hang Seng inched up .1% to 18252.

European markets extended their losing streak to 4, as a weak debt auction in Spain pressured financials. An government auction of 3-month bonds had a yield of 5.11%, more than double the rate from a month ago. The DAX slumped 1.2%, the CAC40 dropped .8%, and the FTSE fell .3%. European banks fell more than 3%, as the value of their bond holdings continues to erode.

European Markets Continue to Fall

In the US, the major indexes closed moderately lower. The Dow shed 54 points to 11494, the S&P 500 dropped .4%, and the Nasdaq slipped .1%.

Currencies

The Dollar closed mixed against world currencies. The Euro rose .2% to 1.3514, and the Swiss Franc gained .4% to 1.0943. The British Pound, Japanese Yen, and Australian Dollar all eased fractionally.

Economic Outlook

US GDP data showed the economy grew at a rate of 2% in the third quarter, less than the 2.5% previously estimated. On a better note, the Richmond Manufacturing Index was flat, better than last month’s -6 reading.

Weak Chinese PMI Data Hits Equities

Equities

Negative PMI data from China pressured Asian shares, as factory growth fell to its lowest level in nearly 3 years. In China, the Shanghai Composite fell .7%, and the Hang Seng slumped 2.1%. Australia’s ASX 200 declined 1.7%, as materials stocks sank on the Chinese news, and the Kospi dropped 2.4%. Japanese markets were closed for a holiday.

European markets continued to drop, and a weak German bond auction spooked investors. The auction had an incredibly low bid-to-cover ratio of .65, as the government failed to sell the entire amount planned. The DAX fell 1.4%, the CAC40 lost 1.7%, and the FTSE shed 1.3%.

Selling pressure mounted in the US, with the Dow closing down 236 points to 11258. The Nasdaq fell 2.4% and the S&P 500 lost 2.2%. Financials fell after the Federal Reserve said it would conduct stress tests on the 6 largest US financial companies to weigh the risk of a worsening European debt crisis. The 6 banks all fell more than 3% on the news.

US Markets Continue to Fall

Deere rallied 2.9% after raising its guidance for 2012 and reporting strong earnings. Pandora Media shares tumbled 11.3% after issuing a weaker than expected outlook.

Currencies

The Dollar rallied strongly against the major currencies, as the Euro closed down 1.3% to 1.3335, and the Australian Dollar tumbled 1.6% to .9687. The Pound fell .8% to 1.5515, and the Canadian Dollar lost .9% to 1.0478. The Yen fell .5% to 77.35, and the Swiss Franc dropped .7% to 1.0867.

Economic Outlook

The reality that even Germany is having trouble raising money is a strong warning sign for the markets, although Germany’s bond yields are close to record lows.

Wednesday’s extensive US data was mixed. Consumer Sentiment came in slightly below estimates, and weekly unemployment claims rose to 393K from last weeks 391K reading, worse than forecast. Personal spending rose by just .1%, much less than last month’s .7% jump.