Forecast

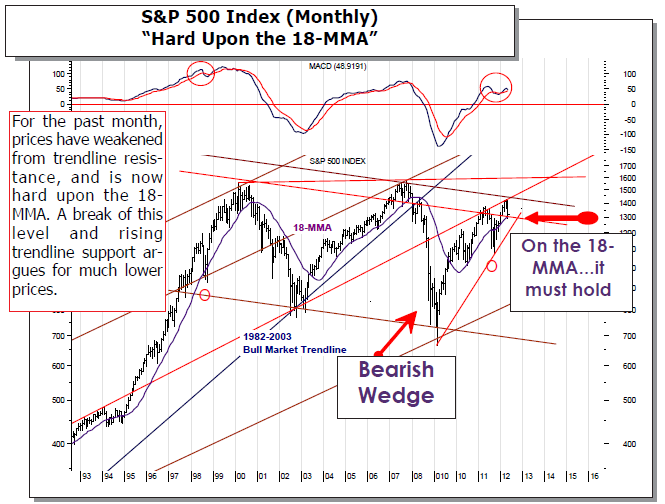

Stocks: The European debt contagion remains front and center, with China “hard landing” concerns creeping into the conversation. Also, US economic data is starting to soften...surprising many. Collectively, given the the economic deceleration — it seems traders are looking for QEn+1, which has held up prices longer than is reasonable. Beware.Strategy: The S&P 500 remains above long-term support at the 160- wma at 1179; which delineates bull/bear markets. But price action has turned atrocious, which suggests tenatively that a bear market has begun. However, we’ll watch the transports: a breakout higher would be bullish of equities in general.

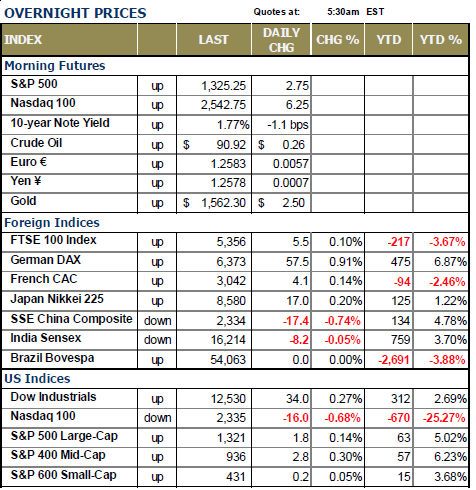

World markets are all higher this morning on rumors the Chinese are planning a stimulus plan, a rumor that has been put down by the appropriate authorities. They did say some tax changes would be accelerated but these are more tactical and minor than anything strategic. However, the markets have taken this as positive and are trading higher – all with the exception of the most important stock market in the world right now – Spain. This is due to the fact she is having to recapitalize her fourth largest bank Bankia with €19 billion or $24; and they are going to do this by selling government bonds. There is no help from outside sources such as the ECB; IMF or others – Spain will simply borrow their way into capitalizing Bankia and her other banks sooner rather than later when it becomes more apparent to her citizenry that holding euros is preferable rather than returning to the old currency Peseta.

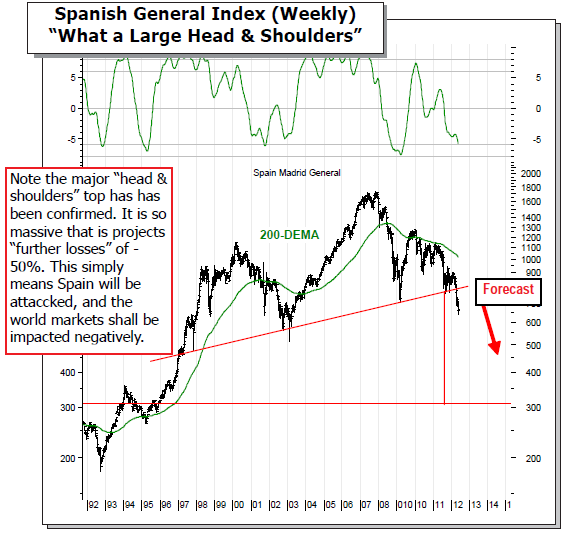

All we know is that Spain’s General index is down by 2.5%; her 10-yr bond yield is down -5 bps to 6.44% – and Europe is trading tentatively higher. We’ll wonder aloud how long this nor rally shall hold up, and we would put even money that it shall down by their close trading at 11:30am EST. That said, we’ve included a chart of the Spanish General and the technicals that stand behind it are simply and absolutely atrocious; a disaster in the making much in the same manner that Greece was were laughed at and derided one year ago when we postulated that Greece’s stock market target was going to experience a massive decline. At the time, it wastrading 1200…our forecasted target was 400…a fall of -66%. Today, the index stands 485…just a bit above our long-term target.

In terms of Spain’s downside targets, we shall say trading began this morning at 660, but the “head & shoulders” topping pattern extant on the charts shows that we should expect a low near the 300 level…a decline of -55%.

Trading Strategy: As noted above the Spanish weakness, we’ve in past day’s further noted the technical breakdowns in Germany’s DAX, Brazil’s Bovespa and Hong Hong’s Hang Seng – each of which is below weekly and monthly moving average support levels that have led to bear markets in the past. Therefore, we feel rather comfortable in saying that a bear market has begun around the world.

This simply means that we are sellers of rallies primarily once those short-covering circumstances come around. For now, the S&P futures have rallied from 1288 to 1323 in what can only be described as a “half-hearted rally attempt,” but there still may be upside remaining towards the 1345 level. Thereafter, we’ll expect to see a swift move lower through the lows at 1288 and for the S&P cash to finally test its 200-day moving average at 1275…which is where the 200-dma/380-dema crosses.

We intend to remain patient in putting on our short position in TWM; preferably at 1340-1350, but we’ll not hesitate to do so if prices simply look as if they are going to collapse in the next several days. For the next several days we have the end-of-the-month/beginning-of-the-month buying group that tends to support prices. If prices can’t be supported during this bullish time, then it will certainly be a sign to be short. Until then, the sidelines are a nice play to be.

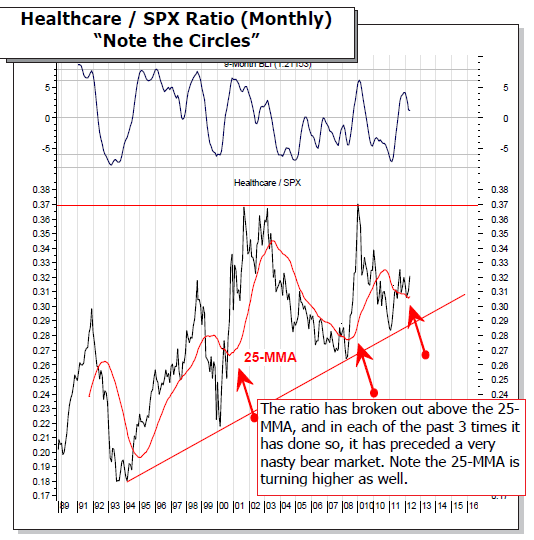

The healthcare ration signaling "danger”: Lastly, we want to bring our collective readership’s attention to the Healthcare/SPX Ratio. We believe this to be very important from a sentiment perspective amongst institutional managers. When the ratio is rising, it means that “defensive” is being played, and we find that is the case at present. But what is most troubling to us from a market perspective given this ratio is that the ratio has now consolidated and is starting to move higher again. Moreover, the 25-monthy moving average has been broken above and has turned higher. The past two instances this has occurred are September 2000 and June 2008; back of the envelope calculations show rather nasty declines followed each of this occurrences. Hence, this is further evidence that “defensive” is where we should be right now; and selling short-covering rallies as they mature.