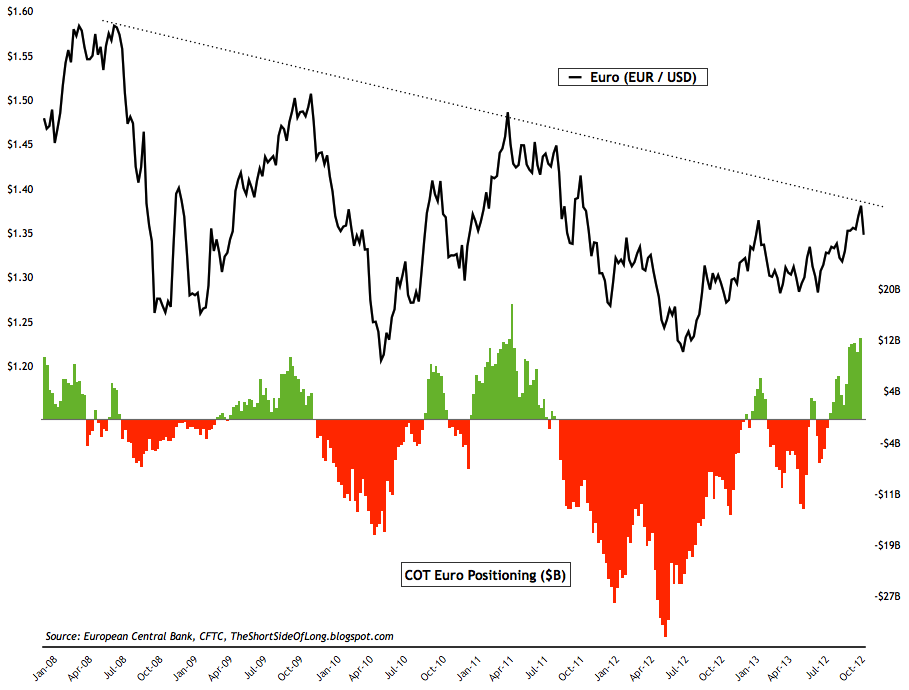

Chart 1: Speculators have built extremely large positions on the euro EUR/USD Long Term Overview" title="EUR/USD Long Term Overview" height="690" width="909">

EUR/USD Long Term Overview" title="EUR/USD Long Term Overview" height="690" width="909">

Before reading the rest of the post, let me please remind you that the CFTC commitment of traders data is still delayed by about a week or so, due to the US government shutdown.

As we can see in the chart above, the euro pulled back sharply last week, just as it found itself near a major resistance area. At the same time, hedge funds and speculators have been holding a rather large net long position to the tune of over $12 billion. The previous two instances (late 2009 and middle of 2011) with positioning higher then $10 billion have led to substantial declines in the euro.

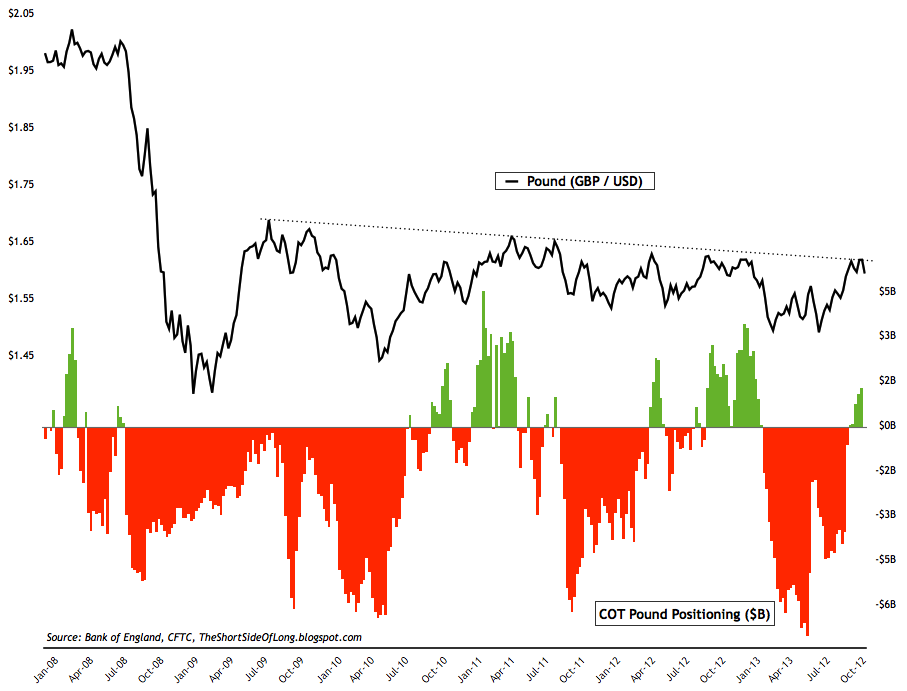

Chart 2: After huge net shorts, funds have turned long on the pound GBP/USD Long Term Overview" title="GBP/USD Long Term Overview" height="690" width="909">

GBP/USD Long Term Overview" title="GBP/USD Long Term Overview" height="690" width="909">

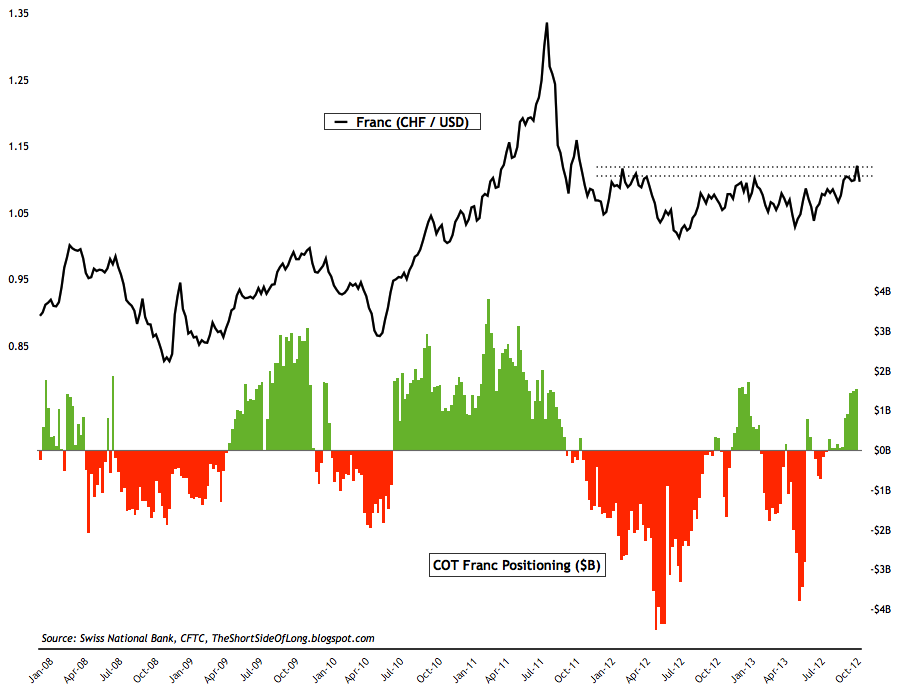

A similar situation is also evident with the British pound (chart above) and Swiss franc (chart below). Both European currencies find themselves at a major resistance level, while from a contrary point of view, speculators have piled into the rally over the last few weeks - adding to the downside risk as positions get shaken out. Continue to monitor the price action in these three European currencies for further clues as to what the Dollar Index might do.

Chart 3: Swiss Franc finds itself at a critical resistance area CHF/USD Long Term Overview" title="CHF/USD Long Term Overview" height="690" width="909">

CHF/USD Long Term Overview" title="CHF/USD Long Term Overview" height="690" width="909">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

European Currencies At Resistance

Published 11/04/2013, 04:37 AM

Updated 07/09/2023, 06:31 AM

European Currencies At Resistance

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.