U.S. Dollar Trading (USD) stocks enjoyed solid gains for the first time this week overnight as the Greece swap deal approached its deadline today and more of the private sector indicated they would agree to the new terms. The US February ADP employment report came in as 216k vs. 170k previously and adds to the expectations that Friday’s Nonfarm report will show another solid number. Looking ahead, Weekly Jobless Claims forecast at 351k vs. 351k previously.

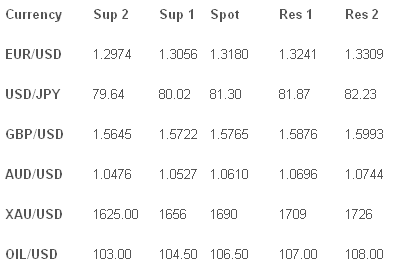

The Euro (EUR) the EUR/USD tested 1.3100 before reversing on news that the more private creditors will accept the debt swap today and the US Fed was potentially looking at more measures to support the US economy and keep rates low. The ECB also meet tonight and there is possibility of rate cuts or new measures to support the Eurozone. The Sterling (GBP) the GBP/USD moved higher but only gently with the BOE today with also an announcement on the currency Asset purchase program. The EUR/GBP is still very quiet at 0.8350 and the GBP/AUD recent rally against the struggling Aussie failed ahead of 1.5000. Looking ahead, ECB rate meeting forecast to hold at 1.0%. BOE Rate Meeting Forecast to hold at 0.5%.

The Japanese Yen (JPY) the major resumed its uptrend with crosses soaring on the stock market rally overnight. USD/JPY broke back above Y81 and is within sight of the Y81.80 recent highs. The EUR/JPY is also showing signs of strength back to the Y107 ahead of tonight’s major risk events. Australian Dollar (AUD) the Aussie has been under attack so far this week testing 1.0500 after weak Q4 GDP data and only saved by the risk on rally in stocks during the US session. UPDATE February Employment change -15.4k vs. 5k forecast adding to the recent run of poor data.

Oil & Gold (XAU) Gold is beginning to recover overnight testing $1690 by US close. Oil’s day to day movement is hard to predict as the global risk premium from the Iran threat interferes with the general risk on or off trading day direction. Overnight we saw a slight pullback to $106.50.

Pairs to watch

AUD/USD back above 1.06 the selling over?

EUR/USD to rally if Greece deal goes through?

TECHNICAL COMMENTARY

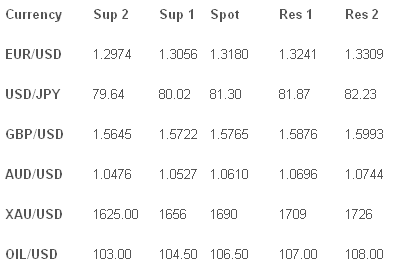

The Euro (EUR) the EUR/USD tested 1.3100 before reversing on news that the more private creditors will accept the debt swap today and the US Fed was potentially looking at more measures to support the US economy and keep rates low. The ECB also meet tonight and there is possibility of rate cuts or new measures to support the Eurozone. The Sterling (GBP) the GBP/USD moved higher but only gently with the BOE today with also an announcement on the currency Asset purchase program. The EUR/GBP is still very quiet at 0.8350 and the GBP/AUD recent rally against the struggling Aussie failed ahead of 1.5000. Looking ahead, ECB rate meeting forecast to hold at 1.0%. BOE Rate Meeting Forecast to hold at 0.5%.

The Japanese Yen (JPY) the major resumed its uptrend with crosses soaring on the stock market rally overnight. USD/JPY broke back above Y81 and is within sight of the Y81.80 recent highs. The EUR/JPY is also showing signs of strength back to the Y107 ahead of tonight’s major risk events. Australian Dollar (AUD) the Aussie has been under attack so far this week testing 1.0500 after weak Q4 GDP data and only saved by the risk on rally in stocks during the US session. UPDATE February Employment change -15.4k vs. 5k forecast adding to the recent run of poor data.

Oil & Gold (XAU) Gold is beginning to recover overnight testing $1690 by US close. Oil’s day to day movement is hard to predict as the global risk premium from the Iran threat interferes with the general risk on or off trading day direction. Overnight we saw a slight pullback to $106.50.

Pairs to watch

AUD/USD back above 1.06 the selling over?

EUR/USD to rally if Greece deal goes through?

TECHNICAL COMMENTARY