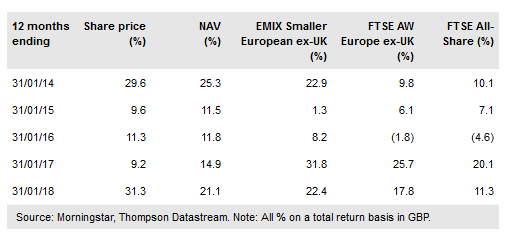

European Assets Trust NV (AS:EURT) (EAT) aims to generate long-term capital growth through investing in listed European small and mid-sized companies. It has a distribution policy to pay 6% of its prior year-end euro-denominated NAV, which supports an attractive yield, currently 5.4%, significantly higher compared with peers. This has helped support a share price premium to EAT’s cum income NAV. The EMIX Smaller Europe ex-UK index had another strong year in 2017, and equity valuations are now more challenging. Notwithstanding, the manager Sam Cosh observes that earnings recoveries are far from mature for many sectors and believes that EAT is well positioned to benefit as Europe’s recovery broadens out.

Investment strategy: Bottom-up, high-conviction

EAT aims to achieve capital growth through investment in small and medium-sized listed companies in Europe ex-UK. Its investment approach is bottom-up, seeking high-quality companies with long-term growth potential, at reasonable valuations. Meeting company managements and undertaking its own in-depth analysis are important parts of EAT’s investment process, and the manager is supported by a well-resourced team of European equities specialists. Unconstrained by sector and geographic weights, the portfolio of 40-60 stocks represents the manager’s high-conviction stock picks.

To read the entire report Please click on the pdf File Below: