Most of the world’s attention is on “fiscal cliff” negotiations in Washington D.C. And when we’re not hearing about the latest crack in the Republican coalition, financial journalists provide thoughts on the latest batch of U.S. economic data.

The question that many wish to know… “Is the domestic employment picture improving?”

If a lower unemployment rate is your go-to measure (7.7%), with October registering 146,000 new jobs, then you may feel better about the country’s well-being. On the other hand, if you are troubled by the notion that 350,000 employees have left the workforce this past month with the labor participation rate at its lowest levels in 30 years (63.6%), then you may be troubled by the net losses in workers.

Granted, there are plenty of older folks who have legitimately opted to retire. By the same token, government programs (e.g., disability, welfare, etc.) have added millions of people, most of whom have dropped off the unemployment radar.

Nevertheless, the U.S. still remains one of the better developed world’s investment prospects in the near-term. Why? Multi-national corporations domiciled in the U.S. and listed on our exchanges are still mega-profitable. In fact, most of them have created remarkable inroads into emerging markets with their brand name products and services.

On the flip side, most of the individual countries that comprise Europe are slipping deeper into recession. Even with ETFs like iShares Germany (EWG) and iShares Austria (EWO) performing splendidly over the previous 5 months, projections for GDP declines and contraction are nearly ubiquitous across the region. It is true that German multi-nationals sell their wares around the world like U.S. firms, yet the euro-denominated feature of international ETFs like EWG and EWO introduces undesirable levels of portfolio volatility.

In fact, I will reiterate from previous commentary… Wisdom Tree Europe Hedged Equity (HEDJ) is the only Europe fund that merits some consideration at this moment. The dollar-denominated ETF gives you access to Unilever, SAP, Bayer and others with global brand recognition, without the likely sovereign debt stress that plagues the region’s fiat currency.

In contrast, I’ve been a huge believer in Asia Pacific ETF momentum for months. In my October 1 article 10 weeks ago, “Asia Pacific ETFs Become Relative Strength Stand-Outs,” I opined that the uptrend was a function of optimism that China’s economy was finally firming.

In the past week, Chinese leadership have discussed support for “urbanization,” which almost certainly involves stimulus for infrastructure. Moreover, recent reports have said that China will reaffirm its 7.5% growth outlook for 2013. Market-watchers know that this is the same percentage that was given for 2012, and that this likely signals determination to engineer the proverbial soft landing.

And there’s more. Unlike the developed world where bailouts and government expenditures are the primary reason for GDP expansion (if any), China’s economy is close to sustaining itself. Commodity prices such as steel have been on the rise and manufacturing has improved dramatically.

Selecting the Asia Pacific ETF that will work best for you may depend on risk tolerance, individual comfort and sector preferences. For example, iShares MSCI Australia (EWA) may be more comfortable for those who shy away from direct exposure to emerging markets. However, it’s fortunes are directly tied to materials demand from China. Meanwhile, if you find that you are comfortable with emerging markets — their low debt-to-GDP levels, low unemployment rates, strong GDP growth — then financially fit iShares MSCI Malaysia (EWM) may be a preferred destination.

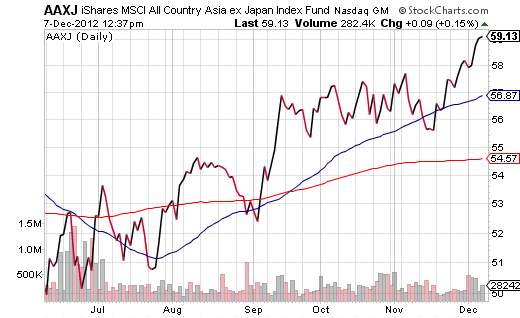

One who is simply looking to access all of Asia with a low cost index should be intrigued by iShares All-Country Asia excl Japan (AAXJ). The current price is well above its 50-day and 200 day moving average. If you are concerned about buying AAXJ at its 52-week high, you might wait for a price pullback to the 50-day support level.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Europe ETFs Will Disappoint Again, Asia Pacific Stock ETFs Will Rally

Published 12/09/2012, 04:17 AM

Europe ETFs Will Disappoint Again, Asia Pacific Stock ETFs Will Rally

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.